We Take Success Personally.

At Weaver, we care about success. But it’s not just the success of our firm or clients that matters to us; it’s the success of our people who make the day-to-day of this business possible. That’s why we’re passionate about bringing together talented individuals and giving them the tools they need to succeed. We lean on each other as members of the Weaver family, understanding that our culture is driven by our collective values, character and efforts. Our goal is to balance both high development with high performance in order to meet the long-term goals of each individual, team and our firm, and every person plays a part.

Weaver

Qualified Small Business Stock (QSBS)

In this episode of Weaver: The Alternative Edge, hosts Blayne Lowary and Vardeep Mann delve into the intricacies of Qualified Small Business Stock (QSBS). This conversation provides crucial information for investors and fund managers looking to maximize tax benefits through QSBS. Lowary and Mann bring valuable insights into how QSBS can be a significant advantage…

Up Next: Navigating Real Estate Education and Water Management in North Texas

Explore real estate education at TCU and water management in North Texas with podcast guest, James Hill, on this upcoming episode of Weaver: Beyond the Numbers, Location Cubed.

Navigating Real Estate Education and Water Management in North Texas

Welcome to another episode of Weaver: Beyond the Numbers, Location Cubed, which examines the complexities of real estate investment and market dynamics with Howard Altshuler and Aaron Grisz. James Hill, the director of the Center for Real Estate at Texas Christian University (TCU), shares his insights on the evolution of TCU’s real estate program, the…

Up Next: Understanding Real Estate Valuations

Explore the nuances of real estate valuations and its cadence, challenges and strategies on this upcoming Weaver: Beyond the Numbers, Location Cubed episode with Selina McUmber, the managing director of valuation services at Weaver. Subscribe and listen to future episodes of Weaver: Beyond the Numbers, Location Cubed, on Apple Podcasts or Spotify. ©2024

Episodes

Up Next: Navigating Real Estate Education and Water Management in North Texas

Explore real estate education at TCU and water management in North Texas with podcast guest, James Hill, on this upcoming episode of Weaver: Beyond the Numbers, Location Cubed.

Navigating Real Estate Education and Water Management in North Texas

Welcome to another episode of Weaver: Beyond the Numbers, Location Cubed, which examines the complexities of real estate investment and market dynamics with Howard Altshuler and Aaron Grisz. James Hill, the director of the Center for Real Estate at Texas Christian University (TCU), shares his insights on the evolution of TCU’s real estate program, the…

Up Next: Understanding Real Estate Valuations

Explore the nuances of real estate valuations and its cadence, challenges and strategies on this upcoming Weaver: Beyond the Numbers, Location Cubed episode with Selina McUmber, the managing director of valuation services at Weaver. Subscribe and listen to future episodes of Weaver: Beyond the Numbers, Location Cubed, on Apple Podcasts or Spotify. ©2024

Understanding Real Estate Valuations

In this episode of Weaver: Beyond the Numbers, Location Cubed, Howard Altshuler and Aaron Grisz sit down for a conversation with Selina McUmber, managing director, valuation services. Together, they explore the complexities of real estate valuations, focusing on the importance of cadence and rhythm in the process, particularly regarding fund clients. Whether you’re an industry…

Navigating Real Estate Investment

Welcome to another episode of Weaver: Beyond the Numbers, Location Cubed, which examines the complexities of real estate investment and market dynamics. In this episode, Howard Altshuler and Aaron Grisz discuss the challenges and opportunities of today’s real estate landscape with Dan Thomas, founder and president of DT Capital. Key Points: Prioritize lower leverage in…

SOC Audits Enhance Momentum’s Security Success

This episode of Weaver: Beyond the Numbers features how Momentum’s strategic approach to SOC audits has driven both security enhancement and business growth. Hosts Lulu Hernandez Walker and Alexis Kennedy welcome Seth Sageser from Momentum. The discussion highlights the evolution of their partnership, focusing on how Momentum expanded its SOC audit practices from two to…

Tune in For: The Evolution of Real Estate in Fort Worth

Don’t miss this upcoming episode of Location Cubed. Weaver’s Howard Altshuler and Aaron Grisz look at the evolution of real estate in Fort Worth with Joel Heydenburk, a Partner at Jackson Walker, LLP. They explore the unique trajectory of real estate law, investments transforming cityscapes, and the nuanced interplay of history and development in…

The Role of Private Equity in The Energy Transition

In this episode of Weaver: Beyond the Numbers, host Gabrielle Bejarano sits down with Mike Collier, a partner in Weaver’s Transaction Advisory Services, to discuss the critical role of private equity in the energy transition. As the world grapples with the urgent need for sustainable energy solutions, this conversation sheds light on whether private equity…

Sales and Use Tax Issues Within the Construction Industry

In this episode of Weaver: Beyond the Numbers, Marc Young, a tax partner at Weaver, is joined by Brandon Hayes, a senior manager in Weaver’s state and local tax group, to review the complex world of sales and use tax issues in the construction industry. They explore this sector’s unique challenges and opportunities, shedding light…

Megatrend: Operating Budget Pressures

In this episode of Weaver: Government Impact, host Todd Hoffman, partner-in-charge, Government Consulting Services, offers insights and best practices for approaching operating budget pressures in government. Joined by Brett Nabors, partner, IT Advisory Services, and Morgan Page, partner-in-charge, Digital Transformation and Automation Services, the discussion focuses on navigating financial challenges, optimizing spending and leveraging technology…

Empowering the Trades: The Humphrey & Associates Story

This enlightening episode of Location Cubed, a Weaver: Beyond the Numbers podcast, examines the heart of the trades with Randy Humphrey, the executive vice president of Humphrey & Associates. Weaver hosts Howard Altshuler and Aaron Grisz discover how this family-oriented business thrives on employee ownership and a commitment to nurturing the next generation of skilled…

