US Economy Cools Like the Fed Wants, Still Risks a Stall in 2023

(Bloomberg) — The US economy beat expectations in the last quarter of 2022, posting the kind of mild slowdown that the Federal Reserve wants to see as it attempts to tame inflation without choking off growth.

Economists who dug into the details, though, saw enough warning signs – especially in weakening demand among American consumers – to suggest that a recession remains a big risk this year.

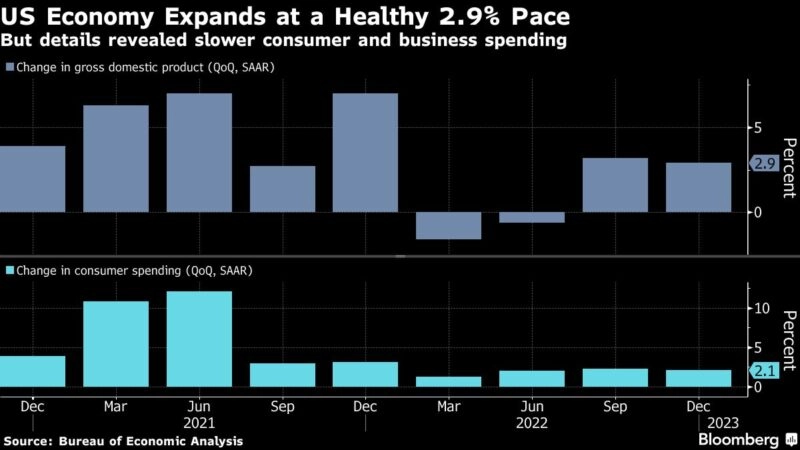

Gross domestic product rose at a 2.9% annualized pace, down from 3.2% in the third quarter. A separate report on labor markets published Thursday also pointed to a resilient economy, rather than one on the verge of a slump, with weekly jobless claims unexpectedly falling.

For the Fed, which has hiked interest rates at the steepest pace in a generation over the past year, the data suggest that there’s still a path to what’s known as a “soft landing.” That’s a scenario in which tighter monetary policy cools household spending and lowers inflation – but avoids squeezing the economy so hard that it ignites mass layoffs nationwide.

Read More: US Economy Shows Slowdown Signs After Growing 2.9% Last Quarter

Stock markets rallied after the GDP data, with some analysts talking up the prospect of the Fed nailing its soft landing.

“The economy is slowing, but the above-forecast number will ease recession fears at the same time,” said Fawad Razaqzada, a market analyst at City Index. “They call this the ‘Goldilocks’ scenario. It should be positive for risk assets.”

‘Loss of Momentum’

But recession-watchers latched on to a key set of numbers in Thursday’s report: the ones that focus on personal consumption, by far the most important driver of the US economy. That rose 2.1% in the fourth quarter, less than economists had expected. Another gauge of underlying demand – sales to domestic buyers, after adjustment for inflation – increased just 0.8%.

Read more: US Recession Call Trickier Than Ever as Mixed Signals Abound

“When we look at what’s happening with the consumer, which is the backbone of the US economy, we are seeing a clear loss of momentum,” Lindsey Piegza, chief economist at Stifel Nicolaus & Co. in Chicago, told Bloomberg TV.

“Without the consumer happy and healthy out in the marketplace, we simply cannot expect to maintain positive growth, let alone more robust growth similar to what we saw this morning,” she said. “We are teetering towards a recession.”

Consumers are getting squeezed by a soaring cost of living, and for much of the pandemic period their wages have failed to keep up. Many have been able to draw on extra savings, accumulated during shutdowns and with help from the government’s Covid-relief programs, to maintain spending.

The Fed’s rate hikes will likely bite even harder into household budgets this year: It typically takes several months before higher borrowing costs start to have an impact.

‘Policy Mistake’

Tighter money is already putting pressure on other corners of the economy. Business investment slowed sharply in the fourth quarter, and homebuilding continued to slump as the housing boom headed into reverse.

The Fed is expected to hike rates by another 25 basis points next week, and investors are betting the central bank is approaching the end of its tightening cycle. Fed officials are signaling that rates will stay high through the rest of this year, until inflation is beaten.

Still, if the consumer slowdown that showed up in Thursday’s GDP numbers snowballs into something worse, the Fed might have to reverse course by year-end, according to Gregory Daco, chief economist at Ernst & Young LLP.

“The Fed’s strong resolve to aggressively tighten monetary policy, and the lagged effects of monetary policy on economic activity, increase the odds of a policy mistake,” he said. “We believe that a couple of rate cuts remain a distinct possibility in late 2023.”What Bloomberg Economics Says…

“Consumer spending on services drove the economy to solid growth in the fourth quarter, but the good news ends there. Two measures of underlying activity that strip out volatile components — including trade, inventory swings, and government spending — showed considerably milder growth.”

— Eliza Winger, economist

© 2023 Bloomberg L.P.