Women and Financial Stability

Only 57% of adults in the U.S. are financially literate, according to S&P’s Global FinLit Survey in 2016. Efforts in multiple states in the U.S. are aiming to improve that, with financial literacy courses becoming a required part of the high school curriculum. But despite these efforts, financial literacy and financial stability, particularly for minority groups, continues to be just out of reach.

How are targeted initiatives helping to improve women’s financial stability and change the way women spend, save, borrow, and plan?

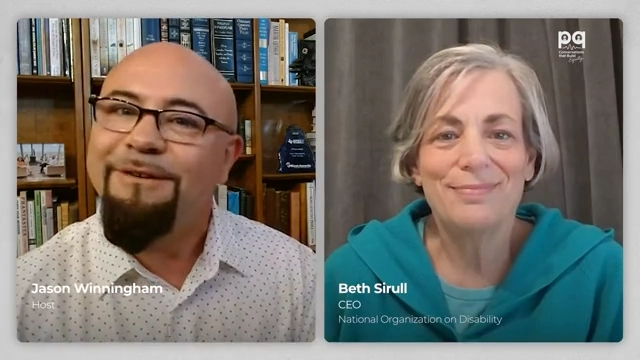

On the latest episode of the SECURE podcast, Chief Health & Wellness Officer at FinFit and host Charles Lattimer, welcomes the VP of Financial Education at Virginia Credit Union, Cherry Dale, to talk about financial stability for women in the workforce.

The two discuss:

- What methods Dale took from her teaching background to her career in financial education

- How education in the community has helped boost financial wellness and financial literacy especially throughout the pandemic

- How programs targeting women helped meet their specific needs and increase literacy on financial stability

“So, when we think about financial wellness, everyone’s on their own path and it’s so individual. The pandemic really created, I think, a particular environment for people to step back and reassess where they were with their finances…something like a pandemic where it comes in and there’s a lot of uncertainty in every aspect, but especially with your finances, can cause people to…be open to, you know, help and guiding them on their financial journey,” explained Dale.

Prior to her role as the VP of Financial Education at Virginia Credit Union, Dale spent eight years as a Lead Teacher with Henrico County Public Schools. As a passionate teacher, Dale has continued encouraging others to never stop learning, especially when it comes to financial literacy. She earned her B.A. in Education from the University of Nebraska at Omaha and her Master’s in Curriculum and Instruction from the University of Virginia.