Clean Energy Sets $1.1 Trillion Record That’s Bound to Be Broken

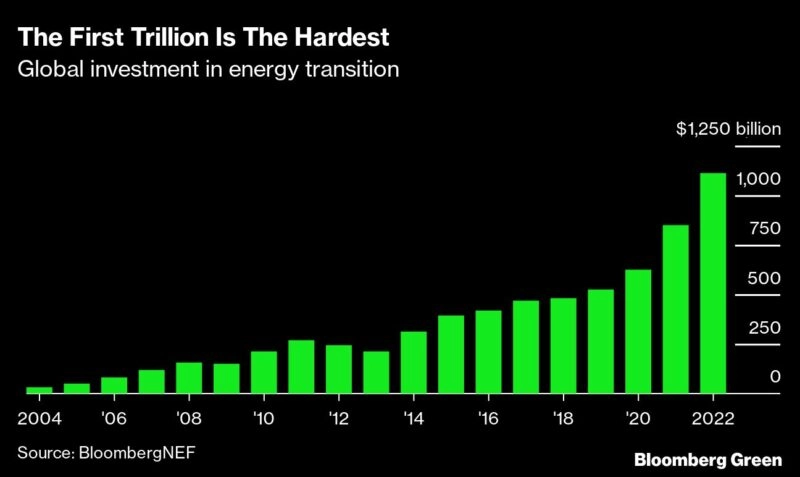

(Bloomberg) — Last year was a double milestone for decarbonizing the world’s energy system. It was the first year when investment in the energy transition equaled global investment in fossil fuels, according to the latest data release from clean energy research group BloombergNEF.

The money flowing into the upstream, midstream and downstream segments of oil and gas, and into fossil fuel-fired power generation without emissions reduction technology, was $1.1 trillion last year. Likewise, annual investment in renewable energy, electrified transport and heat, energy storage and other technologies reached $1.1 trillion.

But 2022 was also a milestone in another sense — as the first year when investment in decarbonizing energy surpassed $1 trillion. The year-on-year increase of more than $250 billion from 2021 was the largest jump yet.

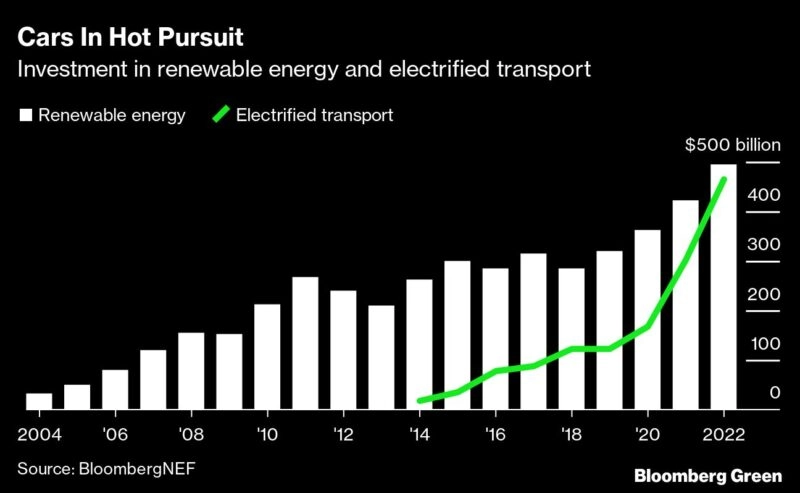

Renewable energy and electrified transport reaped most of those dollars. Those sectors were buoyed by soaring installations of wind and solar — with more than 350 gigawatts of assets built — and sales of 10-million-plus electric vehicles globally.

Although renewable energy saw record investment in 2022, electrified transport is growing at a faster rate. Passenger EVs account for the bulk of the transport dollars invested ($380 billion) but by no means all of that sector’s capital flow last year. Public charging infrastructure saw an influx of $24 billion, while nearly $23 billion was spent on electric 2- and 3-wheelers. Electric buses got $15 billion, and commercial electric vehicles such as trucks received $8 billion.

