U.S. imports up in September as West Coast sees return of diverted cargo

This article originally appeared on Cargomatic.com.

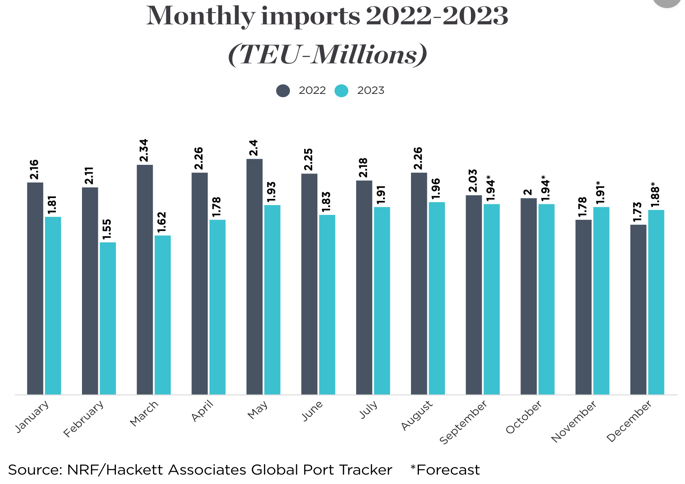

U.S. containerized imports are projected to have risen month over month from August to September but the outlook for the remainder of the year seems somewhat subdued, according to industry analysts.

A close analysis of recent port throughput figures meanwhile suggests that the diversion of cargos from the U.S. West Coast (USWC) ports to the U.S. East Coast (USEC) and Gulf ports is beginning to reverse.

Looking farther ahead, analysts along the USEC foresee a boost in cargo coming out of India and Southeast Asia via the Suez Canal that will prove beneficial to their shipping lines and ports in particular.

THE NRF PREDICTS

“Cargo volumes will still be strong the rest of the year, but not as high as we expected a month ago,” said Jonathan Gold, Vice President for Supply Chain and Customs Policy of the National Retail Federation (NRF).

Gold explained that retailers stocked up early this year as “a safeguard against supply chain labor issues” and are well-situated to meet consumer demand. In a word, there is no need for extra imports at the moment.

Photo Credit: NRF

The slowing rate of growth comes as analysts are predicting a weak holiday shopping season with consumers reducing their credit card purchases, the Financial Times reported.

“A drop in credit card spending is raising concerns about the financial health of the U.S. consumer and the outlook for holiday sales as cardholders face record-high interest charges,” the paper said.

Consultant Ben Hackett meanwhile said the downturn in imports is reflected in operational decisions that ocean carriers are making, in particular, a slowing down of their ships in an effort to reduce capacity without taking vessels offline.

“Ships are not sailing fully loaded, and freight rates are declining as a result. That’s a further indication that no cargo growth from current levels is expected on the near-term horizon. Perhaps 2024 will be better,” Hackett said.