Understanding ESG Impacts in Real Estate

In this episode of Weaver: Location Cubed, hosts Howard Altshuler and Aaron Grisz are joined by Ashly Pleasant, director, ESG and sustainability services, at Weaver. They explore the significance of Environmental, Social and Governance (ESG) in the real estate sector, discussing its impact on investment decisions and the importance of sustainability. Key Points: Start measuring…

Tax Optimization for M&D Plant, Property and Equipment

In the latest episode of On the Shop Floor, hosts Colby Horn and Kurtis Dixon discuss the challenges, issues and questions that arise when optimizing your approach to specialty tax services in the manufacturing and distribution (M&D) industry. Joined by Rafael Ferrales, managing director of tax services and a leader of Weaver’s fixed asset advisory…

Navigating Cybersecurity Risks in the Manufacturing and Distribution Industry

In this episode of On the Shop Floor, hosts Colby Horn and Chris Boyd are joined by Trip Hillman, partner in Weaver’s IT Advisory Services. They dissect the escalating cybersecurity risks in the manufacturing and distribution (M&D) industry, discussing the impact of connected devices and the importance of robust IT risk management. Key Points: Assess…

Tax Benefits in Real Estate: Cost Segregation Insights

Rafael Ferrales, a managing director in Weaver’s fixed asset advisory practice, joins Howard Altshuler and Aaron Grisz on Weaver: Beyond the Numbers: Location Cubed to look into the intricacies of cost segregation in real estate and discuss its benefits for property owners and investors. Key Points: Utilize cost segregation for immediate tax savings on property…

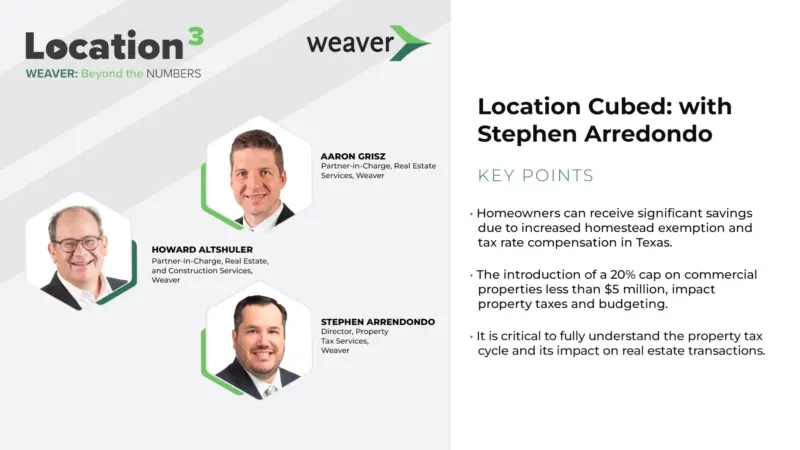

Understanding Weaver’s Property Tax Practice

In this insightful episode of Location3, a Weaver: Beyond the Numbers podcast, hosts Howard Altshuler and Aaron Grisz engage with Stephen Arredondo, Weaver’s property tax leader. They delve into the nuances of property tax, recent legislative changes, and their implications for residential and commercial property owners. Key Points: Homeowners can receive significant savings due to…

Female Leadership in Venture Capital

In this episode of The Alternative Edge podcast, Weaver investigates the experiences and impacts of female participation and leadership in venture capital. Sindhu Rajesh and Sonali Vijayavargiya discuss women’s transformative role in the investment landscape and how this demographic drives efficiency, productivity and sustainability in foundational industries. Key Points: There is a critical need for…

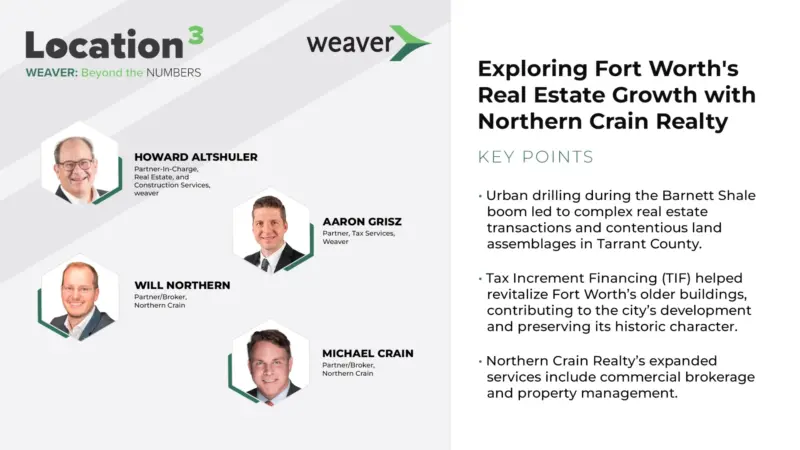

Exploring Fort Worth’s Real Estate Growth with Northern Crain Realty Podcast

In this episode of Location3, a Weaver: Beyond the Numbers podcast, Howard Altshuler and Aaron Grisz delve into the dynamic world of Fort Worth real estate with guests Will Northern and Michael Crain from Northern Crain Realty. They discuss the evolution of the Fort Worth area, the impact of real estate development on the community,…

NYC Discussion: Real Estate and Alts

Explore the evolving landscape of New York City’s real estate and alternative investments with Brandon Cooperman and Howard Altshuler in this insightful episode of Weaver: The Alternative Edge. Dive into the current trends, market forecasts, and strategic growth in the real estate sector. Key Points: NYC’s Office Real Estate market is a tale of haves…

