Why Elon Musk’s $44 Billion Deal Was Impossible for Twitter to Ignore

Editor’s Note: Our previous reporting on this topic analyzed Musk’s Twitter strategies and whether Twitter can ever meet its “social imperative,” and can be found here.

Going once, going twice…Twitter, sold! To the richest man alive!

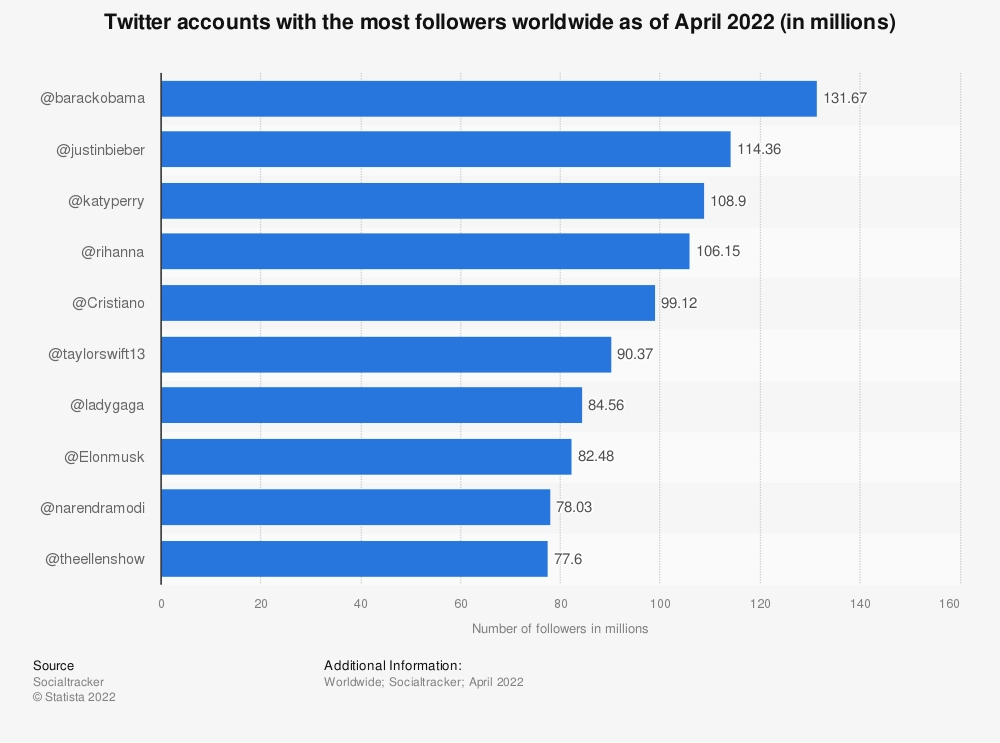

Tesla CEO and top billionaire Elon Musk has purchased Twitter for $54.20 a share, totaling around $44 billion. Under Musk’s ownership, the company will delist from public stock exchanges, go private and begin a new era focused on, what Musk defines as, a First Amendment “social imperative.” Musk, one of the most popular users on Twitter, is now going to have a massive influence on the direction, operation, and vision for the company.

I hope that even my worst critics remain on Twitter, because that is what free speech means

— Elon Musk (@elonmusk) April 25, 2022

“Free speech is the bedrock of a functioning democracy, and Twitter is the digital town square where matters vital to the future of humanity are debated,” Musk said. “I also want to make Twitter better than ever by enhancing the product with new features, making the algorithms open source to increase trust, defeating the spam bots, and authenticating all humans. Twitter has tremendous potential – I look forward to working with the company and the community of users to unlock it.”

There were plenty of naysayers and detractors after Elon Musk announced he’d made an offer to buy all of Twitter on April 14, including Twitter employees. The platform erupted into debates about whether Musk buying Twitter has anyone’s best interests in mind, whether his bid was just a bored billionaire’s past time, and whether new ownership will address Twitter’s fundamental flaws. Despite his insistence on being a free speech absolutist, Elon Musk’s checkered past of free speech practices (there’s more than one example, and they vary in which audiences end up unhappy) validates a lot of those critiques, and said critiques will inevitably be proved right or wrong through Musk’s future actions at the head of the company. However, there was an entirely separate set of critiques that got absolutely blown out of the water: investors and analysts shrugging off the economics of the deal as unlikely, too low of a dollar value, or overall impossible.

