Here Come the Little Electric Pickup Trucks

Tiny trucks are a natural target for electrification. They’re already lighter and more aerodynamic than their sturdier pickup siblings, which makes it easier for engineers to outfit them with smaller batteries. The smaller batteries will make these trucks lighter still — a flywheel-type equation that works against the auto industry when it’s churning out massive electric SUVs. Small electric trucks are also relatively cheap to manufacture, which helps offset battery costs.

And while few drivers need a small pickup — they offer not much more utility than a similar-sized sedan, don’t handle as well and often have half as many doors — people seem to love them, especially Americans. How they look. How they feel to sit in. What they can do, even if they seldom actually do it.

“There are an awful lot of people who are like ‘I want a truck, but I don’t really need a truck, so this little run-around pickup is fine,’” says Bloomberg Intelligence analyst Kevin Tynan. “For a car company, it’s a great little strategy that nobody is really talking about.”

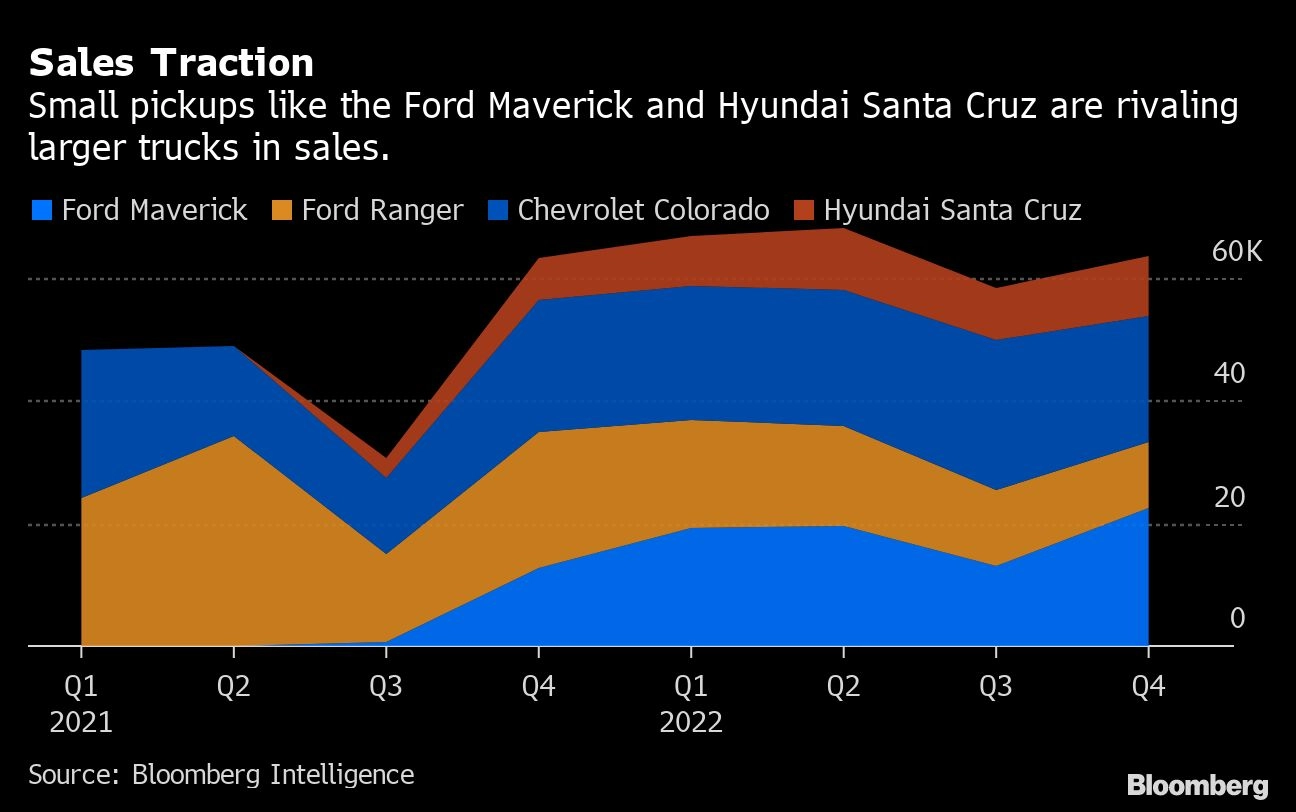

Auto executives tend to green-light a wave of tiny trucks every 20-30 years, typically when gasoline prices spike. In the 1970s, they gave us the Chevrolet LUV, Ford Courier and Subaru BRAT. In the ‘90s, it was the Chevrolet S-10 and Dodge Dakota. Today, we have the Ford Maverick and Hyundai Santa Cruz. Both hit the market in late 2021; their swift popularity is no doubt a factor in carmakers considering similar electric alternatives.

