Experts Hope New Oil Auctions Signal “Striking a Balance” in U.S. Oil Production

The U.S. auctioned off its first oil and gas drilling rights on federal lands since the passing of the Inflation Reduction Act, spanning over 10,000 acres across New Mexico and Kansas. This marks the second federal lease auction in New Mexico in over two years. Now that the U.S. oil auction drought is over, should this serve as an indicator for increased future U.S. oil production?

The sale, modest by historical standards, included 19 parcels across 3,300 acres in New Mexico’s Permian basin and an additional 26 parcels on 6,800 acres in Cheyenne County, Kansas. The parcels in Kansas and New Mexico are projected to yield 1.53 million barrels of oil and 16.66 thousand cubic feet of natural gas, and 3.2 million barrels of oil and 18.61 million cubic feet of gas, respectively.

Several protests from environmental groups sought to cancel the sale due to perceived inadequacies in addressing greenhouse gas emissions. Criticism around this auction didn’t just come from the environmental movement though; some oil economists say this move doesn’t go far enough, doubtful that one new oil auction signals a change in the Biden administration’s tune on an already lukewarm approach to U.S. oil production and energy policy. Other professionals, like Ehud Ronn, Professor of Finance at the University of Texas at Austin, and Joseph Palaia, Vice President of Business Development at Pioneer Energy, are hopeful this auction can be the start of a more balanced approach to U.S. oil production and decarbonization goals.

Joseph’s Thoughts

“This is a required action under the Inflation Reduction Act. So, they have to do this under the law because they’re also going to be establishing some right of ways for some renewable energy projects. That being said, I hope that this signals the necessity of striking a balance where we produce oil and gas in a responsible way, but we produce it. I think the administration recognizes that we need domestic production in order to help energy security for ourselves and for our allies, not to mention help fuel our economy, which is still very dependent on fossil fuels. So, I think the administration is walking this fine line of trying to not upset the Democratic base too much while still meeting these national security objectives.

One other thing to consider is if the world does need oil to function, then it’s going to be consumed regardless of who’s producing it. Shouldn’t we produce it here in the U.S. where we know it will be done in a responsible and clean manner and benefit our economy versus it being produced by those with a blatant disregard for the environment and who perhaps don’t share our ideologies? You tell me what you think is the right thing for us to do.”

Ehud’s Thoughts

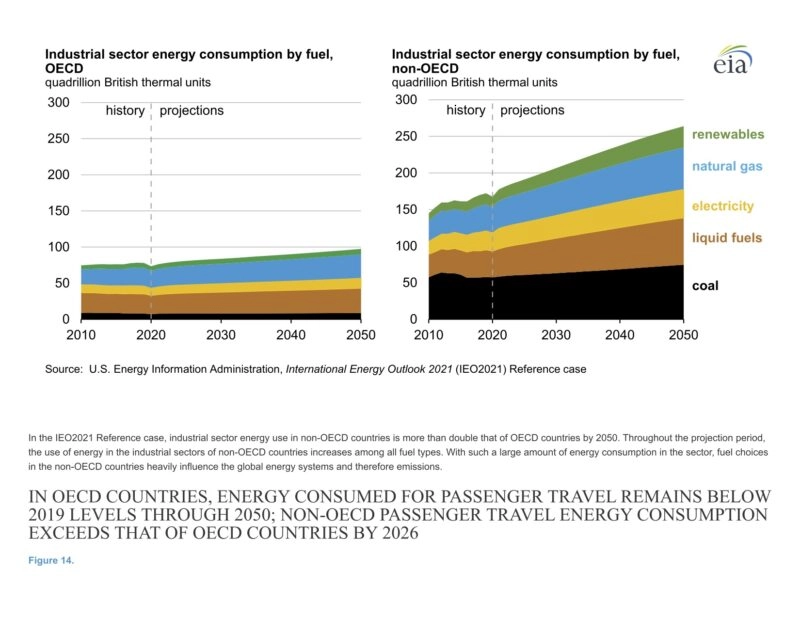

“I think this particular question is more political than it is economics. I’m going to avoid addressing that particular aspect. What I would like to emphasize is this. If you look at the forecast of the Energy Information Administration, the research arm of the Department of Energy, you’ll notice that into the year 2050, we will still need abundant consumption amounts of fossil fuels, including oil and natural gas. And these will provide more resources than will renewables. So whether we’re allowing drilling short-term or long-term, we need to bear in mind and keep focused on the fact that we will need these fuels way into the future.”

Article written by Daniel Litwin.