“I said from the beginning that there was a higher probability than most expected that this deal would happen,” said Daniel Newman, principal analyst and founding partner at Futurum Research. “I think the bottom line is, in the current market condition, there wasn’t another company on the planet that would pay $44 billion for Twitter.”

Several high-profile investors and analysts took the news as a massive joke or a financial miscalculation by Musk, citing things like his finances being too thin and the bid being too low to make the deal a no-brainer for Twitter. Here’s just a fraction of what folks had to say, compiled from various articles:

- “Offer is low and no shareholders will take it.” – Ross Gerber, Co-founder & President, Gerber Kawasaki Wealth and Investment Management & Twitter shareholder

- “I don’t believe that the proposed offer by @elonmusk…comes close to the intrinsic value of @Twitter given its growth prospects.” – Saudi Prince Alwaleed bin Talal, Chairman of the Board, Kingdom Holding Company & major Twitter shareholder

- “It’s going to take a higher price to close a deal.” – Brent Thill, Equity Analyst, Jefferies

- “No board on the planet would ever say yes to something with a 420 reference.” – Thill

- The deal “remains far from the kind of offer the company’s board would be hard-pressed to refuse.” – Rich Greenfield, Analyst, LightShed Partners

- “I don’t think the Twitter board will have a really hard time saying no to this deal. It’s not an excessive premium and it’s not excessively valued now,” – Chris Pultz, Portfolio Manager, Kellner Capital

- A “full blown Elon circus.” – Mark Kelley, Analyst, Stifel

Why did the deal go through, then? It could simply be chalked up to the price point. Against investors’ greater wisdom, like Newman said, it was unlikely any other company or individual could offer this amount of money, especially not other leading social media companies who would’ve likely faced a slew of anti-trust challenges if they attempted to absorb Twitter. Plenty of analysts also (incorrectly) assumed that Twitter’s board would never accept a deal from someone they clashed with so acutely and someone with such a lack of tact.

Beyond the deal’s sticker price, Newman argues that other financial factors played a critical role in pushing Twitter’s board to sell. One after another, the economic chess pieces played their role and put Twitter leadership in a place where taking a blow to their ego was more attractive than a blow to their wallets.

