Hotel Union Labor Primed for Action in 2022

Now that the hospitality economy is deep in the weeds of the holiday season, hoteliers are hopeful hotel workers can handle a return to form for holiday travel bookings. American Airlines reports a massive rebound for holiday travel, with 109 million people set to travel 50 miles or more between Dec. 23 and Jan. 2, 34% more than 2020.

State tourism organizations are signaling high booking numbers for the two weeks of Christmas and New Years, as well; Visit Orlando places reservations at 91% of 2019’s pre-pandemic levels. The Wall Street Journal reports New York hotel owners are cautiously optimistic for a rise in occupancy rates compared to the last two months.

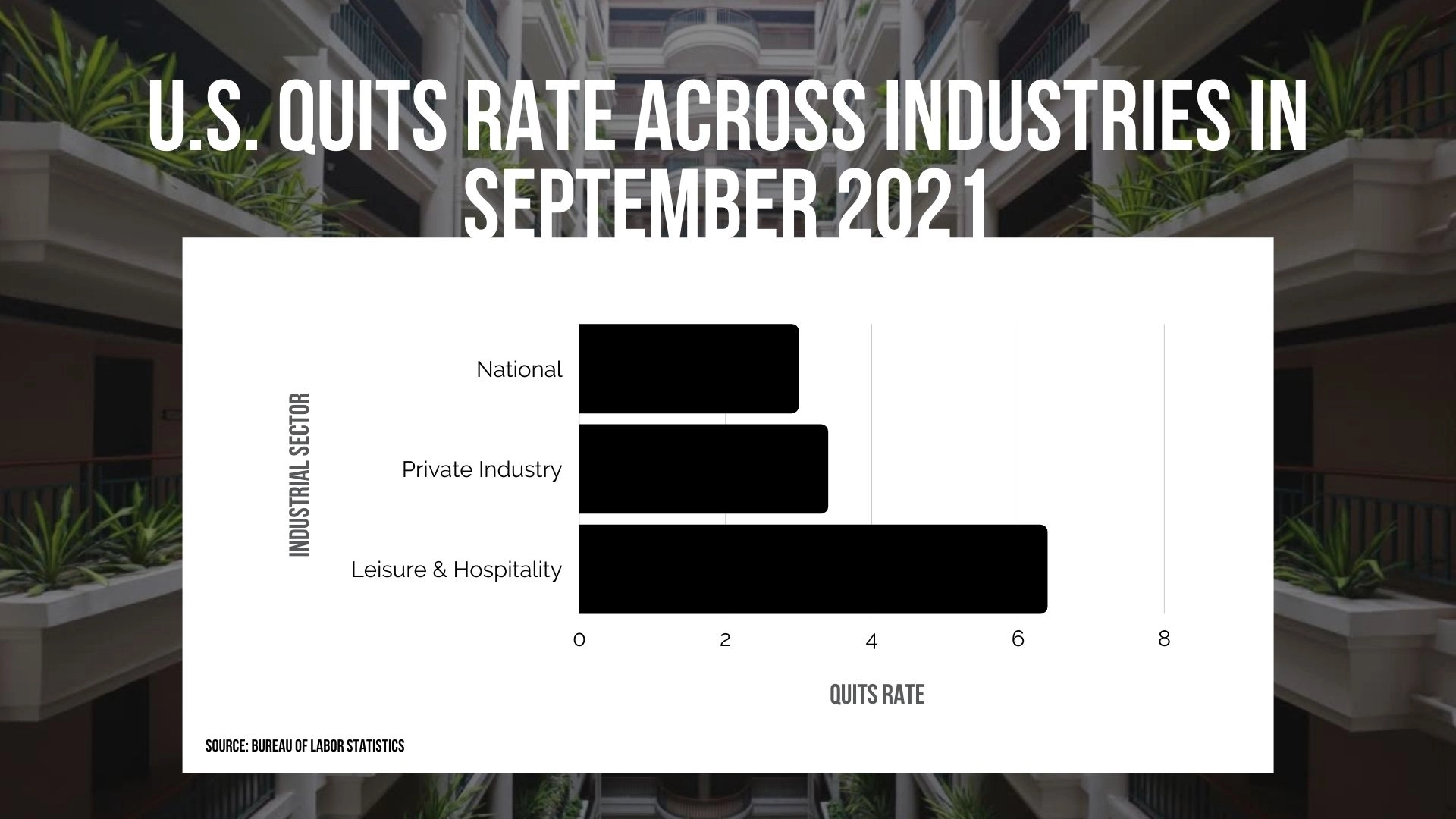

But this rise in demand also proves to be pressure on a strained hospitality workforce, and highlights the continuing difficulties hotel labor faces. The industry has been hit hard by the Great Resignation. September reporting from the Bureau of Labor Statistics puts the quit rate in the hospitality and leisure sector at 6.4%, almost double the national average of 3%, which is itself an all-time high since reporting began 21 years ago.

And when workers aren’t quitting, they’re striking. Most recently, the Philadelphia Inquirer broke news of hotel workers at the Wyndham Philadelphia Historic District Hotel, members of Philadelphia’s Unite Here Local 274, going on strike, their bodies “deteriorating,” as one worker called it, after being overworked and underpaid. This strike could be one of many if the motivating factors giving hotel labor more power and militancy don’t change.