VC Investment Valuations Podcast

In this episode of The Alternative Edge, a Weaver: Beyond the Numbers Podcast, host Becky Reeder, an audit partner and co-leader of the alternative investments practice at Weaver, engages with Sindhu Rajesh, an Alternative Investment Services Partner with Weaver. They unpack the complexities of venture fund valuations, offering critical insights into industry dynamics and best…

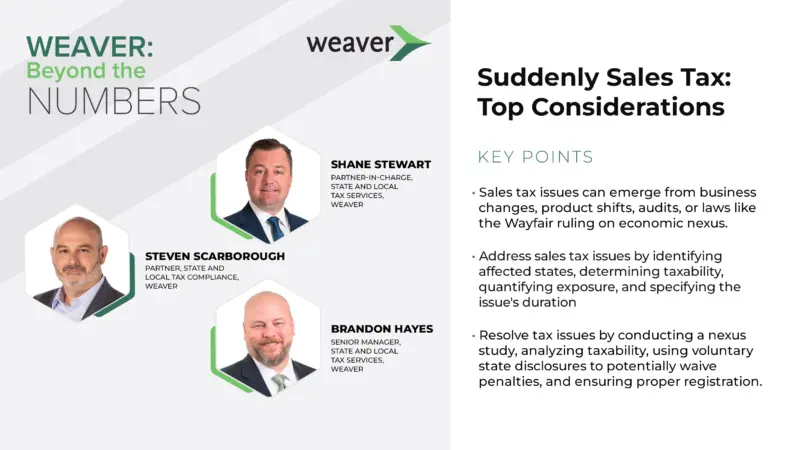

Suddenly Sales Tax: Top Considerations

In this episode of Weaver’s Beyond the Numbers, Brandon Hayes, a senior manager in Sales and Use Tax Practice, leads a crucial discussion about sales tax issues and sales tax compliance strategies. Joining him are Stephen Scarborough, partner in the State and Local Tax Compliance Group, and Shane Stewart, the partner in charge of the…

Wayfair: “Still Ignoring Sales Nexus” Or “Evolution of”

In this Weaver Beyond the Numbers episode, Steven Scarborough, Mayur Naik, and Brandon Hayes review the implications of the Wayfair vs. South Dakota case. As e-commerce continues to dominate the market, understanding the nuances of sales tax and economic presence becomes crucial for businesses. Key Points: The Wayfair vs. South Dakota case determined that companies…

Direct Pay Compliance: Direct Pay, Don’t Overpay

In this episode of Weaver: Beyond the Numbers, Shane Stewart, Mayur Naik, and Tony Burgess look into direct pay permits, their potential benefits, and the intricacies of maintaining them. As companies explore ways to optimize their tax functions, this conversation sheds light on the potential savings and responsibilities of direct pay permits. Key Points: Direct…

Credit for Sales Tax: Back, Back, Back it Up

In this riveting edition of Weaver: Beyond the Numbers, host Brandon Hayes sits with Weaver’s Tony Burgess and Steven Scarborough to discuss sales and use tax. Uncovering the multiple avenues available for businesses that might have overpaid on their taxes, this episode provides insights and actionable advice for companies navigating this complex landscape. Key Points:…

The Real Estate Council of Greater Fort Worth and its Impact on the Region

In the latest episode of Weaver’s Location Cubed, hosts Howard Altshuler, partner-in-charge, real estate and construction services at Weaver, and Aaron Grisz, partner, tax services at Weaver, are joined by Karen Vermaire Fox, executive director, The Real Estate Council of Greater Fort Worth (REC of GFW), to discuss the impacts of the real estate council…

How Bank Fraud Still Occurs in the Financial Sector Even With Protective Measures

Digital transformation drives a shift in financial operations globally, which makes understanding the mechanisms of bank fraud becoming increasingly more critical. From grand schemes that can potentially topple large banks to smaller-scale cons, fraudulent activities continue to plague the financial sector. Vigilance, robust anti-fraud systems, and a comprehensive understanding of red flags are the…

Where To Go From Here: Decoding the Future of the Real Estate Landscape in An Unstable Economy

As the country continues to grapple with things like unstable geopolitical issues, record-high inflation and rising interest rates, the real estate landscape is undergoing seismic shifts. Investors and professionals are vying for insights to predict market movements and drive sustainable investment strategies. Experts, like those at JP Morgan, note that a mild to moderate…

R&D Tax Credit Maximization: Expert Tips and Strategies for Businesses

The R&D tax credit allows businesses to claim a tax credit for qualifying research and development expenses, including wages, supplies, and contract research costs. It was created to incentivize businesses to invest in innovation and technological advancement in the United States, and it can provide a significant cash infusion for future development. The Research and development…

Weaver: Learning About Employee Stock Ownership Plans

An employee stock ownership plan is a form of employee benefits that rewards workers by giving them a share in the company in the form of a stock. ESOPs, as they are dubbed, have steadily increased in popularity since their inception in the 1970s. So, what exactly is an ESOP, how do you know if…

Weaving a Healthcare Safety Net: A Strategic Response to Changing Needs

“Every cloud has a silver lining,” an adage that aptly describes the current state of healthcare. In the wake of an ever-evolving pandemic, providers have faced countless new compliance and regulatory requirements. These once-in-a-lifetime challenges have necessitated swift pivots, leading many providers to explore strategies for stability. Amid this landscape, Weaver’s strategic approach stands out,…

Revolutionizing Data Management in Government: Insights and Best Practices

The saturation of data in various areas of life and functionality has led to an interest in exploring different types of data management. Government agencies, along with their goal to be more transparent, have further put a demand on the handling of all of this data. As a result, incorporating newer and improved technology is…

Converting Commercial Buildings to Residential Buildings: Is This Sustainable?