Twitter Had an Offer it Couldn’t Refuse

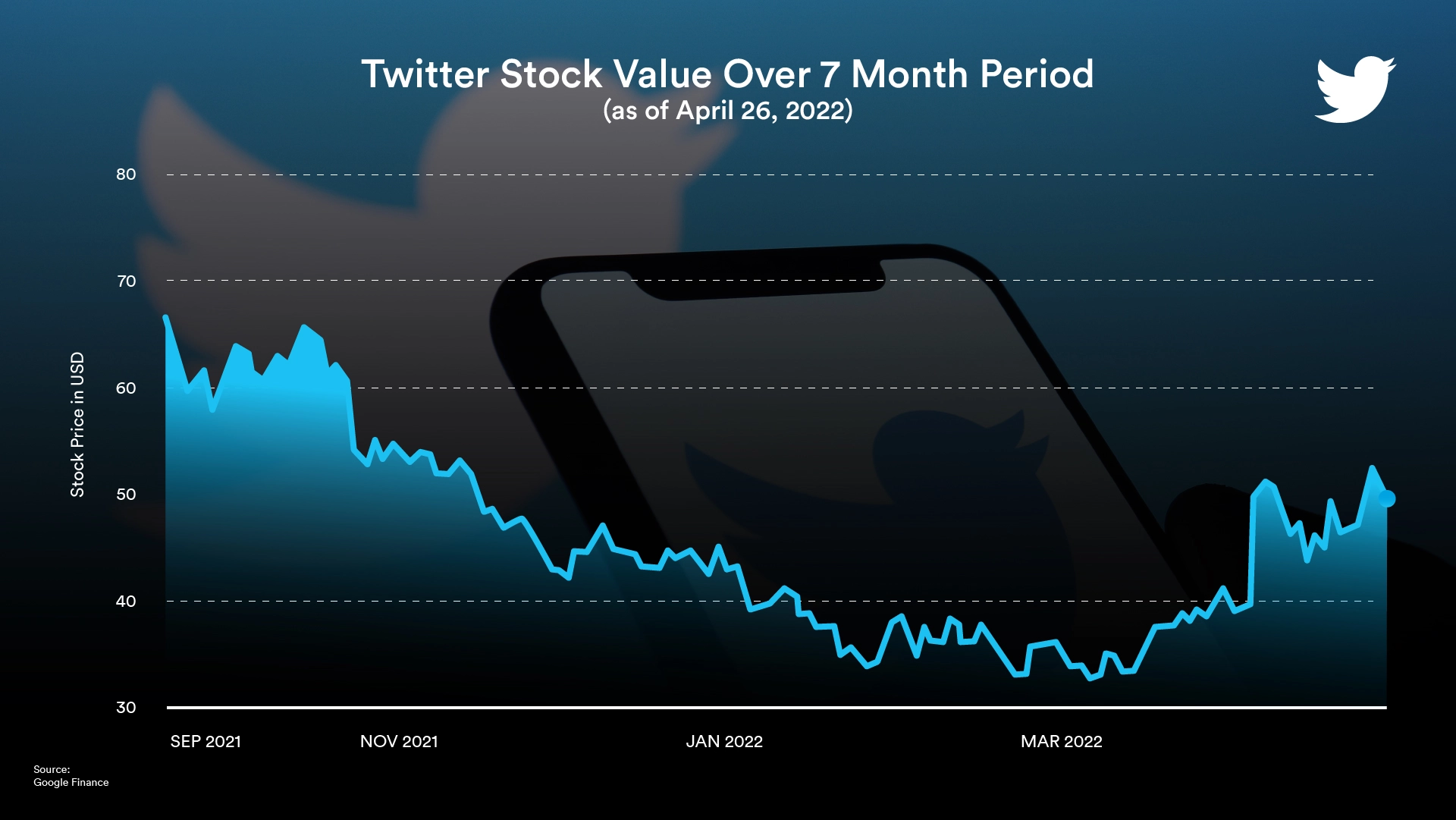

The state of the US economy itself, and a global geopolitical field in the middle of realigning its poles, created pressure that made it hard to ignore Musk’s offer, an offer at a nearly 40% premium from the stock’s value during Musk’s public stake disclosure.

“A lot of the positive sentiment towards growth is shifted away towards value in cyclicals, safety net investments. That’s because of the macroeconomic environment. You’ve got high inflation, you’ve got rising interest rates. You’ve got a fed tapering its balance sheet. You’ve got an election coming up. We’ve still got a war going on in Europe. And [Twitter’s] growth has been actually on a decline for about six months,” Newman said.

As if this wasn’t enough instability to motivate taking Musk’s deal seriously, the Twitter board had to deal with the public influence that Musk brought to the whole situation. Like Newman said, Twitter’s stock price had already lost a lot of confidence by the time Musk said he’d buy the platform; it fell from an October peak of $66 a share down to under $33 a share, a more than 50% drop in value. It wasn’t until Musk announced his more than 9% shareholder status that the valuation rocketed back up. Turning away Musk’s bid to buy the company and effectively pushing away the company’s newest cheerleader was likely too big of a gamble for the board to bet on.

“Twitter saw a huge surge in price just under the idea that Musk might buy the company, taking its value up almost 50% from the time that Musk initially mentioned it,” Newman said. “With simply Musk having said, ‘I’m done, I’m pulling out,’ it would have been very likely that the stock could have fallen back below 30 the same day.”

A surge in stock value was only one indicator that interest was high in a Musk-owned Twitter. You could’ve jumped on Twitter the day of his announced bid and seen a mix of reactions. Some were bullishly optimistic and some were acidic in their critique, but you can’t deny it sparked conversation; active users had an opinion and were vocal about it. The board’s disdain with the idea of Musk buying the company was also very public (going so far as to swallow a proverbial poison pill), and if they had it their way may have just laughed off the bid as a rich Twitter critic’s fever dream. But since a company’s board is supposed to act in the best interests of its shareholders, and since its shareholders were seeing the value of their stock rise after months of decline, the board unquestioningly shutting down the deal would’ve had little support.