Experts say, to fully understand the issue, get a grasp on what’s to come, and come up with a solution that meets workers’ and the industry’s needs, it’s critical to look back at trends of unionization over the years, look ahead and expiring union contracts in 2022, and be honest about the realities of hospitality work in today’s environment.

Hospitality Faces a Holiday Labor Reckoning Years in the Making

“We went from one third of workers unionized to about 10% today. So in terms of what’s gonna happen now, I don’t think there’s much room to go much more down.” – Alexis Walker

Alexis Walker, Chair of History & Political Science at Saint Martin’s University, focused her research over the years on American political development and organized labor. Looking at the current wave of strikes across the country, Walker explained that it bookends almost 70 years of declining union numbers, waning support from the public, and backlash from the government against labor since its unionization peak in 1953.

“[Unionized] labor has become such a small part of the workforce, so seeing this kind of mobilization, activism among workers, there’s potential for growth in a way that we haven’t seen in a while,” Walker said.

If anything, the current wave should feel unprecedented because of that steady decline; strikes numbers have also been waning since the 80s, Walker said. But she notes that this resurgence is indicative of pent up frustrations and energy, as well as market factors, like the pull-away of unemployment benefits, that domino into labor pressures.

“One is supply chain shortages that mean many industries are under a lot of pressure to meet mounting demand. And then we see a labor shortage with employers struggling to fill positions. This means when a strike happens, employers don’t have one of the big tools they often use to break strikes: hiring replacement workers,” Walker said.

More pressures on employers means more reasons to listen to striking workers’ demands. Walker isn’t sure this means the right demands are being heard, though. One tactic she’s seen from employers as of late is responding to strikes with more COVID protections, reimbursement, and paid leave. Employers, especially hoteliers, as well as hotel labor, are understanding that this is more than a COVID issue, though.

“COVID has amplified frustrations, but what’s coming out in these strikes and the demands workers are making is really speaking to decades long frustration. Wage stagnation. Also contracts within unionized work places that they agreed to when workers felt they didn’t have any leverage,” Walker said. “That frustration isn’t going to be solved by thinking this is just COVID.”

Learning From the Philadelphia Wyndham Strike

“The crystal ball is really cloudy to see what the union demands are going to be and what management is willing to give to, and whether the focus is going to be economic or the focus is going to be operational.” – David Sherwyn

What’s unique about the Wyndham Philadelphia Historic District Hotel strike isn’t in the demands or the strike itself, per se, but the extra layer of conditions that motivated the strike in the first place.

“The Philly strike is based on a property that hasn’t had a [union] contract for years, so this is a situation where there’s a time where, for whatever reason, the property and the union couldn’t come to an agreement and now there’s a time where the employees feel like they have leverage,” said David Sherwyn, Director of the Cornell Center for Innovative Hospitality Labor and Employment Relations at Cornell University.

Sherwyn follows trends in hotel unionization actively, from the minutia of specific union contracts to ideating hotel labor solutions for the whole industry. He emphasizes that strikes aren’t just taken on a whim, even if the conditions are right. Unions and workers will only engage in a strike when there’s a contract on the table, and they feel they have the leverage to make material changes to their well-being.

“When you’re on strike, you’re not getting paid, you’re not getting health insurance, you don’t get unemployment. Ultimately, you can be permanently replaced,” Sherwyn said.

For hotel labor specifically, recent mounting demand from holiday travel as well aspects of the job that exist regardless of the season are creating discontent that can turn into labor militancy. Sherwyn explained the variety of issues; some markets have labor shortages, while other hotels are barely functioning, with no guests and many workers on furlough. For workers, though, the reason for shortages doesn’t matter as much as the effect.

“If you’re going to work each day, the geopolitical or economic reasons for a labor shortage doesn’t really affect you, you just know there’s not enough people for you to work with, there’s not enough colleagues, and there’s a need for overtime,” he said.

With a number of union contracts expiring in 2022, will more service industry unions go out on strike to force the issue?

“They’ll only do that if they believe, in the contract, that they’ll get something that makes the strike worth it,” Sherwyn answered.

“What you’re likely going to see is one brand and Unite Here will be working together, and what usually happens is, once Unite Here and the brand settle in a city, it sort of follows in that city that the other brands sign on to something,” he said. “I’m really looking at LA, San Fransisco, Chicago, DC, Boston…large cities with a bunch of union hotels, substantial density, that will dictate where we’re going.”

If more strikes, or at the very least tense contract negotiations, are imminent for hotels in 2022, is there anything unions and hotels can do proactively to improve working conditions for workers and save themselves from industry disruptions in the new year? Sherwyn’s solution is to rethink how workers in the industry view their career path; usually, this means offering a career path in the first place.

“What we really have to do is kind of bifurcate and look at things in two different ways. How do we make this job for people who want this to be their job forever something that is rewarding at every level… and then how do we attract the person who says ‘this is my career’ and show them this is a career path, and work together, union and management, on both of those things,” Sherwyn said.