The trend of converting commercial buildings, including offices, into residential buildings has been around for some time. However, with the increase in remote work, many home offices are replacing commercial office spaces as places to work. About 998 million square feet of office real estate across the United States is available but in search of…

The Provider Relief Fund: A Government Lesson in Unintended Consequences

The Provider Relief Fund (PRF) created a necessary cash infusion for healthcare providers during the pandemic. The pandemic required unprecedented government action to the tune of more than $19 billion distributed through the program. Now that the storm of Covid is behind us, the true story of PRF is around its success compared to mandated…

Inside the ‘Fort Worth Development’: A Conversation with Aaron Grisz

Since the pandemic, downtown Fort Worth, Texas, has entered a new era of development activity, an important chapter in the ongoing Fort Worth Development. Smack dab in the middle of all this action is Weaver’s Fort Worth office, located on West 7th Street. Weaver recently renovated their office, which included knocking down walls, increasing natural…

What the Changes to IRS’s Code Section 174 Means for Taxes This Year

For businesses, tax season can be especially stressful, given the weight of information to prepare and consider, along with various changes coming from the IRS. The Tax Cuts and Jobs Act of 2017 amended Code Section 174, whereby requiring companies to capitalize and amortize costs for their R&D expenses starting in the 2022 tax year….

Understanding Direct Pay Permits and Their Tax Benefits

Direct pay permits, which allow taxpayers to pay sales tax directly to the state rather than sellers, are becoming more common. Many businesses see direct pay as an essential element to the management of their state and local tax obligations, however there are still many questions. How do direct pay permits work and how are…

Decoding the 2023 Tax Changes: An Insightful Discussion with Tax Services Partner Kurtis Dixon

Every year, legislators make new regulations and changes to the tax code, and 2023 is no exception. On this episode of On the Shop Floor, Weaver’s Partners-in-Charge of Manufacturing, Distribution, and Retail Services—Colby Horn and Jody Allred—sat down to talk with Weaver’s Tax Services Partner, Kurtis Dixon on the latest developments and tax changes in…

Bipartisan Infrastructure Bill: Managing a Deluge of Funds and Delivering on Promises

Our nation faces high inflation and an uncertain post Covid economic recovery. However, the government sector is flush with cash and funding for infrastructure improvements and capital programs approaches historic levels. Nearly a year ago President Biden signed the Bipartisan Infrastructure Bill,” a once-in-a-generation investment in our nation’s infrastructure and competitiveness”. Millions, billions and yes,…

Remote Work: Unintended Challenges and Dilemmas Explored by Experts

While remote work might seem like a fantastic way to build a company and retain employees, some unintended consequences come with it. In this episode of Location Cubed, Weaver’s Howard Altshuler, Partner-in-Charge, and Rob Nowak, Partner, talk about the strategies and dilemmas companies face in undertaking remote work. Often, when a company changes location, there…

Confessions of a QSA: PCI DSS Version 4.0

In March of 2022, the Security Standard’s Council released version 4.0 of its Payment Card Industry Data Security Standard (PCI DSS.) Weaver’s IT Advisory Services’ Kyle Morris, Senior Manager, and Brittany George, Partner, spoke to Tyler Kern about the new standard and what people need to know on this episode of the show. PCI DSS…

Go Barefoot with Direct Examinations – SSAE 21

As the market grows and develops, it changes. Some of these changes include renewed marketplace dependence on third parties. To talk about these changes, risk evaluations, and SSAE 21 direct examinations, host Tyler Kern chatted with Weaver’s Neha Patel, Partner-in-Charge of IT Advisory Services, and Alexis Kennedy, Partner of IT Advisory Services. Patel broke down…

Automation and Digital Transformation: Changing the Government Environment

Automation and digital transformation are revolutionizing the way organizations conduct business. Technology continues to change the way organizations conduct business. Governments across the country can enhance their effectiveness by leveraging new tools and modernizing processes. Morgan Page, Partner-in-Charge of Digital Transformation and Automation at Weaver joins host Adam Jones on the show, for a look…

Key Considerations for Asset Managers: Acquiring and Developing Human Capital

On this episode of Weaver: Beyond the Numbers, host Becky Reeder, Partner-In-Charge, Alternative Investment Services, of the Alternative Investment Practice at Weaver speaks with Paul Olschwanger, Founder and Chief Inspiration Officer at Wendell Rhoads Consulting about the significance of developing human capital to meet an organization’s demands. With over 30 years of experience in the…

The Fundamentals of Cyber Insurance

Malicious cybercriminals see government entities as prime targets and many leaders are investing in the best protection against loss and interruption. In this edition of The Business of Government, our host, Adam Jones, is joined by Trip Hillman, Weaver’s Partner of IT Advisory Services to discuss the ever-changing cybersecurity landscape and the growing need for…

Holistic Risk Management: Is Insurance Ready for the Shift?