DESCARTES SEES 2019 PARALLEL

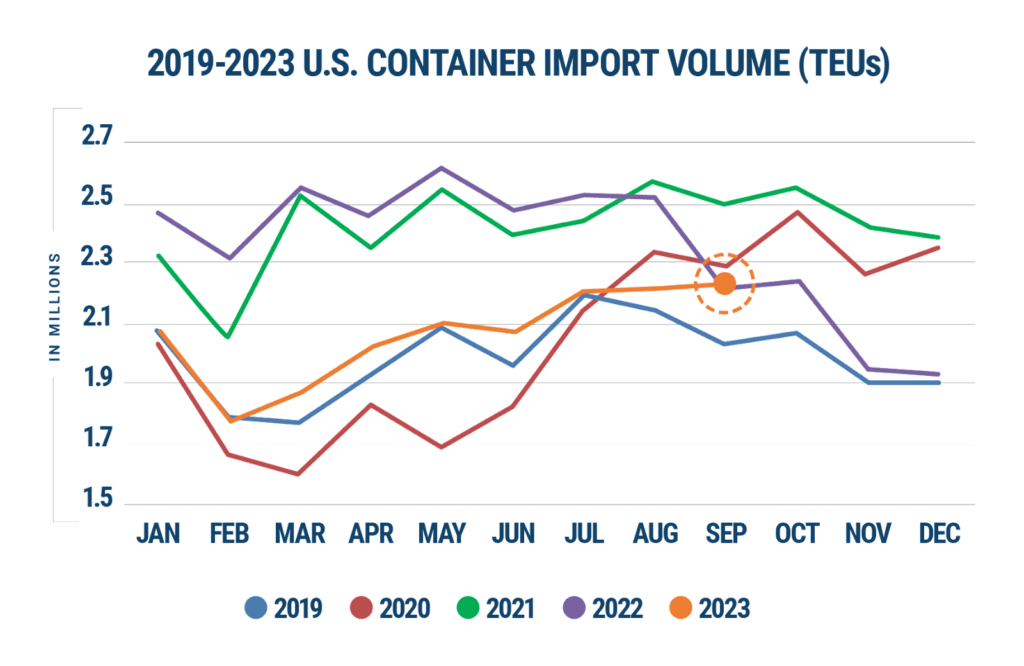

The consultancy firm Descartes Datamyne, which also offers throughput projections based on advanced retail orders, said September 2023 U.S. container import volumes increased by 0.3% over the previous month and were up 8% from pre-pandemic September 2019.

Photo Credit: Decartes

“The growth in import volume over the first nine months of 2023 is within 2.5% of the same period in 2019,” Descartes said.

Cargomatic numbers, computed on the basis of actual port throughput, fits in with that parallel, showing that between August 2019 and August 2023, the U.S. as whole saw a decline of just .01% in imports month over month.

In terms of total TEU throughput, year to date for August, the U.S. is down just 2.33%—much in line with the Descartes estimate of 2.5%.

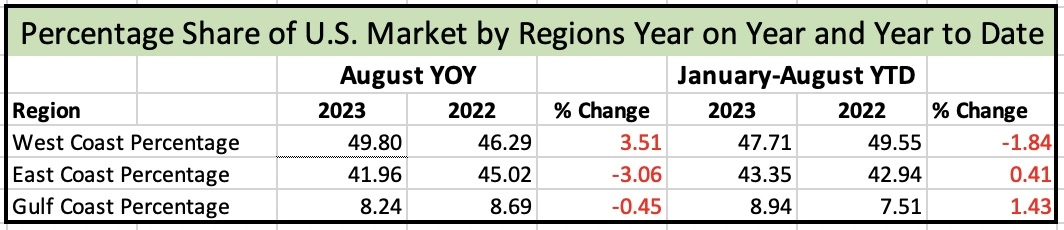

Significantly, Descartes also projected that total import volume numbers for September 2023 versus August 2023 show that “top West Coast ports increased [their market] share to 43.3% (up 1.4%) and top East and Gulf Coast ports decreased to 42.1%.”

That shift also is reflected in Cargomatic figures comparing actual year-over–year (yoy) and year–to–date (ytd) throughput numbers for August.

The ytd figures for January through August do show a -1.84% change in market share for the USWC ports. They fell from 49.55% in August 2022 to 47.71% in August 2023, and their 1.84% loss in share was picked up by the USEC with 1.43% and 0.41% by the Gulf.

However, by contrast, the yoy figures show a decided slowing of the eastward drift of containerized cargo, with the USWC gaining 3.51% in market share to 49.80% in August 2023 from 46.29% in August 2022. That 3.51% USWC gain came at a loss for the USEC and Gulf ports which dropped market share yoy in August by 3.06% and 0.45% respectively.

USEC PORTS LOOK EAST OF SUEZ

While USEC and Gulf ports are mounting robust efforts to retain as much of that rerouted USWC cargo as possible, they also appear to be adopting an alternative strategy to attract business: looking at new trade volumes out of Asia via the Suez Canal.

“Just as the West Coast was the beneficiary of the shift to Chinese production, the East Coast will be the beneficiary of that shift to Southeast Asia and, and South Asia production,” said Stephen Edwards, CEO and Executive Director of the Virginia Port Authority.

Edwards rendered his prediction in a “People on the Move” interview with Cargomatic Chief Spokesperson and SVP for Industry Weston LaBar on October 10.

Edwards’ view was reinforced in New York on October 11 by CMA CGM Chairman Rodolphe Saadé who told investors that his firm looks to offer more vessel space on trade lanes from India and Southeast Asia that are best suited for big ships coming to the USEC.

“The bigger the ship, the less it costs you per unit,” Saadé said. “Now that we own container terminals in the United States, and with the investments we will be making, in a few years from now we will be in a position to accommodate those big ships.”

Not least, Saadé said that CMA CGM’s U.S. customers have come up with “an ambitious shopping list of additional capacity they will need from Southeast Asia.”