What Rising Construction Spending Means for Future Projects

The construction industry has been anything but normal since the pandemic started. It has weathered a variety of challenges, including supply chain disruptions and labor issues. However, the sector is recovering, especially as the demand for residential property soars.

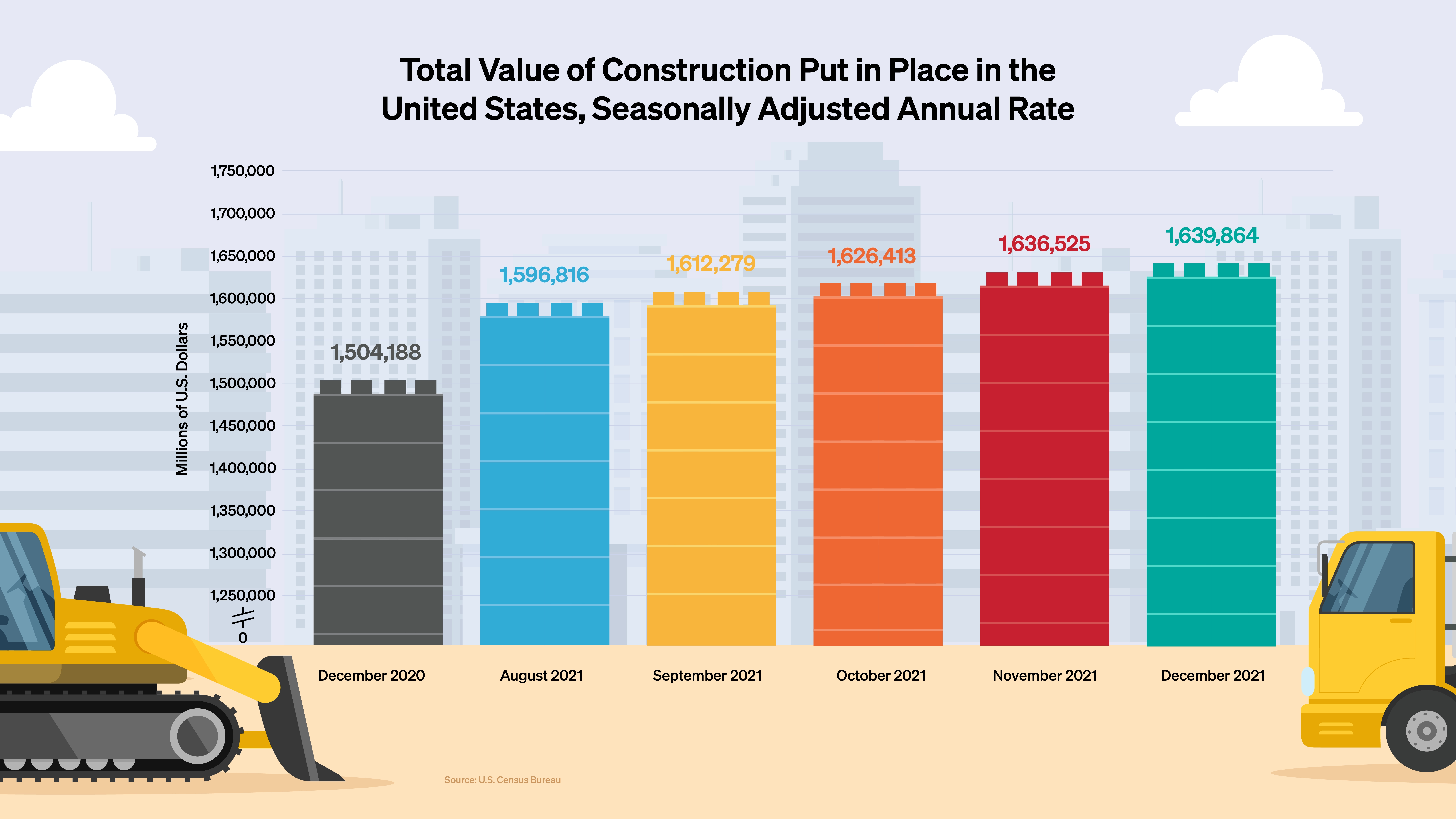

While December is typically a slow month for construction, reports from the U.S. Census Bureau announced that spending was $1,639.9 billion, a 9% increase over December 2020. So, why this uptick? A mix of experts in the industry shared their insights on why, along with predictions on what happens next.

Does Higher Spending Simply Reflect Higher Costs?

Justin White, Vice President of Specialty Services and Principal Building Consultant at Sedgwick, attributed a rise in spending to a mix of factors in and out of the industry’s control. He noted there are multiple areas where spending rose.