Brian Hunt is a Texas native whose career focus includes insurance and risk management. Today, Hunt is a VP at USI, the seventh largest insurance broker in the country, where he specializes in construction and real estate. “It’s not my job to tell you what you want to hear. It’s my job to tell you…

The Future of Government

“These are public funds and we have an obligation to not just be good stewards, but the best stewards we can. This is why adding a strong process to ensure you’re getting the best value is important.” – Porter Wilson, Executive Director, Texas Employees Retirement System The Employee Retirement System of Texas is one of…

Beyond the Numbers: Managing Crown Jewel Data Within Organizations

An organization’s intellectual property, trade secrets, and any proprietary information that requires protection are considered crown jewel data. Managing this data can be as crucial to the organization as the data itself. Trip Hillman, Director of Cybersecurity Services at Weaver, and Hunter Sundbeck, a Privacy Lead for IT Advisory Services at Weaver, checked in with…

Weaver Beyond the Numbers: Business of Government

Jennifer Ripka, CPA, Partner at Weaver, and Jackie Gonzales, CPA, Partner at Weaver, discuss single audits and the challenges many government entities face with the influx of federal financial assistance over the last two years. Adam Jones, Stage Government Practice Leader at Weaver, points out, “There’s never been a year quite like the last couple…

The Impact of The Supply Chain on Residential Home Prices

In this episode of Location Cubed, host Rob Nowak, a Tax Partner with Weaver, sat down with Howard Altshuler, Weaver’s Partner-in-Charge of Real Estate Services. The two discussed the impact of the supply chain on the recent spike in residential home prices. Pre-covid, everything was moving along fairly smoothly for the supply chain; however, COVID-19…

Weaver On-Chain: Crypto Tax Reporting

Shehan Chandrasekera, Head of Tax Strategy at CoinTracker, is a subject matter expert in cryptocurrency taxation. Like many who first experience crypto, Chandrasekera saw the potential of cryptoassets, but realized transacting and investing in these assets presented an enormous administrative burden. With few professionals and CPAs skilled in the industry, Shehan set out to build…

Beyond the Numbers: The Oil Spill Liability Tax

For this discussion on motor fuels taxation issues, Beyond the Numbers sits with two of Weaver’s industry leaders, Emilda Santiesteban and Leanne Sobel, J.D., both Directors of Motor Fuels and Excise Tax Services. They join host, Tyler Kern, to explore motor fuel taxation dynamics and offer their insights on a constitutional challenge to the federal…

Crown Jewels Data: Managing Essential Company Data Within Organizations

An organization’s intellectual property, trade secrets, and any proprietary information that requires protection are considered crown jewel data. Managing this data can be as crucial to the organization as the data itself. Trip Hillman, Director of Cybersecurity Services at Weaver, and Hunter Sundbeck, a Privacy Lead for IT Advisory Services at Weaver, checked in with…

Weaver On Chain: The Current Regulatory and Tax Challenges of Decentralization

David Kerr, Principal at Cowrie, has ten years of experience in tax strategy, financial accounting, anti-money laundering, international tax compliance, and risk consulting across the gaming, telecommunications, technology, and digital asset industries. He is an expert in decentralized autonomous organizations and advises on structuring for legal and tax purposes. DAOs are represented by rules that…

Risk Mitigation Strategies for Major Capital Projects

Risk mitigation strategies play a key role in handling federal funds available for capital projects today. The Business of Government discusses the risks involved with such projects and offers strategies for mitigating those risks. Daniel Graves, Partner, Risk Advisory Services at Weaver, provides crucial insights and best practices for those in the government sector considering capital…

Analyzing the Impact of Tax Legislation on Real Estate

Politics and capital gains—how are these related and what do changes in both sectors mean for the real estate industry? Rob Nowak, Partner in Tax Services at Weaver, and Howard Altshuler, Partner-in-Charge of Real Estate Services at Weaver, dove into the impact of tax Legislation on Real Estate in this episode of Weaver: Beyond The…

Beyond the Numbers: Tax Considerations When Investing in Crypto

Two terms many people are familiar with these days are crypto and blockchain. However, the familiarity does not always translate into understanding. There are plenty of questions about cryptocurrency and blockchain, so Weaver’s Beyond the Numbers reached out to Tim Savage, who oversees tax services for Weaver’s Cryptocurrency Task Force, to help answer those questions….

Beyond the Numbers: Operational Errors

Two Partners at Weaver’s Assurance Service Department, Kerri Franz, and Aracely Rios, joined Beyond the Numbers to talk about the top five operational errors that occur and how to reduce them. Untimely remittances of employee contributions can occur if the plan sponsor does not transmit those contributions or loan payments to the trust in a…

Weaver On-Chain: The Blockchain World

In this exciting debut episode of Weaver On-Chain, host Tim Savage, CPA, Blockchain & Digital Assets, Tax Services welcomes world-renowned expert Dr. Sean Stein SmithDBA, CPA as his inaugural guest on a podcast dedicated to the exciting world of cryptocurrency and the blockchain industry. Sean holds many titles including Assistant Professor at City University of…

The Evolution of Sports Stadiums throughout the US

In this episode of Weaver: Beyond the Numbers, hosts Rob Nowak, Tax Partner at Weaver, and Howard Altshuler, Partner-in-Charge of Real Estate Services at Weaver, took time to reflect on the evolution of sports stadiums in the United States. Altshuler recalled how his visit to a sports stadium to watch the Dallas Stars, got him…

Weaver Beyond the Numbers Real Estate Edition: A Look at What to Expect in Real Estate in 2022

The world of real estate had another unprecedented year in 2021. However, big changes didn’t materialize due to the Build Back Better Act not passing. In this Real Estate Edition of Weaver Beyond the Numbers, hosts Rob Nowak and Howard Altshuler discussed the Build Back Better fallout and predictions for the industry in 2022. “The…

Weaver Podcast: The Future of Revenue Recognition

Not too long ago, accounting standards established by the American Institute of Certified Public Accountants required real estate companies to navigate various purchase options and agreements that often resulted in limited guarantees for home sales. But that changed in May 2014, when FASB issued new guidelines designed to strengthen revenue recognition standards and increase transparency….

