Weaver Beyond the Numbers Real Estate Edition: The Long and Winding Road to Tax Reform

“There are a number of proposed provisions in the Build Back Better Act that could impact tax rates.”

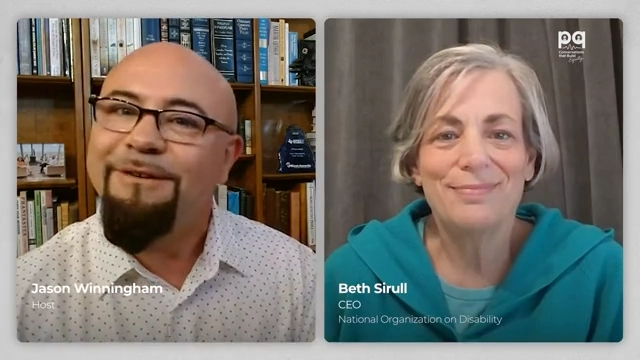

A lot is going on in the tax world that could have implications for companies and individuals. While nothing is official, there are many proposed changes to the tax code in the Build Back Better Act. In this episode of Weaver Beyond the Numbers Real Estate Edition, Weaver hosts Rob Nowak, Partner in Tax Services, and Howard Altshuler, Partner-in-Charge of Real Estate Services, break down what those proposed changes are.

“There are a number of proposed provisions that could impact tax rates,” Nowak explained.

First, there’s the possible graduated rate tax structure for corporations. “It starts at 18 percent for companies with $400,000 in profits and moves up to 26.5 percent for those with over $5 million. It’s still less than tax rates prior to the 2017 cuts,” Nowak said.

On the individual side, there are possible changes, as well. “The top marginal income rate would go up to 39.6 percent. The income brackets would change. For capital gains, the tax rate could rise from 20 percent to 25 percent, which is still less than Reagan-era rates of 28.5 percent,” Nowak noted. He continued, “1031 survived and is not limited. 1231 assets, real estate held for trade or business purposes, could see an impact for the real estate industry.”

These provisions are much different from those discussed months ago, and there will likely be more compromise for the bill to pass.

Altshuler then asked Nowak to “pull out his crystal ball on the likelihood of passage.” Nowak answered, “It comes down to a few key decision-makers. Most consider Senator Manchin a tie-breaking vote. If there’s a fifty-fifty split in the Senate, the Vice President casts the deciding vote. But that only happens if Manchin votes for it. If you want to read the tea leaves, follow Manchin.”