Taking Twitter private at $54.20 should be up to shareholders, not the board

— Elon Musk (@elonmusk) April 14, 2022

“The shareholders, I believe, would be very unhappy to find out that the board made a unilateral decision to reject the offer from Musk without conferring,” Newman said.

Sabotaging the deal could’ve been the first domino in a lineup of unfortunate news for Twitter, another outcome that would’ve left the board having to explain itself to shareholders. Twitter is on the precipice of sharing its quarterly earnings on Thursday as well, and analysts like Newman expect the news to be less than exciting, with a more competitive landscape from Meta, an unstable macroecomonic climate, and more existentially, Apple’s updates to iOS privacy law.

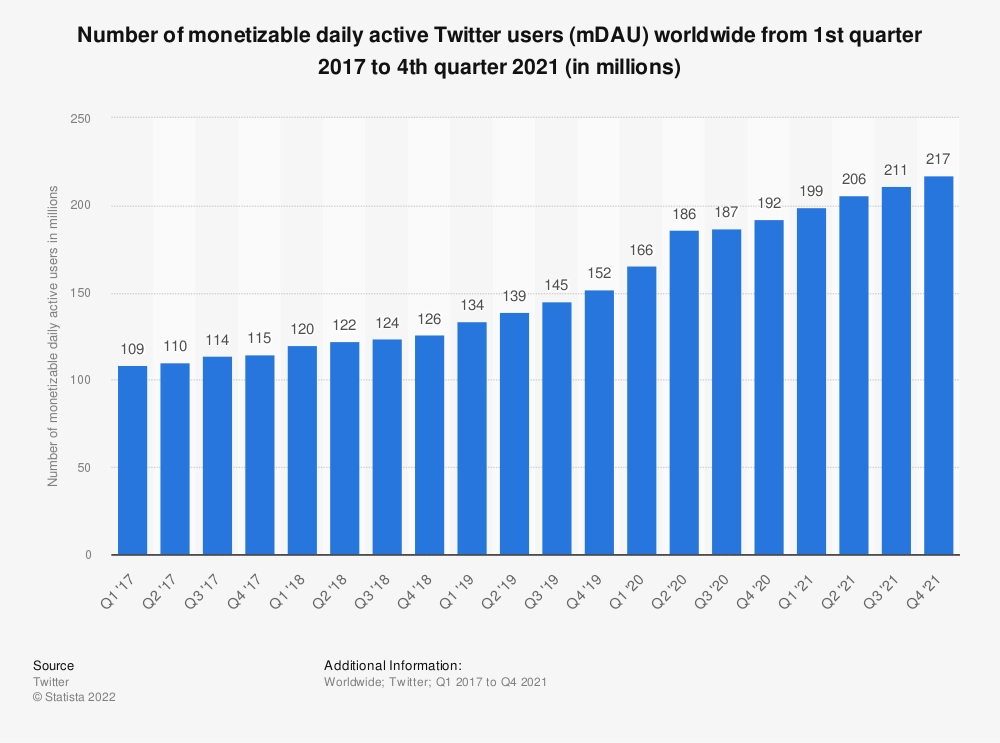

If the company’s Q4 report was any indication of what’s still giving Twitter trouble, it admitted to Apple’s App Tracking Transparency having a “modest” impact that diverted a lot of its resources toward “retooling [its] revenue products.” It was also struggling to meet analyst forecasts and earnings estimates in Q4 with net income down and operating costs up. With more recent news like Russia blocking Twitter services in March, and a general trend of plateauing user acquisition rates since 2020, engagement and daily active user numbers could be down as well.

“So you could imagine Musk pulling out, bad quarter…you’ve got a board that’s going to get sued by its shareholders. It’s just so much negative attention and I think in the end they got together and they’re like, ‘we have to take this offer, we have to,'” Newman said.

