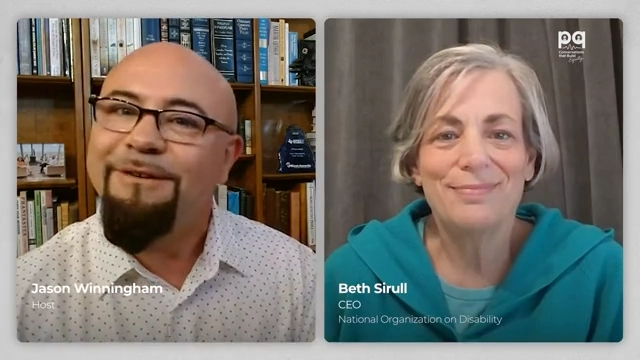

Motor Fuels Tax Minute, Episode 43: Biofuel Feedstock

In this week’s episode of Motor Fuels Tax Minute, our hosts discuss non-tax specific permits for biofuel feedstocks.

For information or assistance, contact us. We are here to help.

©2024

Detailed Description of Weaver’s Motor Fuels Tax Minute, Episode 43

00:00:00

Emilda: Welcome to Weaver’s Motor Fuels Tax Minute, the vlog where we talk all things motor fuel. This week Leanne will talk a little bit about non-tax specific permits for biofuel feedstocks.

00:00:13

Leanne: That’s right, Emilda. And I’m sure people are wondering, this is the Motor Fuels Tax Minute, so why are we talking about permits that are not tax-specific? And that’s because as our sustainable aviation fuel industry, and some of our other biofuel industries, really start to expand and grow with the new energy evolution and the clean energies, we have to think about the feedstocks that are being used to produce them. And a lot of these feedstocks are coming from outside of the United States, things like tallow and used cooking oil. It’s so easy to forget that there might be permits for these products. They are food-based products, after all, and there are permits within the USDA. Tallow requires you to reach out to the USDA and let them know you plan to do it, and they’ll give you an import authorization. Used cooking oil is a little more in-depth. They require an actual veterinary permit from their veterinary division that shows that the used cooking oil meets all standards. You’ve got to be careful where it’s coming from as well. A lot of the EU is restricted, and you cannot bring in these feedstocks from many EU countries. So, while it sounds like it may be easy enough to bring in a feedstock and then get your 637 and other state permits to produce your biofuel, you’ve got to remember those USDA permits so you don’t get tripped up at the border.

00:01:36

Kelly: That is such a great point, Leanne, and something that we usually miss sometimes because we’re so focused on gasoline and diesel and all the big ones. These little products, to your point, can have environmental fees attached to them. They can have gross receipts tax, so definitely worth making sure you’re following the rules and regulations. And if you have any questions, we’re here to help you out at Weaver.

So that was this week’s Motor Fuels Tax Minute. Our last one, which went through net, billed, and gross, was actually sent in by one of our viewers and he received some Weaver swag. So just as a reminder, if you want some swag, send us over some ideas and we will do a presentation on it. And you’ll get a little something from Weaver.

Thanks for listening.