Will Rises in COVID-19 Cases or a Projected Increase in Production Cause Bigger Oil Price Jumps?

With gas prices at the highest America has seen since 2014, consumers are left wondering what is causing the increase while energy traders try to make sense of the various factors fluctuating oil futures. Troy Vincent, a Market Analyst with DTN, a real-time commodity market information and analysis company, took some time to break down how inflation, along with a host of other metrics, is shaping the U.S. dollar, and in turn, expectations around oil price jumps for the end of the year.

One of the persisting factors leading to oil price jumps is a diminished demand for energy from less cars on the road to shorter retail hours due to an increasing number of COVID-19 cases in Russia, Germany, the UK and U.S. With winter coming and the fear of COVID-19 cases spiking with it, Vincent looks back on the increase in demand earlier in the year when cities reopened and the combined supply chain issues to paint a fuller picture of oil price movers.

“Given that the loose fiscal and monetary policy that we’ve seen the past couple of years here in the U.S. — combine that with the opening demand boom that we’ve seen this year and all of the supply chain issues that continue to linger on — we have inflation at levels that are going to push the fed reserve to begin tapering their balance sheet and eyeing interest rate hikes much sooner,” Vincent said.

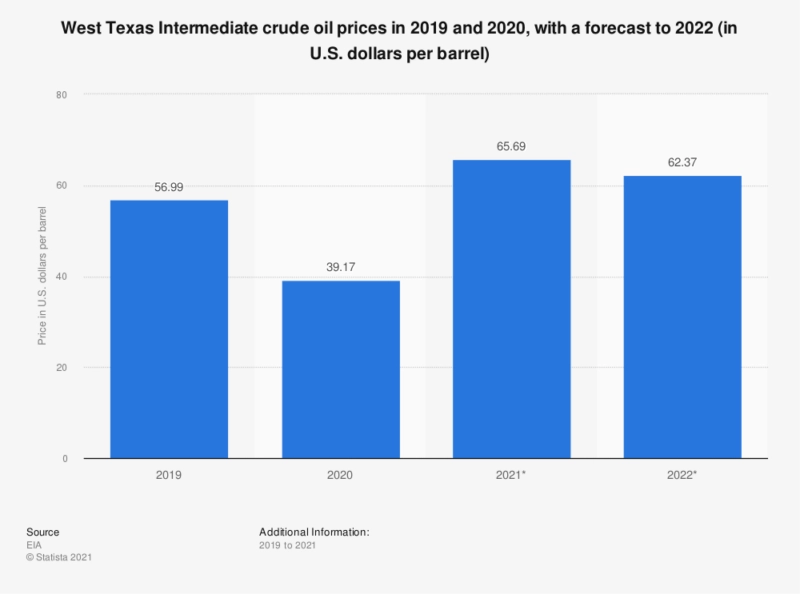

This isn’t the only piece of the puzzle worth weighing for smart oil market predictions, either. Rystad Energy, an independent energy analysis company, sees producers as eager to get supply back up, predicting that U.S. oil and natural gas production will land close to pre-pandemic levels in December 2021, meaning lower oil prices if demand doesn’t match. Other federal agencies like the Energy Information Administration have similar projections, expecting prices to decrease by $3.32 per barrel in the West Texas Permian Basin in 2022.

More Stories Like This:

Can the Texas Energy Grid Overcome its Own Legacy of Issues for the Winter Season?