The board’s inclination to take the deal and avoid the stock market consequences was proven correct, at least in the immediate short term. Though Twitter’s share value has dropped over the last day or so, it reached its highest closing peak in months on Monday after the news of Musk’s purchase went public, hitting $51.70 per share.

Is a Twitter Leadership Purge Imminent?

With Twitter in new hands, the plan is to take the company private. Though private companies don’t require a board of directors like public companies do, it’s still a US requirement for all C and S corporations to have some sort of board of directors. Twitter being a corporate entity means it won’t be just Musk at the top of the company, but there’s no guarantee that Musk retains the same governance structure without the financial hammer of meeting Wall Street’s needs. Board strategies vary depending on state requirements, whether a company needs to reflect investor’s interests, or whether they’re seeking outside expertise. Musk and the company’s current board already don’t get along, to put it mildly. Will any of them survive the transition?

“Of course nothing can be said for certain, but I have a very high level of confidence that most of the board and the executives will be cut loose and he will be bringing in his own team,” Newman said.

During the week after announcing his offer, Musk made several comments about his distaste with the board and how he plans on dealing with them. He called them out via tweet for their very small ownership stake, though this practice isn’t all that uncommon for publicly-traded entities. Regardless, in Musk’s eyes, the world’s “public square” should have leadership with a financial connection to its success.

Wow, with Jack departing, the Twitter board collectively owns almost no shares! Objectively, their economic interests are simply not aligned with shareholders.

— Elon Musk (@elonmusk) April 16, 2022

“He was outwardly vocally critical of that. How do you have a board, a company of this size and level and not have your board members more financially committed to the company,” Newman said.

Musk also threatened to reduce board member salaries to $0 if his bid goes through. It’d save the company a few million a year, but considering Musk is more interested in the essence of Twitter than its economic value and financials, the board should probably take his threat personally.

Board salary will be $0 if my bid succeeds, so that’s ~$3M/year saved right there

— Elon Musk (@elonmusk) April 18, 2022

As much as Musk’s interest in Twitter is fueled by his own love for the platform, it’s also fueled by a vision for course-correcting the company after failed strategies from current leadership. Twitter’s algorithm, moderation policies, ethos and leadership are all at the whims of Musk’s referendum, and it doesn’t help leadership’s case for keeping their jobs considering they had antagonistic responses from the very start of Elon’s buy-out move.

“The board seemed somewhat hesitant if not straight up against the idea of accepting this offer,” Newman said.

Twitter’s CEO Parag Agrawal warned investors and the public of “distractions ahead” after Musk declined an offer to join Twitter’s board, already hinting at a dismissive attitude toward future Musk interest in the platform.

Elon has decided not to join our board. I sent a brief note to the company, sharing with you all here. pic.twitter.com/lfrXACavvk

— Parag Agrawal (@paraga) April 11, 2022

The most aggressive action taken by the board was its unanimous adopting of a “poison pill,” or limited duration shareholder rights plan, a day after Musk announced his bid. The rights plan is common from boards aiming to prevent a hostile buyout of their company. In effect, if an entity seeks to gain more than a 15% stake in a company without board approval, other shareholders would be given the opportunity to buy additional stocks at a discounted price. This would dilute the stock value of the new majority owner and increase the ticket price significantly, sabotaging a buyout if it went through but hopefully acting as a deterrent before a deal ever materializes.

“When they initiated that poison pill, you can be sure that during that time they were out shopping, they were talking to hedge funds, private equity, competitor, anybody else willing to come in,” Newman said.

The deal did keep Musk from pressuring the board through the public market by buying up 15% or more of shares without an agreement that satiated the board. But overall, the plan didn’t work. Musk slyly threatened a tender offer takeover instead, where he would bring his $54.20-per-share bid directly to shareholders and bypass the board, contingent on a reasonable enough financing plan. The poison pill only delayed the inevitable; that same weekend, the Wall Street Journal reported Musk and the Twitter board were already in negotiations. Musk swallowed the pill and survived, but the aftertaste is sure to linger. His pettiness may prove he won’t be quick to forget this response from the board.