“Individual projects have increases in material and labor at 20 to 30 percent. Then there’s what’s happening in the market that’s driving costs,” White said.

It’s not just that materials and labor cost more. It’s demand for housing and other economic factors that impact the price of everything. Another category of increased spending relates to the cost of project managers and engineers and the lack of them.

“Those costs are expanding as well. What was once incidental is now a 2 to 3 percent line item,” White said.

Lee Calisti, a Strategic Architectural Advisor at Real Estate Bees has seen those high material costs throw a wrench in certain projects.

“The pricing for materials skyrocketed beyond anyone’s imagination and it became difficult to get projects we designed even started because when bids came in, the numbers were so out of line that clients tabled their projects, said Calisti.

These high-cost environments can still turn to profitable jobs. Derek Alley, CEO of commercial general contractor VCC, stressed the importance of deepening relationships downstream and upstream.

“Getting all parties involved early to mitigate costs helps reduce risk as a team,” said Alley.

Residential Construction Continues Growth, Doesn’t Shudder to Higher Costs

Residential construction hasn’t slowed. In fact, it’s one segment that’s significantly rising. There are two reasons for this.

First are new home builds, which are tracking up due to the shortage of houses for sale. According to the National Association of REALTORS® (NAR), January 2022 saw active listings decline by 28.4 percent compared with last year. Homes are also selling a full month more quickly than pre-pandemic years. January 2022 represented the quickest turns of any January in recent history.

The second driver on the residential side is renovations. With people working and spending much more time at home, they want their spaces to look and function as they like. The spike of DIY projects was certainly part of 2020. In 2021, those homeowners turned to professionals to make where they are working actually work for them. Ladi Goldwire, General Contractor and Principal Owner at Brinmar Construction and Development Group explained residential and home renovation growth.

“Materials costs are up, and that’s a valid spend increase. New construction and renovation for single-family homes have demand,” Goldwire said.

Goldwire noted that her firm, which focuses on residential, experienced upticks in renovation projects because homeowners have a lot of equity and access to funds.

“They are motivated to spend to renovate,” Goldwire added.

