Petroleum Engineering: A World of Opportunity

A recent survey out of Texas Tech University found the number of new petroleum engineering graduates in the U.S. is expected to decline substantially from the previous five years, despite robust growth and career opportunities within the oil and gas industry. Why the disconnect? E2B: Energy to Business host Daniel J. Litwin tapped two industry experts for their take on the industry hiring challenges and why now is an excellent opportunity for those seeking to pursue petroleum engineering careers. Austin Ward, Consultant in Opportune LLP’s Valuation practice, and David Edwards, Petroleum Engineer with Ralph E. Davis Associates, an Opportune company, help Litwin break it all down.

Ward is an Opportune newcomer, freshly minted two months ago. He looked forward to using his petroleum engineering background at the company. Edwards is still early in his petroleum engineering journey and couldn’t wait to put his skills to use in the industry. As a new engineer in the petroleum industry, Edwards precisely knows why he chose to get involved in the field.

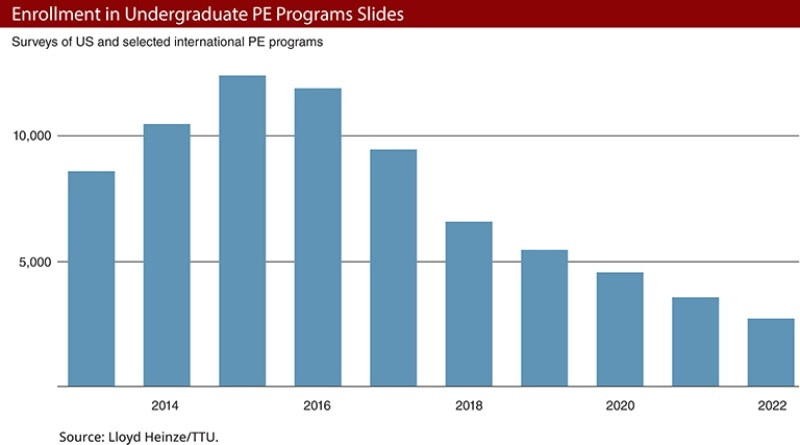

(Source: Journal of Petroleum Technology)

“I was always math and sciences inclined, so that leads your thinking towards engineering in general,” Edwards says. “So, the main driver for my interests in petroleum engineering specifically came my father who was an entrepreneur in Dallas, and he had many clients in the oil and gas industry. So, being around them and hearing how they spoke about the oil and gas industry rubbed off on me.”

As for what’s driving the lack of new petroleum engineer graduates, Edwards and Ward pointed to recent events over the past few years such as industry consolidation during the pandemic and the growth of ESG and renewable energy, to name a few, which may have given engineering majors pause working in the oil and gas industry when they graduated.

“We’ve seen a lot of volatility of people studying petroleum engineering; there’s been downcycles in enrollments and graduation rates before, so this trend isn’t new,” Ward says.

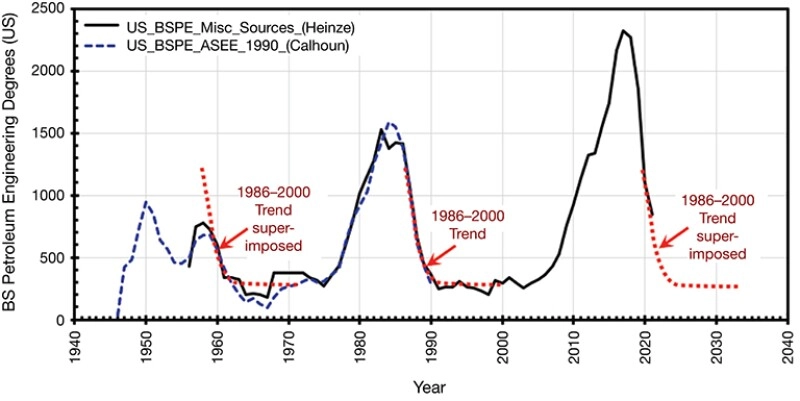

(Source: Journal of Petroleum Technology)

Edwards notes that the negative connotations and perceptions that sometimes hit the oil and gas industry could also impact those decisions. But Edwards says that when people take the time to look into petroleum more, they might find it’s something they’d enjoy doing.

“The truth is there’s going to be a need for new talent to roll through the industry for years to come,” Edwards adds. “There’s a lot of energy in this world that needs to be replaced by renewables but there’s still a lot of regions and places in the world that aren’t at the level we [in the U.S.] are at with affordable and reliable energy. So, there’s still a lot of growth that needs to happen in the industry to sustain that increasing energy demand.”