Financial freedom for all.

FinFit has grown to be one of the nation’s largest financial wellness benefits servicing over 185,000 clients. FinFit provides a self-directed online experience that lets employees measure their financial well-being and provides fun, educational resources and tools to increase their financial knowledge and drive results.

FinFit

SECURE 2.0: What to Expect in 2024

Regardless of the uncertainties of the economy, the SECURE 2.0 Act of 2022 offers new avenues for financial stability and security. This landmark legislation, an extension of the SECURE Act of 2019, introduces over a hundred provisions designed to bolster American workers’ economic well-being. In a climate where an alarming 60% of the workforce…

FinFit: The Evolution of Employer-Sponsored Health Benefits

In recent years, the landscape of employer-sponsored health benefits has undergone significant transformation. With rising healthcare costs and the increasing complexity of health insurance, employers are seeking innovative solutions to provide comprehensive benefits to their employees. A recent study revealed that the average deductible for Americans has skyrocketed, creating a mismatch between the risk…

A Data Approach to Understanding Mental Health and Financial Precarity

The intersection of mental health and financial precarity is a topic that has recently gained significant attention. As society grapples with the challenges of a rapidly changing economic landscape, the impact on individual mental well-being is undeniable. Studies show that approximately 46% of individuals with debt also have a mental health diagnosis, highlighting the…

Student Loan Debt: Restarting Payments Post-Pandemic & the 529 Solution

When the Supreme Court struck down the Biden administration’s Student Loan Debt forgiveness plan, it not only eliminated a potential $400 billion in student debt relief, it reset the clock for payments to resume in October 2023. Less than a year prior, the Biden plan announcement gave millions of Americans struggling with student loan…

SECURE Podcast

SECURE 2.0: What to Expect in 2024

Regardless of the uncertainties of the economy, the SECURE 2.0 Act of 2022 offers new avenues for financial stability and security. This landmark legislation, an extension of the SECURE Act of 2019, introduces over a hundred provisions designed to bolster American workers’ economic well-being. In a climate where an alarming 60% of the workforce…

FinFit: The Evolution of Employer-Sponsored Health Benefits

In recent years, the landscape of employer-sponsored health benefits has undergone significant transformation. With rising healthcare costs and the increasing complexity of health insurance, employers are seeking innovative solutions to provide comprehensive benefits to their employees. A recent study revealed that the average deductible for Americans has skyrocketed, creating a mismatch between the risk…

A Data Approach to Understanding Mental Health and Financial Precarity

The intersection of mental health and financial precarity is a topic that has recently gained significant attention. As society grapples with the challenges of a rapidly changing economic landscape, the impact on individual mental well-being is undeniable. Studies show that approximately 46% of individuals with debt also have a mental health diagnosis, highlighting the…

Student Loan Debt: Restarting Payments Post-Pandemic & the 529 Solution

When the Supreme Court struck down the Biden administration’s Student Loan Debt forgiveness plan, it not only eliminated a potential $400 billion in student debt relief, it reset the clock for payments to resume in October 2023. Less than a year prior, the Biden plan announcement gave millions of Americans struggling with student loan…

New Approach to Debt Management and Preventing Bankruptcy

As financial challenges persist, more individuals seek assistance in managing debt and achieving financial stability. Over 50% of Americans are concerned with their ability to pay off their credit card debt this year, emphasizing the urgency of discussing financial wellness solutions. How can you take control of your financial future and tackle credit card…

Building Workplace Communities Around Wellness

In the modern business world, the importance of wellness and the focus on building strong workplace communities is gaining momentum. This comes as no surprise considering the shift towards remote work and flexible schedules, which while advantageous, can potentially threaten the social fabric of organizations. In fact, the US Surgeon General recently reported that over…

Employee Ownership for Financial Health

Stocks are one of the most commonly used investment options, with 58 percent of Americans reporting they owned some form of stocks in 2022, according to Gallup. But what about owning stock in the company you work for, or employee stock ownership plans (ESOPs)? There are just under 14 million participants in the U.S., which…

Determinants for Health and Purpose

As our understanding of human behavior and motivation deepens, businesses are starting to realize the importance of providing holistic support to their employees. Mental health is becoming a major point of conversation in our society with a number of events and individuals bringing it to the forefront. The recent pandemic and subsequent inflation, the focus…

Unpacking Wellbeing in the Workplace

Wellbeing is a vague term that is thrown out often, but why is it important? The CDC states that greater wellbeing levels are associated with “decreased risk of disease, illness, and injury; better immune functioning; speedier recovery; and increased longevity” and that greater wellbeing levels are associated with improved work productivity. So, given the inherent…

Employee Financial Wellness: Getting C-Suite Buy In and Measuring for Success

In this bonus episode of SECURE by FinFit, Charles Lattimer, Chief Innovation Officer, FinFit, and Tim O’Neil, Sr. Workforce Solutions Specialist, TrueNorth Companies, talk about the importance of financial wellness in the workplace and how HR executives can establish a data-driven strategy for success. Due to factors such as inflation and a tight labor market,…

Women and Financial Stability

Only 57% of adults in the U.S. are financially literate, according to S&P’s Global FinLit Survey in 2016. Efforts in multiple states in the U.S. are aiming to improve that, with financial literacy courses becoming a required part of the high school curriculum. But despite these efforts, financial literacy and financial stability, particularly for minority…

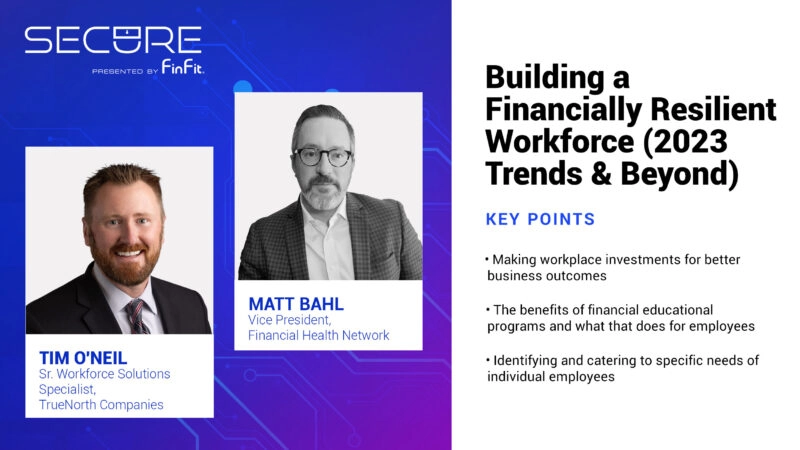

Building a Financially Resilient Workforce

Financial education is an ongoing life lesson that people continually have to learn in order to stay abreast of new ways to achieve financial well-being. Financial literacy is important, as it can not only be the saving grace in helping someone save money, but it can also be a factor in employee productivity. It is…

Fostering Community

Memorial Day: Honoring Those Who Made the Ultimate Sacrifice

In light of Memorial Day, Lylybell Vega, Enterprise & PEO Sales & Account Manager of FinFit, and Charles Lattimer, Chief Innovation Officer and host of SECURE presented by FinFit, pay tribute to the courageous individuals who have made the ultimate sacrifice for their country. As we gather with loved ones this weekend, it is essential…