R&D Tax Credit Maximization: Expert Tips and Strategies for Businesses

The R&D tax credit allows businesses to claim a tax credit for qualifying research and development expenses, including wages, supplies, and contract research costs. It was created to incentivize businesses to invest in innovation and technological advancement in the United States, and it can provide a significant cash infusion for future development.

The Research and development credits were introduced in 1981 as a temporary measure to encourage innovation and investment. Since then, it has been extended and modified several times and was made a permanent tax credit in 2018.

How has the Research and development credit changed since its inception and what does the future hold for this incentive?

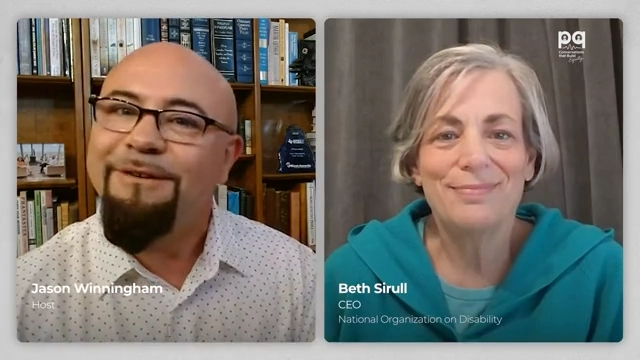

On today’s episode of Weaver’s On the Shop Floor podcast, hosts Colby Horn and Jody Allred, speak with Nancy Imholte, Director of Research and Development Tax Credit Services and Kurtis Dixon, Partner-Tax Services, to talk about the rules and regulations surrounding the R&D tax credit.

The topics include:

1. Compliance tips for businesses regarding the R&D tax credit

2. Recent changes to the R&D tax credits from the IRS

3. IRS audits of R&D tax credit claims

“Research and Development(R&D) credits are a federal incentive to encourage companies to develop R&D in their companies and increase their spending year over year. It can be a nice cash flow incentive for companies,” said Imholte.

Nancy Imholte has more than 20 years of experience in public accounts and leads research and development (R&D) tax credit services for Weaver. The R&D team services multiple industries including companies focused on manufacturing and distribution, oil & gas support services, software development, biotech, and many more. Nancy also provides tax compliance, planning and consulting services to small business and individuals.

Kurtis Dixon has more than 15 years of experience in public accounting and focuses on providing tax compliance, planning and consulting services to Corporations, S Corporations, Partnerships and individuals. Kurtis also has experience with preparation and review of income tax provisions.