Community Generated Content – Weaver

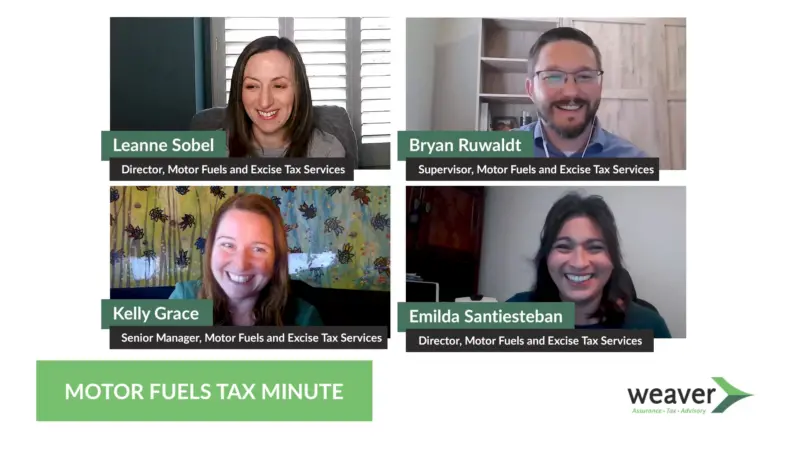

In this week’s episode of Motor Fuels Tax Minute, our hosts introduce Supervisor and Motor Fuels team member, Bryan Ruwaldt, who offers audit tips. For information or assistance, contact us. We are here to help. ©2024 Detailed Description of Weaver’s Motor Fuels Tax Minute, Episode 48 00:00:00 Kelly: Thank you for joining us on this…

Latest

Business Services

Motor Fuels Tax Minute – Episode 47: ExSTARS Requirements

In this week’s episode of Motor Fuels Tax Minute, our hosts dive into some ExSTARS requirements. For information or assistance, contact us. We are here to help. ©2024 Detailed Description of Weaver’s Motor Fuels Tax Minute, Episode 47 00:00:00 Kelly: This is Motor Fuels Tax Minute, where we talk all things motor fuel. In this…

Business Services

Motor Fuels Tax Minute – Episode 46: Stacking Credits

In this week’s episode of Motor Fuels Tax Minute, our hosts touch on the stacking credits as it relates to the Inflation Reduction Act. For information or assistance, contact us. We are here to help. ©2024 Detailed Description of Weaver’s Motor Fuels Tax Minute, Episode 46 00:00:00 Emilda: Welcome to Weaver’s Motor Fuels Tax…

Business Services

Motor Fuels Tax Minute – Episode 45: Flash Titles

In this week’s episode of Motor Fuels Tax Minute, our hosts give an overview of flash titles. For information or assistance, contact us. We are here to help. ©2024 Detailed Description of Weaver’s Motor Fuels Tax Minute, Episode 45 00:00:00 Leanne: Welcome to this week’s Motor Fuels Tax Minute, the vlog where we talk all…

Business Services

Motor Fuels Tax Minute, Episode 44: Heavy Vehicle Use Tax

In this week’s episode of Motor Fuels Tax Minute, our hosts discuss heavy vehicle use tax. For information or assistance, contact us. We are here to help. ©2024 Detailed Description of Weaver’s Motor Fuels Tax Minute, Episode 44 00:00:00 Kelly: Welcome to our Motor Fuels Tax Minute, where we talk all things motor fuel. Emilda…

Business Services

Motor Fuels Tax Minute, Episode 43: Biofuel Feedstock

In this week’s episode of Motor Fuels Tax Minute, our hosts discuss non-tax specific permits for biofuel feedstocks. For information or assistance, contact us. We are here to help. ©2024 Detailed Description of Weaver’s Motor Fuels Tax Minute, Episode 43 00:00:00 Emilda: Welcome to Weaver’s Motor Fuels Tax Minute, the vlog where we talk all…

Business Services

Weaver Core Value Awards

How can recognizing core values within a company foster a culture of collaboration and excellence, as exemplified by the achievements of Weaver’s Core Value Award winners? This year’s Weaver Core Value Award winners, Dana Burris, Director of Administration; Christopher Maurer, Manager in Tax Services; Dan Brumwell, Director of Transaction Advisory Services, and Ashley Winkler,…