Pro AV Revenue for 2022 is Forecast to Exceed Previous Peak of 2019

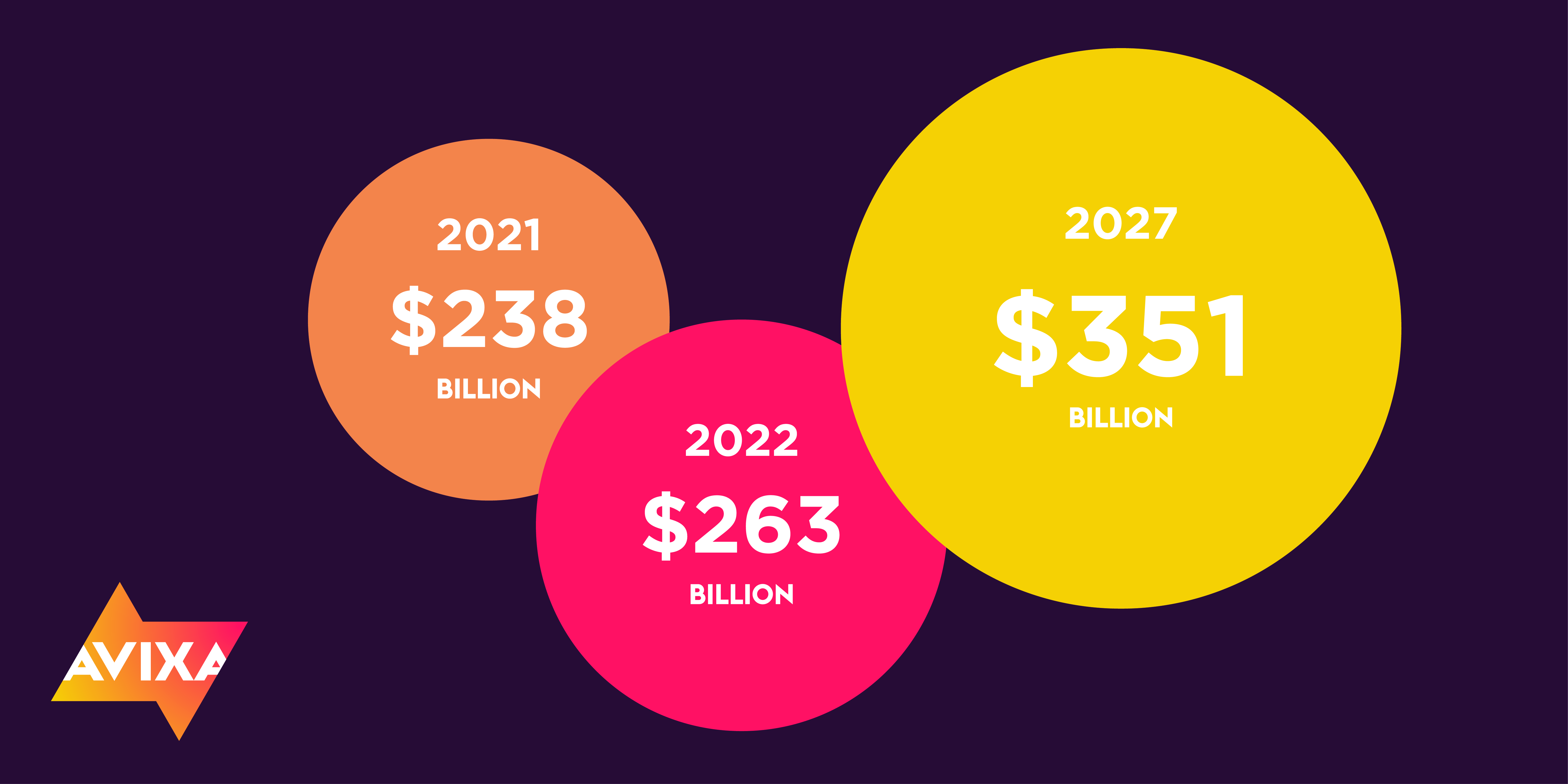

After a strong 2021, when pro AV revenue growth exceeded initial expectations and hit 11%, 2022 is set up to hit a new high-water mark for pro AV, reaching $263 billion globally, according to AVIXA’s 2022 Industry Outlook and Trends Analysis (IOTA). Growth moderates in the coming years to a compound annual growth rate (CAGR) of 5.9% from 2022 to 2027. While this is due in part to the slow-down in economic expansion across the globe, pro AV is still set to grow faster than most countries’ GDPs during the same period.

AVIXA’s 2022 Industry Outlook and Trends Analysis (IOTA) presents data and analysis about the size of the pro AV industry with a global perspective – plus regional and vertical breakouts. The research covers product trends, solution categories, and vertical markets.

“As COVID-19 restrictions decline and people regain comfort with gathering in person, the economy is transforming and pro AV feels a surge in demand,” said Sean Wargo, Senior Director of Market Intelligence, AVIXA. “Up to this point, the strongest solution areas were those offering adaptation to new behavior, such as conferencing and learning. This has shifted to events and performance as we return to in-person.”

After being upended during the pandemic, the venues and events market is demonstrating its resiliency through a high ranking among market opportunities. The market is forecast to grow from $30.7 billion in 2022 to $47.2 billion (9% CAGR) in 2027 globally.

As consumers shift their spending back out of the home and inflationary pressures take their toll, residential spending on pro AV is set to decline. This enables transportation to shift upwards, consistent with a shift in spending towards travel again. The transportation market is forecast to grow from $11.8 billion to $18.3 billion (6.8% CAGR) globally from 2022 to 2027

The fastest growing markets for pro AV include many that are recession resistant. While pandemic recovery drives high growth in venues, media, and hospitality, others are benefitting from more stable investment. This includes government, energy, and transportation.

Despite some lingering challenges associated with the pandemic, APAC is resuming the economic expansion that began in prior periods, driven by rising corporate activity and a growing middle class looking to spend. The region remains a mainstay for digital signage as retail growth pushes it to the top solution spot. Digital signage in APAC is forecast to grow from $14.3 billion to $20.1 billion (7% CAGR) from 2022 to 2027.

While growth in collaboration solutions slows in the Americas, the experiential solution areas like venues and events are rebounding and driving growth. Revenue for venues in Americas is forecast to reach $10.7 billion in 2022, rising to $16.1 billion by 2027, CAGR of 8.5%. In addition, the Americas is the one region where services capture the most revenues ($2.1 billion in 2022). Control systems are where the growth is, as content must be managed and distributed in a venue.

EMEA faces the greatest headwinds due to the wide-reaching impacts of the conflict in Ukraine, though growth is still relatively strong. While in-person brings a welcome surge to the venues market, energy, with 7.8% growth over the next five years, is also a key contributor thanks to sustainability efforts.

While the pro AV industry is experiencing strong growth, there are still headwinds in the current environment. Supply chain challenges are reaching a peak, now that demand is at all-time highs making it difficult for suppliers to keep up, particularly after having been battered by shortages and logistics issues over the past two years. Rising interest rates as governments seek to mitigate inflation are spurring fears of a recession as spending retreats in response. Hiring has also become increasingly challenging in a competitive employment landscape, resulting in labor shortages. Despite it all, the data from IOTA shows tailwinds prevailing and pro AV continuing to grow, even if growth is somewhat muted below what might be possible.

To learn more about the 2022 AV Industry Outlook and Trends Analysis (IOTA), visit www.avixa.org/IOTA.