Weaver: Beyond the Numbers: It’s Up to You, New York (and Charlie)

Howard Altshuler and Rob Nowak invited Charlie Anastasia to Weaver’s Beyond the Numbers — Real Estate Edition, to give his insight on life in New York City pre-Thanksgiving 2021. “You definitely will see a lot more people in the city, which is really refreshing,” Anastasia said. The last six months have seen an increase in…

The Business of Government: Leadership in Government

Government does not measure profit and loss, but it is still a business. Government leaders deliver change, develop strategies, and adapt. Sharing her insights on the topic, Weaver National Strategy Leader Alyssa Martin, CPA, joined Business of Government host and State Government Practice Leader, Adam Jones. Martin has decades of public accounting experience and founded…

Changing Role of Government Leaders—Strategy, Motivation and Efficiency

Government does not measure profit and loss, but it is still a business. Government leaders deliver change, develop strategies, and adapt. Sharing her insights on the topic, Weaver National Strategy Leader Alyssa Martin, CPA, joined Business of Government host and State Government Practice Leader, Adam Jones. Martin has decades of public accounting experience and founded…

Beyond the Numbers: Analyzing the Impact of Tax Legislation on Real Estate

Politics and capital gains—how are these related and what do changes in both sectors mean for the real estate industry? Rob Nowak, Partner in Tax Services at Weaver, and Howard Altshuler, Partner-in-Charge of Real Estate Services at Weaver, dove into this topic on this episode of Weaver: Beyond The Numbers Podcast. Recently, Virginia and…

Beyond the Numbers: The Rebound and Current Financial State of the Biopharma and Med Tech Industries

COVID-19 rocked the world in most industries, but particularly for biopharma and pharmaceuticals, which were at the forefront. Tyler Ridley, Senior Manager of Valuation Services at Weaver, joined this episode of Weaver: Beyond The Numbers Podcast with Weaver hosts Howard Altshuler, Partner-In-Charge of Real Estate Services, and Rob Nowak, Tax Partner with Weaver, to…

Weaver Beyond the Numbers Real Estate Edition: The Long and Winding Road to Tax Reform

“There are a number of proposed provisions in the Build Back Better Act that could impact tax rates.” A lot is going on in the tax world that could have implications for companies and individuals. While nothing is official, there are many proposed changes to the tax code in the Build Back Better Act. In…

Unlock Your Home Equity Without Taking On Additional Debt: Weaver: Beyond The Numbers

Often, traditional lending products keep homeowners on the debt treadmill and may not be the best way for homeowners to pursue renovations, consolidate debt, or put their kids through college. With that being said, Unison lets homeowners unlock their home equity without taking on any additional debt, allowing these homeowners to achieve their goals in…

Weaver: Beyond The Numbers Podcast

On this episode of Weaver: Beyond The Numbers Podcast, hosts Rob Nowak, Partner, Tax Services at Weaver, and Howard Altshuler, Partner-in-Charge, Real Estate Services at Weaver, discuss climate change and adaptability for the real estate industry. This past year we’ve seen extreme weather events creating stress on buildings, infrastructure and the supply chain. Texas faced…

Beyond the Numbers: CCBO Conference Recap

Dan Graves, CPA, Partner with Weaver Risk Advisory Services, and Rebecca Goldstein, CPS, Partner with Weaver’s Assurance Services Team, returned from the recently held 2021 CCBO (Community College Business Officers), where they gave a joint presentation on grant compliance. They shared their experiences and insights from the conference with Adam Jones, Weaver’s State Government Practice…

Weaver: Beyond the Numbers: The Global Minimum Tax Explained

Covering core elements of the Global Minimum Tax being considered by the world’s largest economies, Weaver’s International Tax professionals provide insight for multi-national businesses. Key Points: The Organization for Economic Cooperation and Development (OECD) looks to certain measures, including a global minimum tax to level the playing field among countries. Generally, the Global Minimum Tax…

Weaver: Beyond the Numbers: Making the Most of Charitable Contributions

With tax season just around the corner, host Tyler Kern discussed the latest updates around charitable contributions with Justin Reeves, CPA, Tax Partner at Weaver. For those who itemize their deductions, the limit of cash contributions in 2021 has increased from 60% to now a staggering 100% of adjusted gross income. Reeves clarified the difference…

Bonus Depreciation of Business Assets

“Both new and used property now qualify for bonus depreciation, which is a little bit of a departure from some prior law,” Nowak said. On this episode of Weaver: Beyond the Numbers, Host Tyler Kern talked with Rob Nowak, Partner in Tax Services at Weaver, about the bonus depreciation of business assets. “Bonus depreciation is…

Reflecting On OPIS RFS, RINs and Biofuels Forum 2021

“The timing of the conference this year was quite interesting,” Dunphy said. “We have annual objectives that EPA publishes each year of the period of the regulations. We have now been waiting for an announcement related to 2021 about the standards the industry to try to meet.” On this episode of Weaver: Beyond The Numbers,…

Weaver Beyond the Numbers Property Taxes, An Appeal to the Appeals Process

The tax assessor’s notice isn’t always the final say on what taxpayers must remit. Companies can easily appeal these decisions with a proactive appeal strategy for their real and personal property taxes . Discussing Property tax can encompass a large portion of your company’s tax burden and with rising assessments there is a feeling…

Confessions of the QSA: An Introduction to the Payment Card Industry Data Security Standard

As most in the industry know, a QSA must get certified by the PCI Security Standards Security Council to audit merchants for Payment Card Industry Data Security Standard (PCI DSS) compliance. Created in 2004 by major credit card brands, such as Visa and American Express, the council acts as a form of self-regulation. So,…

Ep 1049: Predictions For The Industry for 2021-2022

On this episode of Weaver: Beyond The Numbers Real Estate Edition Podcast, hosts Rob Nowak, Partner, Tax Services at Weaver and Howard Altshuler, Partner-in-Charge, Real Estate Services at Weaver, talked about their predictions for industry trends for the rest of 2021 and into 2022. “If I had my sunglasses, I’d be putting them on because…

Ransomware…What in the World Is Going On?

