2022 Gas Costs More than Doubled the Average Cost in 2020. Prices Have Dropped but are Still High in 2023…Why?

Last year, eyes were popping as the price per gallon of gas passed the five-dollar mark in most places. This is more than double the average gas cost per gallon in 2020, which was $2.17 per gallon, according to the U.S. Energy Administration. While prices are down from that five-dollar mark now, they have risen for five straight weeks and there are predictions that the prices won’t be heading the other direction anytime soon.

Why are some predicting the gas cost could rise to four dollars per gallon later this year? It seems to be a combination of factors, including the demand outpacing supply, and refineries performing winter maintenance. Prices are highest now in states like California and Hawaii, which average more than four dollars per gallon; the lowest prices are in states like Texas and Arkansas, which are averaging the low-threes.

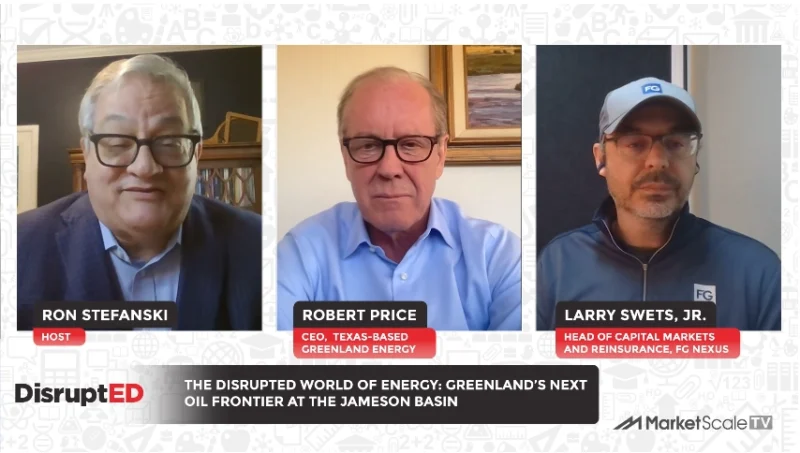

Are there any other factors that are impacting the recent spikes in prices, and how is the Federal Reserve playing a role in the oil and gas economy? ____ explains the turmoil in the oil and gas industry and forecasts what is to come for gas cost prices later in 2023.

Tim’s Thoughts

“Good morning. I’ve got a bunch of calls asking why gasoline prices are on the rise again while crude oil prices seem to be falling. So here are the answers on what’s going on with prices at the pump as we finish the first month of this year. This time last year due to a number of factors, not the least of which is the Biden administration’s distaste for fossil fuels, and they’re never-ending administrative interference In the process of developing, maintaining, and producing crude oil prices for refined products began to rise.

Seasonal demand this time last year was resurging and inflation was beginning to push prices higher across the board, right up to the point where the Russians invaded Ukraine. As luck would have it, this is the time of year as well that refineries go into what’s called turnaround at a refinery.

It’s a set of scheduled maintenance items that need to be performed and then adding any updates that are needed for the process ongoing. Last year in February, the refineries decided to postpone any non-essential turnaround items that were planned for 2022, so as not to add additional upward pressure on gasoline and diesel prices.

However, diesel had already suffered from a covid induced shutdown in a refinery in Canada and then a fire in a refinery in Pennsylvania. Those, the loss of those two refineries cut more than a million barrels per day from distillate products destined for the United States. This still needs to be recovered as of this report.

So the past, the turnaround buck from last year to this year. We now have to pay the piper and there are two years of maintenance that needs to be done for our refineries and updates, and this will take longer for the process to be completed. This will push prices higher at the pump as demand will most certainly outpace a tightening supply for refined products.

Remember, rebound demand, we rebound demand in spring as temperatures begin to rise if people get out to absorb some badly needed vitamin D. You may understand that in normal years markets trend season up in the spring, up until about the 4th of July, and then lower falling all the way to the beginning of December.

As we head into February, our seasonal pattern is pushed up with the reality that our US production of gasoline and diesel is already tight, and recovery from the pandemic will help boat demand as well. Nothing has changed in a favorable direction to hold retail fuel prices lower unless the administration adds to its negative pressure on fossil fuels and OPEC needs to add to its market share.

We’ll see that today. The Fed will probably add another quarter point to the discount rate today, the only right that they control, and we’re watching to see if a recession truly does develop as we hated the second half of 2023. It’s all up in the air right now, nothing has changed since 2022, so we shouldn’t expect much different this year than what we had last year.

Of course, that all depends on what the groundhog sees tomorrow.”