Articles by tag: Taxes

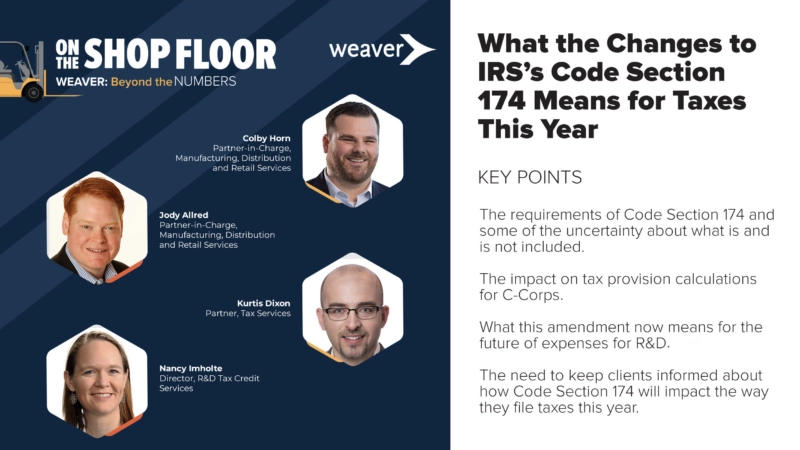

For businesses, tax season can be especially stressful, given the weight of information to prepare and consider, along with various changes coming from the IRS. The Tax Cuts and Jobs Act of 2017 amended Code Section 174, whereby requiring companies to capitalize and amortize costs for their R&D expenses starting in the 2022 tax year. […]

Latest

Weaver: Beyond the Numbers

Weaver Beyond the Numbers Real Estate Edition: A Look at What to Expect in Real Estate in 2022

The world of real estate had another unprecedented year in 2021. However, big changes didn’t materialize due to the Build Back Better Act not passing. In this Real Estate Edition of Weaver Beyond the Numbers, hosts Rob Nowak and Howard Altshuler discussed the Build Back Better fallout and predictions for the industry in 2022. “The […]

Food & Beverage

E.U. Whiskey Tariffs Are Lifted, But the Industry is Still On the Rocks

The whiskey market is eager for a return to form. In 2018, in response to the U.S. steel and aluminum tariffs targeting the E.U. and ordered by former President Donald Trump, the European Commission imposed a retaliatory 25% tariff on some key American goods, including U.S. distilled bourbon and whiskey. The popular aged American […]

E2B: Energy to Business

Bringing Clarity To SMOG Reporting

Dave Loucks, Principal with Opportune LLP’s Complex Financial Reporting practice based in Denver, joined E2B host Daniel Litwin to discuss what the Standardized Measure of Oil and Gas (SMOG) is and why its reports and calculations are essential to the oil and gas industry. SMOG reporting provides a comparable measure of the value of […]

Business Services

Weaver: Beyond the Numbers: The Global Minimum Tax Explained

Covering core elements of the Global Minimum Tax being considered by the world’s largest economies, Weaver’s International Tax professionals provide insight for multi-national businesses. Key Points: The Organization for Economic Cooperation and Development (OECD) looks to certain measures, including a global minimum tax to level the playing field among countries. Generally, the Global Minimum Tax […]

Business Services

Weaver: Beyond the Numbers: Making the Most of Charitable Contributions

With tax season just around the corner, host Tyler Kern discussed the latest updates around charitable contributions with Justin Reeves, CPA, Tax Partner at Weaver. For those who itemize their deductions, the limit of cash contributions in 2021 has increased from 60% to now a staggering 100% of adjusted gross income. Reeves clarified the difference […]

Business Services

Ep 1049: Predictions For The Industry for 2021-2022

On this episode of Weaver: Beyond The Numbers Real Estate Edition Podcast, hosts Rob Nowak, Partner, Tax Services at Weaver and Howard Altshuler, Partner-in-Charge, Real Estate Services at Weaver, talked about their predictions for industry trends for the rest of 2021 and into 2022. “If I had my sunglasses, I’d be putting them on because […]