In a landscape that’s seen an uptick in cybersecurity concerns thanks to a boost in remote work, hurried adoption of technology solutions and more, there’s one cyberattack du jour – ransomware. To explore this specific kind of threat and its impact on government Weaver: Beyond the Numbers, The Business of Government host Adam Jones was…

Weaver Beyond the Numbers Real Estate Edition: What Is Reverse Logistics, and How Can You Navigate It?

Weaver’s Rob Nowak, Partner, Tax Services, and Howard Altshuler, Partner-in-Charge, Real Estate Services, know many logistical challenges come into play when ordering something online. But what barriers exist on the backend for returning those online purchases? Nowak and Altshuler discussed the world of reverse logistics to see if they could figure out what goes on…

What Are the Biggest Unknown Risks in Real Estate?

On this episode of Weaver Beyond the Numbers, Real Estate Edition, Howard Altshuler, Partner-in-Charge, Real Estate Services for Weaver and Rob Nowak, Partner, Tax Services for Weaver were joined by Andy Freundlich, Partner, Assurance Services for Weaver for a lively discussion on risk assessment and management in real estate. “This last year has been amazing…

Relocating Your Business to Texas? Critical Considerations before Making the Move

Relocating a business is a complex move but something that can be very beneficial to a company. One state where they are flocking is Texas, named the “Best State for Business” by Chief Executive Magazine. What are the implications, tax-wise, for such a move? Weaver experts and CPAs David Jackson, Partner, State and Local Taxes, and Jason Avila,…

The Keys to Succession Planning and Business Valuation

On today’s episode of the show, Weaver’s Brad Jay, Partner-in-Charge of Manufacturing, Distribution and Retail Services, brought together three industry leaders, Jon Gormin, Managing Director for Owners Resource Group, Brad Wallace, Principal LKCM Headwater Investments and Curt Germany, Partner In Charge, Valuation Services at Weaver to provide knowledge, insights and best practices from their experiences…

Ep1044: How Accurate Are Commercial Property Tax Assessments?

Commercial property tax assessments arrive every year, but how accurate are they, and should companies appeal? After all, this is a number that owners want to see low, low, low. Providing his in-depth knowledge, Jason Armstrong, Senior Manager, State and Local Tax Services, joined his colleagues and hosts of Weaver Beyond the Numbers Real…

Using ESG Strategy to Drive Performance and Value – Part 2

Greg Englert, Partner, Risk Advisory Services, continues Weaver’s Beyond the Numbers’ examination of ESG strategy to drive performance and value for companies in the second of a two-part series. Englert provides a recap of topics covered in part one before diving into several current trends in sustainability reporting to begin the discussion.

Ep1043: Building Trends Impacting Commercial Real Estate

The world experienced many changes during the pandemic. As a result, many things might translate to the commercial real estate (CRE) sector. Weaver Beyond the Numbers Real Estate Edition hosts Howard Altshuler, Partner-in-Charge, Real Estate Services and Rob Nowak, Partner, Tax Services shared their thoughts on these possibilities. “I was thinking about some things I’ve seen, like contactless…

Weaver: Beyond the Numbers: Sales Tax Recovery – Where Can Oil and Gas Companies Find the Dollars?

Mayur Naik and Shane Stewart discuss opportunities for oil and gas companies to recoup overpayment in sales taxes.

Tips and Insights on Personal Liability for Sales Tax in the Manufacturing, Wholesale, and Retail Industries

Gone are the days when remote sellers can afford to procrastinate their obligations to register and begin filing sales tax returns under the economic nexus laws requirements.

Building Inclusive and Diverse Non-Profi Boards with Ronnie Haggerty and Dr. Froswa’ Booker-Drew

There are many challenges in achieving inclusion and diversity on boards. Many non-profit boards struggle with putting together a balanced board of diverse voices, including younger board members. Ronnie Haggerty, Vice President of Community Relations for The United Way at Greater Houston, and Dr. Froswa’ Booker-Drew, Vice President of Community Affairs for the Strategic Alliances…

Beyond the Numbers: COVID-19’s Impact on Manufacturing and Distribution Companies: a CFO’s Perspective.

Brad Jay, Weaver’s Partner-in-Charge of Manufacturing and Distribution Services tapped Frank Cinati, CFO of ABATIX, Vince Rullo, CFO of Howard Supply Company, and Matt Nafziger, CFO of Royal Manufacturing to give their perspective on how manufacturing and distribution companies have weathered the COVID-19 storm. What does the post-pandemic outlook like, and what can companies do…

COVID-19’s Impact on Manufacturing and Distribution Companies: a CFO’s Perspective, with Frank Cinati, Vince Rullo, and Matt Nafziger

Brad Jay, Weaver’s Partner-in-Charge of Manufacturing and Distribution Services tapped Frank Cinatl, CFO of ABATIX, Vince Rullo, CFO of Howard Supply Company, and Matt Nafziger, CFO of Royal Manufacturing to give their perspective on how manufacturing and distribution companies have weathered the COVID-19 storm on Weaver: Beyond the Numbers. What does the post-pandemic outlook like,…

How To Build a Great Corporate Culture When Office-Work Isn’t Possible

Management is never easy, but what’s the best way to manage when in-person meetings or even informal tools for collaboration like happy hours are no longer on the table? That’s the challenge the majority of businesses have faced in 2020. Still, Julie Armendariz, GitLab Director and People Business Partner, said managers don’t need to reinvent…

Beyond the Numbers: SOC Reporting for Supply Chain Management

The purpose of SOC reporting is to give insights into business-to-business relationships. Neha Patel, Partner-in-Charge, IT Advisory Services, Weaver, and Alexis Kennedy, Senior Manager, IT Advisory Services, Weaver, joined Beyond the Numbers to talk about the importance of SOC reporting in supply chain management, which is a critical component of many businesses. “The force behind…

Beyond the Numbers: COVID-19 Happened – Where Did Your Data Go?

