Exploring The ‘S’ In ESG & What To Expect In 2023

KEY POINTS:

- The Covid pandemic has forced energy companies to create more flexible work environments to appeal to a younger workforce and to stay competitive.

- The energy industry is making progress with diversifying its ranks of leadership and boards.

- The social aspect of ESG is expected to make a significant impact in 2023, especially on the government relations front.

When people in the energy industry think of ESG they tend to focus on the “E”, or environmental component. However, little attention is given to the “S”, or social aspect of ESG, which can play a big role in how the industry is perceived by young professionals and the public at large, the communities it supports, and how it interacts with government and regulatory bodies.

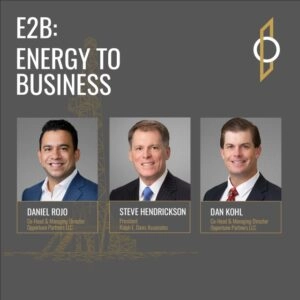

On this episode of E2B: Energy to Business, host Steve Hendrickson, President of Ralph E. Davis Associates, an Opportune company, catches up with two of Opportune’s Directors, Linden Nicosia and Katie-Rose Herd to get a better understanding of why diversity within the workforce is important, what areas within the social component of ESG are helping drive transparency and accountability when it comes to government relations, and what changes the industry is making to improve its public image to attract and retain young professionals heading into 2023 and beyond.

Today, Gen Z’ers make up roughly one-fifth of the U.S. population (about 60 million) and they possess new skills, technological expertise, and innovative approaches that will undoubtedly shape the future of an industry that needs to stay competitive and remain relevant in the new digital age. They also bring with them a shift in workplace expectations and preferences paired with a higher attrition rate than previous generations.

“Covid changed everything, and it changed kind of our way of thinking about working and home life and that balance, and that’s a factor that plays into the hiring, the recruiting culture right now,” Herd says. “A lot of companies have taken great strides to adjust their mindset and adjust the culture to fit that need and remain competitive in the market, such as allowing flexible workdays or work from home policy. It’s what companies have been doing is pretty diverse across the board, but everybody’s trying to pivot and fit that need, that gap, that’s been for this new world that we live in post-Covid.”

Nicosia notes that ESG is becoming an increasingly important measure of a company’s performance and sustainability and that investors are increasingly taking ESG into account when making investment decisions. She also discusses how the industry is making progress, albeit slowly, in making diversity more of a priority within its ranks.

“I think that there’s progress that’s being made,” Nicosia says. “I wouldn’t go as far as to say it’s keeping up with other industries and especially in the U.S., but I do think that there’s been progress made. Part of that is being driven by capital and investors coming into these companies, and that’s something that we’ve seen with clients.”

Looking ahead to 2023, Herd and Nicosia predict that the social aspect of ESG will continue to gain importance in the energy industry, especially concerning government relations.

“I see energy companies, as well as companies like us [Opportune], keeping up with government relations as it keeps changing and our clients are trying to adapt and keeping up with the changing regulations,” Herd says.

Nicosia echoes her colleague’s sentiment.

“I’m personally very interested in seeing how this evolves in 2023 and particularly around the energy crisis in Europe,” Nicosia says. “As we head into winter, there’s a lot of conversation about what that is going to look like and I think that’s going to drive some interesting conversations, and I’m hoping there’ll be more transparency between the industry and government relations. I think that that will only lead to good progress there, and I think it’s going to drive the important conversation of energy equity.”