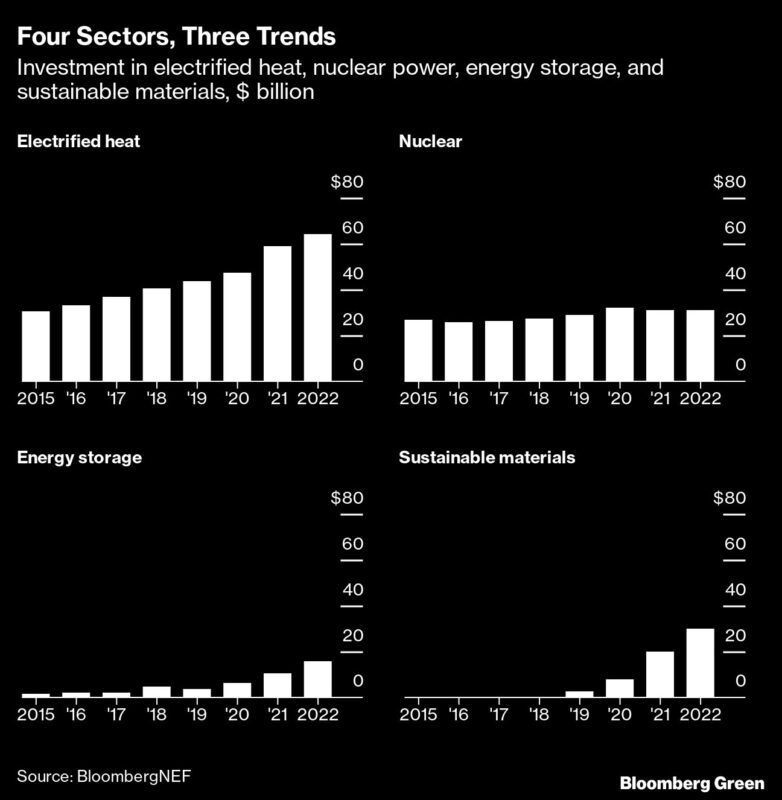

BNEF tracks six other sectors in the energy transition, and all but one of them (nuclear) also set annual investment records last year.

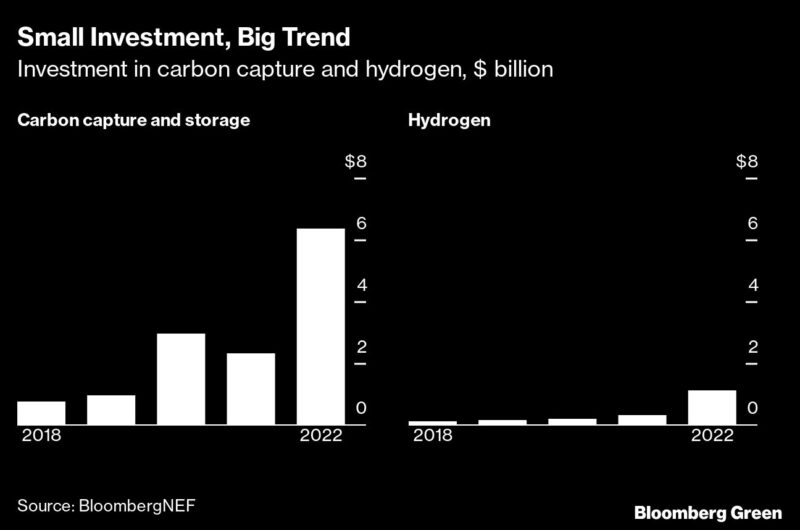

The two smallest sectors for investment, shown below, are also worth noting. Carbon capture received $6.3 billion in 2022 and hydrogen a little over $1 billion. However, both grew significantly in relative terms: Carbon capture investment almost tripled while hydrogen investment more than tripled. Both technologies have made big promises in the past half-decade, and investment is now following. But there will need to be orders of magnitude more use of them to have a substantial climate impact.

Inflation did play a role in the increase in invested dollars last year — but not that much of a role, given that inflation in the range of 8% is less than a third of the total year-on-year dollar increase. Inflation drove up costs of components, construction and financing for energy across the board. Yet expansion in nearly every sector increased total dollars invested much more.

A trillion dollars invested in a year is something. It is also short of what is needed. In order to get on track for net zero emissions in 2050, the world would need to immediately triple this $1.1 trillion spend — and add hundreds of billions of dollars more for the global power grid.

Decarbonization is a game of decades and a game of dollars. Since 2004, the world has invested $6.7 trillion in the energy transition. It took eight years, from 2004 through 2011, to reach the first $1 trillion. It took less than four years to reach the next trillion, and a little less than one more year to reach the latest trillion. One dollar out of every six invested over the last 18 years flowed in 2022.

To paraphrase the late energy investor T. Boone Pickens, the first trillion was the hardest. The most recent trillion was the fastest — but if we are to achieve the deepest decarbonization possible, it will also be slower than every trillion that comes after it.

Article by Nat Bullard. Nat Bullard is a senior contributor to BloombergNEF and Bloomberg Green. He is a venture partner at Voyager, an early-stage climate technology investor.

To contact the author of this story: Nathaniel Bullard in Washington at nbullard@bloomberg.net

© 2023 Bloomberg L.P.