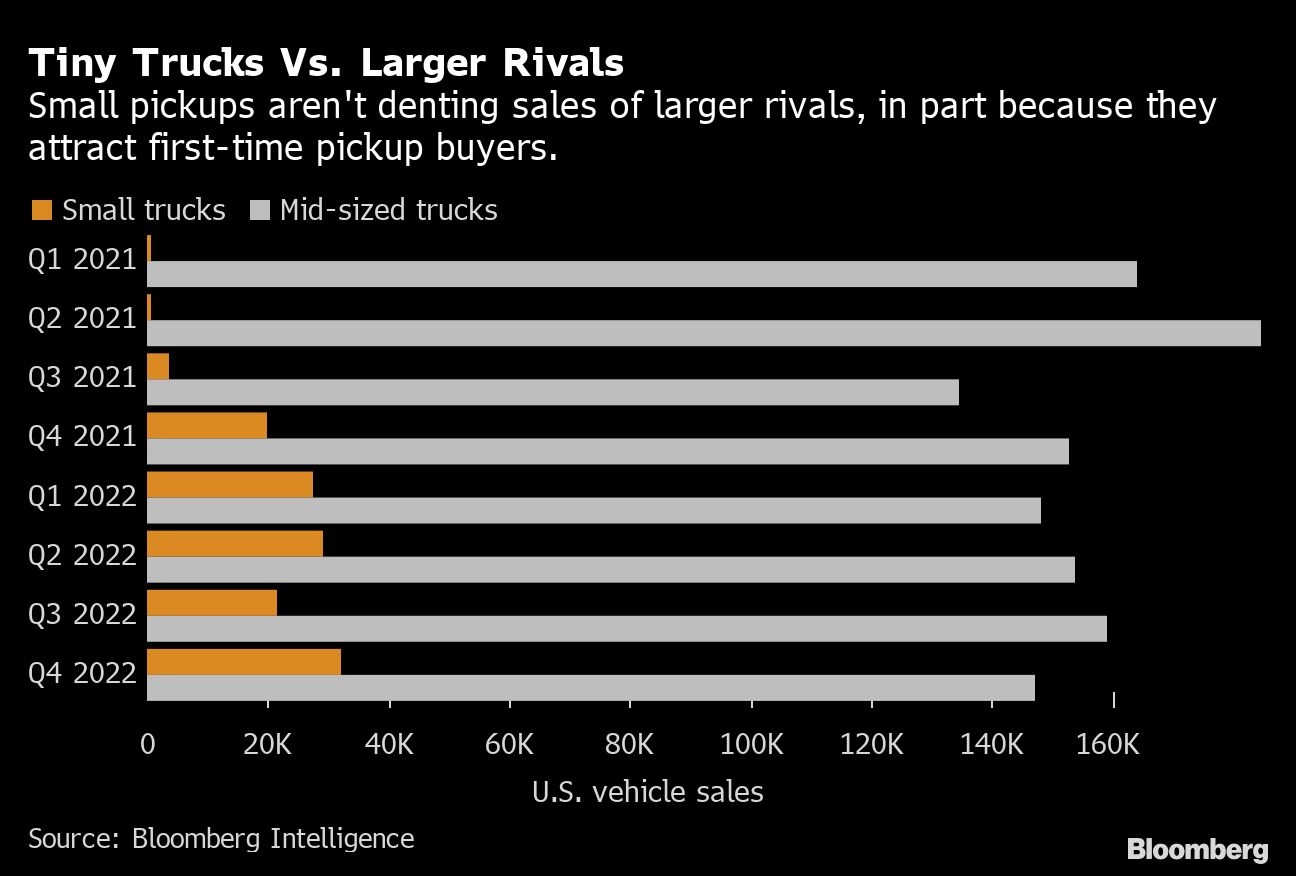

Although it starts at just $22,195, the Maverick generated some $2.1 billion in revenue for Ford last year, according to Bloomberg estimates, nearly as much as its larger sibling, the Ford Ranger. Critically, it didn’t seem to pull buyers away from Ford’s other trucks; the Maverick instead attracted drivers who typically go for car-shaped cars.

The truck has proved so popular, Ford intermittently stopped taking orders to allow its factory to catch up.

The Santa Cruz, meanwhile, let Hyundai tap into America’s lucrative truck market for the first time. In developing the vehicle, the company said it found a lot of people in focus groups who drive small SUVs but yearn for more cargo capability. The Santa Cruz has resonated with that crowd, helping the brand post a 17% increase in vehicles sold in the second half of 2022.

Americans’ menu of tiny trucks will almost definitely keep growing. Thanks to the combination of consumer interest and the strong economics for carmakers, forecaster LMC Automotive sees the compact-pickup market in the US — gas-guzzling, hybrid and electric — swelling to as many as 200,000 vehicles a year by mid-decade, which would be nearly double its current size.

At GM, Fowle says the company’s engineering-and-design working group is dreaming up EVs that can “be affordable from the start versus a decontenting exercise.” In other words, the company is looking to design electric models with a focus on affordable parts, materials and solutions, rather than stripping frills away from a more opulent model.

Conveniently, GM doesn’t currently make any truck the same relative size and price as the Maverick or Santa Cruz. Its closest product is the mid-sized Chevrolet Colorado, which starts around $31,000 and burns a gallon of gas at least every 24 miles.

More stories like this are available on

bloomberg.com

©2023 Bloomberg L.P.