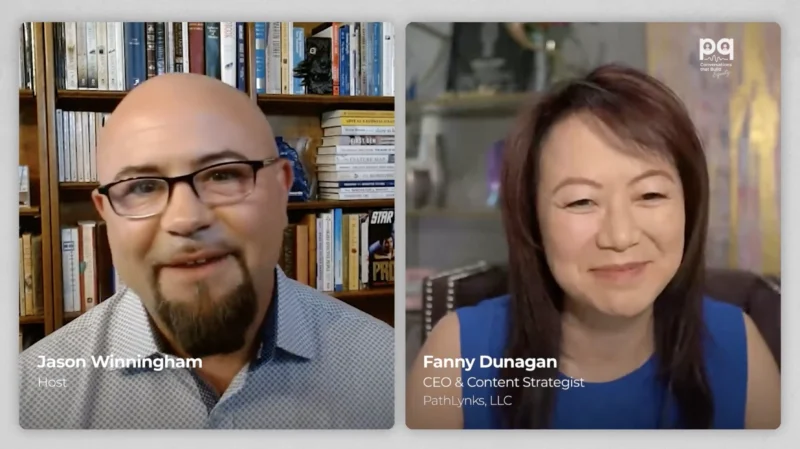

What if the biggest pivot of your career started with a conversation? In this episode of Professional Quotient, host Jason Winningham welcomes Fanny Dunagan, CEO and Content Strategist of PathLynks, LLC. Fanny shares her journey from high-pressure consulting in Singapore to founding her own media and branding company — and why learning to network…

What if the biggest pivot of your career started with a conversation? In this episode of Professional Quotient, host Jason Winningham welcomes Fanny Dunagan, CEO and Content Strategist of PathLynks, LLC. Fanny shares her journey from high-pressure consulting in Singapore to founding her own media and branding company — and why learning to network…

A Look at the Rise of Commerce Media Networks: How Nift Helps Brands Own How Their Message Shows Up

As traditional digital advertising struggles to retain consumer trust, brands are exploring new, more authentic ways to connect with shoppers. Platforms like commerce media networks, which weave together commerce, content, and data, are emerging as powerful tools in this shift. Research from MG2 Advisory reveals that only about 37% of consumers feel brands genuinely…

Heart-First Hospitality Leadership: How Saying ‘Yes’ Transforms Guest Experiences, Boosts Staff Morale, and Drives Business Results

As the hospitality industry emerges from years of pandemic-driven upheaval, hospitality leadership is evolving to meet new challenges. Leaders are looking for new ways to retain staff, elevate guest satisfaction, and drive revenue without burning out their teams. One trend gaining traction is the power of “Yes”: empowering employees to say yes more often,…

Mayor Gerard Hudspeth’s Civic Leadership Journey: What Politics Teaches About People

What does a mayor learn about human nature? In this episode of Professional Quotient: Conversations that Build Equity, host Jason Winningham sits down with Gerard Hudspeth, longtime mayor of Denton, Texas, and a respected figure in civic leadership. Drawing from his years in public service, Hudspeth explores how leading a city reveals the core…

Community Building Through Marketing—Powered by Showing Up and Staying Open

In this episode of Professional Quotient: Conversations That Build Equity, host Jason Winningham sits down with Alicia Layfield, founder of Casa Layfield, a boutique marketing agency in Houston, Texas. Alicia shares how she built her business from the ground up—not by following a perfect plan, but by showing up, staying open, and turning connections…

Experts Talk

Experts Talk

Supply Chain Leaders Must Abandon Outdated Routing and Embrace Last Mile Optimization Through Modeling and AI

As geopolitical tensions disrupt global shipping and tariffs create fresh uncertainty in international trade, companies are being forced to reexamine their most vulnerable supply chain segment—the last mile . While upstream operations get the spotlight during crises, the final leg of delivery remains a persistent blind spot. That oversight has consequences: empty trucks, fragmented delivery…

Trending now

Podcast Episodes

No Permission Needed: Forge Your Own Path Forward Through Bold Moves, Clear Focus, and Continuous Growth

What happens when you stop waiting to be chosen—and choose yourself? In this episode of PQ: Conversations that Build Equity, Jason Winningham talks with Amy Chavez, a seasoned marketing professional and graphic designer who boldly forged her career in commercial real estate, even before she had the credentials. Amy shares how a gutsy cover…

The AI-Powered Edge in Education: How LearningClues Is Enabling Student Success with Co-founder and CEO Dr. Perry Samson

As AI continues to reshape education, institutions face a growing challenge in ensuring students succeed without compromising engagement or integrity. Today’s college students are often juggling jobs, family, and coursework, leading to limited study time and increased dropout risk. According to the National Center for Education Statistics, 40% of full-time undergraduates and 74% of…

Passion, Pause, and Disability Inclusion: Building Equity Through Self-Aware Leadership

Beth Sirull, President and CEO of the National Organization on Disability, joins Jason Winningham on PQ: Conversations that Build Equity to share a powerful career journey shaped by a passion for social enterprise, economic equity, and disability inclusion. From her early work in community finance to leading a national nonprofit, Beth reveals how she’s built…

Taming the Inner Critic to Fuel Career Growth: Crush Doubt, Build Confidence

In this episode of Professional Quotient: Conversations That Build Equity, host Jason Winningham speaks with Mike O’Hora, a former Marine turned learning executive, now the founder of Semper Mind. With a career spanning sales, HR, and talent development, Mike brings a unique blend of resilience, humility, and wisdom to this powerful conversation about career…

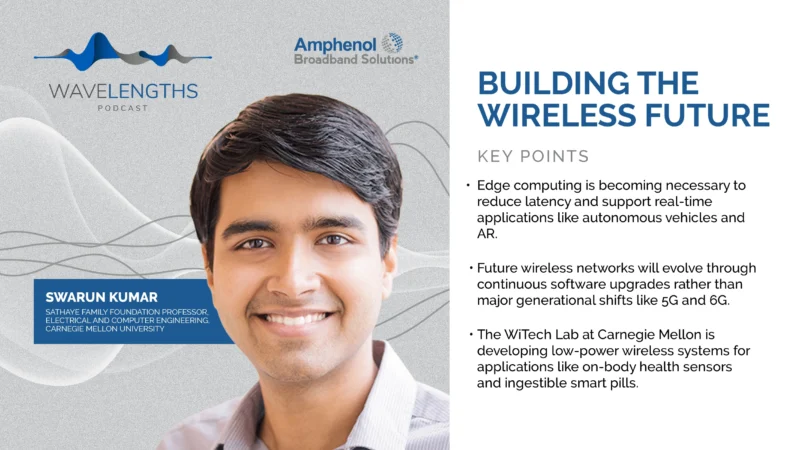

On-device AI revolutionizes the tech landscape, making it a critical factor for industry dominance. This cutting-edge technology directly integrates advanced AI capabilities into devices, transforming consumer and enterprise applications. This shift stems from the need for improved performance, reduced latency, enhanced data privacy & security, and personalized user experiences. With advancements in neural processing…