“You saw how he reacted to Bill Gates shorting Tesla stock, he seems like a guy that might hold a grudge from time,” Newman said.

in case u need to lose a boner fast pic.twitter.com/fcHiaXKCJi

— Elon Musk (@elonmusk) April 23, 2022

The only board member vocally on Musk’s side during this buy-out saga is the person with one foot already out the door: co-founder and ex-CEO Jack Dorsey. Over the course of several tweets, Dorsey has come to Musk’s defense and critiqued the board along with him.

it’s consistently been the dysfunction of the company

— jack⚡️ (@jack) April 17, 2022

The ex-CEO also publicly vouched for Musk as the new owner of the company. His disdain for Wall Street’s impact on the company was clear, which he saw as at the whims of traders, investors and “the ad model.” Regardless of which hands cradled the company next, Dorsey said getting it out of Wall Street’s was the “correct first step.”

In principle, I don’t believe anyone should own or run Twitter. It wants to be a public good at a protocol level, not a company. Solving for the problem of it being a company however, Elon is the singular solution I trust. I trust his mission to extend the light of consciousness.

— jack⚡️ (@jack) April 26, 2022

Dorsey is already scheduled to step down from his board position in May upon expiration of his term. As for shareholders and their future in the company, Musk made it clear during a TED event in Vancouver, the same day he announced the deal, that he’s not eager to throw them out with his acquisition.

“I should also say the intent is to retain as many shareholders as is allowed by the law in a private company, which I think is around 2,000 or so,” he said.

Will endeavor to keep as many shareholders in privatized Twitter as allowed by law

— Elon Musk (@elonmusk) April 14, 2022

“It’s going to be interesting to hear if he has anything more to say about that, because obviously going private, there’s very little requirement for anyone to have the opportunity to invest in the company at that point,” Newman said. “So will he be opening doors for some people to invest? So that’ll be a structural thing. I don’t know that is going to be even broached during this period of time.”

What’s Next?

According to the official press release, the Twitter-Musk deal is expected to close this year, “subject to the approval of Twitter stockholders, the receipt of applicable regulatory approvals and the satisfaction of other customary closing conditions.” There isn’t much indication that these next steps will halt the deal, but Musk does have a history of improperly maneuvering regulatory mechanisms with the SEC. In 2018, Musk infamously tweeted his plan to take Tesla private at $420 a share (nice). The SEC sued Musk on the basis of exaggerating his claims and misleading investors; Tesla’s board went as far as to publicly call out Musk after they blamed his lack of tweeting foresight on being drugged out on Ambien.

Am considering taking Tesla private at $420. Funding secured.

— Elon Musk (@elonmusk) August 7, 2018

More recently, Musk shrugged off another SEC regulation when he failed to disclose his 9.2% ownership stake in Twitter in the required 10 calendar day period. Even if he’s fined the full amount for this filing failure, it’d likely clock in around $100,000, which is chump change for Musk. It’s not like Musk is too concerned with playing by the SEC’s rules, though.

SEC, three letter acronym, middle word is Elon’s

— Elon Musk (@elonmusk) July 2, 2020

“We know Musk has made a few mistakes there. Maybe on purpose, maybe on accident. Nobody knows exactly what happened with that incorrect filing. But he’s got the best lawyers on the planet. He’s got all the resources in the world and he will get the disclosures, the filings done that he needs to do to complete this deal,” Newman said.

To finance the deal, Musk collateralized half of his Tesla stock and secured funding from Morgan Stanley. In total, Musk has “$25.5 billion of fully committed debt and margin loan financing and is providing an approximately $21.0 billion equity commitment” to back his buy-out. The SEC filing for the deal shows that if either party decides to pull out, either due to Musk failing to secure the needed loans or if Twitter reneges and takes a competing offer, they’d owe the other party $1 billion in fines.

Twitter users, employees and investors will be waiting to see which new features and moderation policy changes come down the pipeline first from Musk as the company’s owner. Bringing “free speech” back to the platform is still Musk’s intended goal, and he reiterated such a stance after securing the company.

By “free speech”, I simply mean that which matches the law.

I am against censorship that goes far beyond the law.

If people want less free speech, they will ask government to pass laws to that effect.

Therefore, going beyond the law is contrary to the will of the people.

— Elon Musk (@elonmusk) April 26, 2022