Fuel Prices to Remain High as Drive Season Looms

Key Insights

- US oil supply has steadily decreased since May 2021.

- The US oil supply has experienced an unprecedented decline.

- Oil prices continue to increase for the 2022 driving season.

The great oil crunch that the US is experiencing does not show any slowing signs. The inventory has been steadily tightening since April 2020. The country has experienced a steady decline in barrel production and cannot meet the daily demands of crude oil.

As of March 2022, crude oil production remains at 11.7 million barrels. Once it’s manipulated into a refinery, the measure is at about 15.9 million barrels per day. However, the US manufacturing demand requires 21 million barrels of crude oil per day. Unfortunately, with the gaps in production to need, the supply has suffered. This mismatch results in oil prices rising.

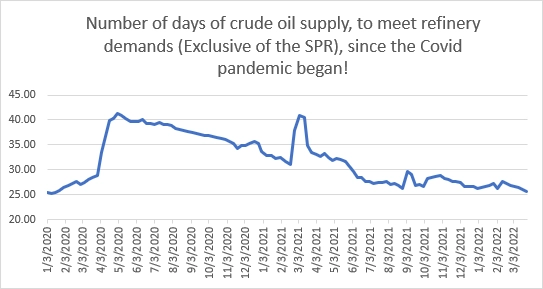

Economists consider the number of days available in the supply to understand the future of fuel prices, exclusive of the Strategic Petroleum Reserve (SPR). One year ago, the supply reported about 45 available days of oil. Today, our available supply is 25.76 days. That is an unprecedented decline to experience in one year alone.

Lowered production and higher demand account for the dramatic drop in supply. It’s crucial that as we approach the 2022 driving season and demand increases, demand will increase to about 17.4-17.5 million barrels a day. Driving season refers to summer in the Northern Hemisphere when fuel demand is typically at its seasonal peak. Tim Snyder warns, “It’s going to be difficult to meet those numbers” regarding production.

“Our inventory numbers are tightening. We will see exclusive what happens in Ukraine and the Baltic States. We’ll see inflationary pressures on the price of the crude oil barrel and, therefore, the [price of] gas and diesel.” Snyder explained.

The petroleum economist urges that an increase in oil production in the United States is “the only and effective way” to reduce the price of gasoline in the US.

Over the last two years, the US Supply started low in the first quarter of 2020. The country experienced an increase in April 2020 to just over 40 million barrels in supply. That supply has steadily decreased between June 2020 to March 2021. Despite best efforts to increase the supply again in April 2021, the country has experienced a steady dwindling since May of 2021.