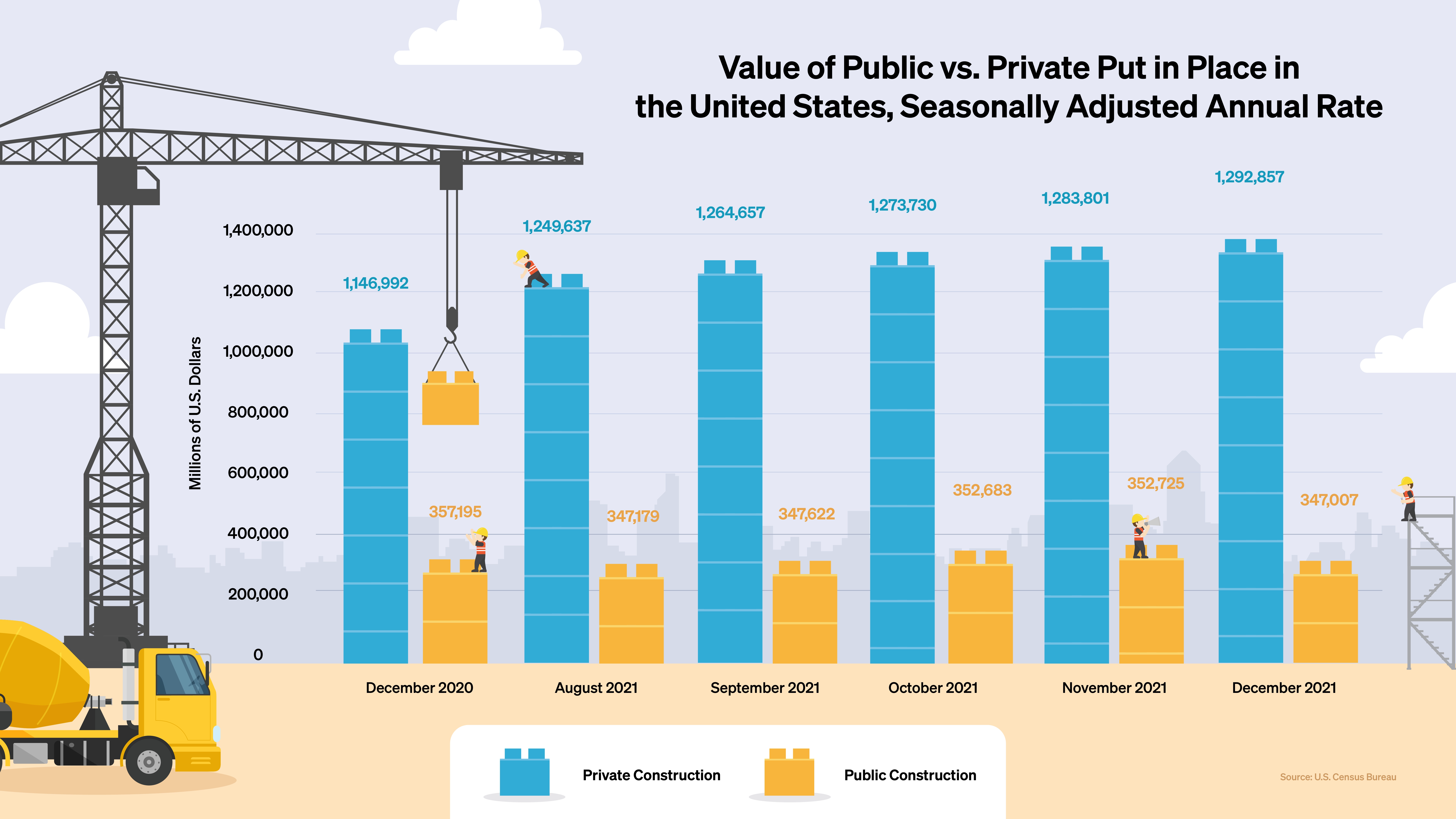

Infrastructure and Public Works Projects: Waiting for the Funding

Federal dollars will soon be heading to infrastructure and public works projects from the Infrastructure and Investment Jobs Act, signed into law by President Joe Biden in November 2021. According to Justin White, that influx of dollars is decidedly not part of the spending increase.

“The buzz around new funding has yet to materialize because there’s a cycle that leads up to the projects with design and planning. Projects are on the cusp of that,” White said. “There’s also prioritization, and these projects will get done no matter what. They are likely to kick off the second quarter of 2022.”

Time is also what Alley said is necessary for federal funding to become available.

“Projects are so complicated, contractually and planning wise that it will take years,” Alley said.

With money coming, this category will rise. But what are the other opportunities right now?

The Best Opportunities in the Construction Market

Residential appears to be a bright spot, but Alley noted that the supply chain and labor issues impact this segment more, especially with multi-family. The demand is present and rising. Outside of residential, Alley expressed promise in specialty markets like industrial and data centers as well as retail bouncing back.

“Localized retail looks strong,” Alley said. “Money is going back into it based on positive numbers.”

Bradley Davis, CFO at VCC, also echoed that multi-family housing is where deals are flowing.

“Rents are strong. It’s a good return for investors with occupancy levels at record highs.” Davis said.

While the need for this type of construction isn’t waning, these projects are complex. They require lots of different materials and labor. Davis described the highest cost as the people.

“We’re constantly evaluating this resource and weighing where we are in this cycle and if we have the resources ready for future work and to maintain current work,” Davis said.

Construction is an industry that’s one of the pillars of any economy. The need for it won’t ever disappear. Dips and blips impact it either at the time or down the road. What’s crucial sector resiliency is looking at ways to optimize and make data-driven decisions.

Good Spend for Construction Delivers Savings Down the Road

Ezinne Udezue, Vice President of Product at Procore, a provider of construction management software, offered some insights on technology and data’s role in the next generation of construction.

“More companies are adopting software and rethinking digital transformation. It helps create better transparency, leading to better planning,” Udezue said.

By analyzing the data found in previous projects, they can identify trends and patterns, which can inform the next project. The addition of more software represents new spending for construction companies, which is really an investment.

Udezue explained, “Smarter technology will help them reap savings in the long term,” Udezue said.

Solutions for Overcoming Construction’s Big Challenges

These large-scale challenges don’t have simple solutions. The industry needs new strategies.

Goldwire recommended, “Finding balance with hybrid operations and doing things differently than in the past, which will require project management professionals and creative adjustments,” Goldwire said.

White also had some suggestions. He says it starts with the basics.

“Treating workers well and paying them is a way to secure the labor force. Those that committed to this early will move forward,” White said. ”There are also less traditional methods like repurposing materials or styles. For example, wood veneer or paneling isn’t available, so the bare concrete is smoothed and sealed. It’s finished, and they could come back later and add that.”

At any time, no matter the environment, construction companies are either growing or shrinking. These times are novel in many ways. This has the industry rethinking how it will move forward, emphasizing relationships, retaining people, using technology and data, and thinking way outside of price. Price alone doesn’t win contracts, as Davis pointed out.

“The company that can secure, provide and mobilize the resources and materials wins the project,” Davis said. It’s not only a function of price but also quality.”

Higher spending reports are but one data point across a very crowded space. With uncertainty and unknowns still prevalent, the construction industry has emerging and old challenges to address but can do so with new perspectives and approaches.