Bonus Depreciation of Business Assets

“Both new and used property now qualify for bonus depreciation, which is a little bit of a departure from some prior law,” Nowak said.

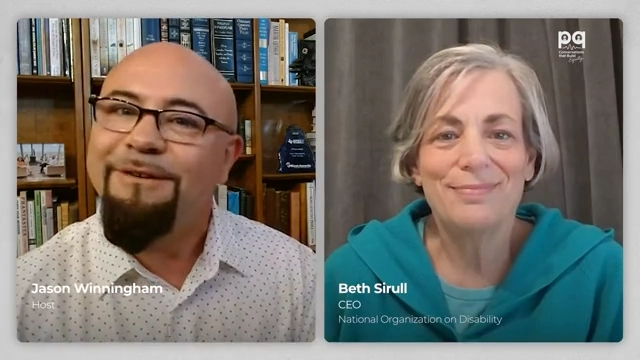

On this episode of Weaver: Beyond the Numbers, Host Tyler Kern talked with Rob Nowak, Partner in Tax Services at Weaver, about the bonus depreciation of business assets.

“Bonus depreciation is one of the incentives that’s been around in the tax code for about 20 years,” Nowak said. “It’s an enhanced expensing election that allows taxpayers to immediately write off the cost basis of qualifying assets placed in service during a year.”

So, what are qualifying assets? It’s a tangible property with MACRS class life of 20 years or less. It also includes some other property that is specialized to an industry, like particular water treatment property, software that is amortized over three years and certain types of plants.

“Both new and used property now qualify for bonus depreciation, which is a little bit of a departure from some prior law,” Nowak said. Under the 2017 Tax Cuts and Job Act, the law was changed to allow new assets but also used property. However, those would not qualify if a taxpayer previously used the property or a predecessor entity or related entity.

“There’s also a specific classification of property referred to as qualified improvement property,” Nowak said. “That’s certain improvements to commercial real estate.”

Listen to the full episode to hear all of Nowak’s insights on the bonus depreciation incentives.

Subscribe and listen to future episodes of Weaver: Beyond the Numbers on Apple Podcasts or Spotify.

Weaver’s professionals are known for helping clients address problems, achieve compliance and prevent fraud or loss. Visit weaver.com for more thought leadership.