In the wake of the spread of the novel coronavirus and the COVID-19 pandemic it brought about, the world’s businesses and operations are attempting to engineer a return to what’s likely to be a new global normal. However, in the midst of this uncertain period, what’s happened to data? On this episode of Beyond the…

Beyond the Numbers: COVID-19 Concerns Top of Mind for U.S. Manufacturing Leaders

As Americans shelter in place to help flatten the curve of infection, manufacturing industry leaders have the challenging task of balancing employee health and safety with international supply chain demands like never before. On this episode of Weaver’s Beyond the Numbers podcast, host Shelby Skrhak sat down with Jody Allred, Partner-in-Charge for Large Market Manufacturing…

Beyond the Numbers: Clashes Between Finance Leaders and Clinicians Could Boil Down to Classic Introvert/Extrovert Types

An epic push-and-pull takes place every day in for-profit hospitals and healthcare facilities. Finance teams need to do their jobs to keep the business profitable, while medical professionals work to give patients the very best care possible. Today on Weaver: Beyond the Numbers, host Shelby Skrhak sits down with CPA Anna Stevens to discuss accounting…

Weaver Jobcast: Audit Associate I

Position Summary: Perform audit procedures as assigned on engagements and help with any other duties necessary to complete an audit engagement. Work closely with Senior Associates and Managers to identify and resolve issues encountered in performance of financial statement audits through effective and timely communication. Develop effective and clear work paper techniques; Assist with financial…

Beyond the Numbers: Should Your Bank Consider Banking Cannabis-Related Businesses?

Cannabis-related products and companies squarely live in a world of a perpetual gray area. To help clear up the opaque nature of banking by cannabis-related businesses on this episode of Weaver: Beyond the Numbers, host Shelby Skrhak sits down with Rachel Mondragon, Weaver Senior Manager in Regulatory Compliance specializing in financial institutions, to discuss. The…

Beyond the Numbers: Texas is a Dynamic State That’ll Never Stop Surprising

On this new episode of Weaver: Beyond the Numbers, the Texas economy is our subject matter of focus as we look at the state’s economic durability and why the Texas Legislature placed a large bet on that fiscal sustainability. Host Shelby Skrhak sat down with Weaver’s State Government Practice Leader Adam Jones for his expert insight…

Personal Growth at Weaver: A Paradigm Shift in Public Accounting Internship Programs?

“Every journey begins with a single step.” So it was for one of Weaver’s original interns who began their career path in the early two-thousands. They saw a developmental focus at Weaver, a stark contrast to many public accounting firms where employees are often treated as mere numbers. This nurturing environment provided the perfect platform…

Weaver Beyond the Numbers: Improving Your IT Compliance Program

On this episode of Weaver: Beyond the Numbers, we spoke about the increasingly important topic of IT compliance programs. To provide insight and expertise was Brett Nabors, IT advisory services partner with Weaver. There’s no question that IT compliance programs are essential to companies in any industry. Much of this intense scrutiny is due to…

Beyond the Numbers: Documentation is the Key to an Effective Fiduciary

Mistakes are costly in any industry, but when it comes to employee benefit plans, you’re dealing with someone’s retirement income and their livelihood. That’s why being designated an employee benefits plan fiduciary is much more than crossing your T’s and dotting your I’s on paperwork. In this episode of Weaver: Beyond the Numbers podcast,…

Beyond the Numbers: How Recent Tax Reform Efforts Affect the Energy Industry

On today’s episode of “Weaver: Beyond the Numbers,” Partner Rob Myatt explains how tax reform is affecting the energy industry. It’s an important topic with never-ending changes in the last few years, beginning with the Brady Bill and culminating in the 2017 Tax Cut and Jobs Act. It’s a true tax cut overall, but whether…

Beyond the Numbers: How Economic Nexus Laws Will Change Sales Taxation For Good

Technology continues to change the way that Americans are doing business. More consumers than ever are shopping online, helped by outdated laws about sales tax collection for remote sellers. Congress was asked to act and change the laws, but when they moved too slowly, the states took their own action. Enter South Dakota v….

Beyond the Numbers: How Do You Keep Your Company Safe in the Cloud?

Trip Hillman and Kyle Morris join Weaver: Beyond the Numbers this week to talk about how companies can maintain compliance in today’s “cloud offering” society. To the average user, there is still much uncertainty about the cloud. However, it has revolutionized business capabilities. It has allowed companies to scale without having to invest time and…

Beyond the Numbers: Why Texas Has One of the Nation’s Best Economies with Adam Jones

In this episode of Weaver: Beyond the Numbers, host Shelby Skrhak sits down with Adam Jones, consultant for Weaver and owner of Capitol Jones, LLC. Jones and Skrhak take a detailed look at how the state of Texas is faring economically in 2019. In Jones’ eyes, it’s one of the best in the United States,…

Beyond the Numbers: Redefining Lease Accounting with Jody Allred & Colby Horn of Weaver

This podcast was recorded in November of 2018. The new FASB standard is having a drastic effect on lease accounting. Though what you pay isn’t changing, how you pay and categorize your leases is seeing a major shift. Under the FASB standard, lessees must use their balance sheet to recognize operating lease assets and…