Understanding MiCA: EU’s Next Steps Toward a Greener Cryptomining Market

The cryptocurrency industry is preparing to welcome its newest set of regulations from the largest ruling body to date, as 27 countries adopt a “uniform legal framework for crypto-assets.” The EU passed its Markets in Crypto-assets (MiCA) bill on March 14, a first draft of rules covering previously unregulated aspects of the crypto market in Europe, from legal supervision and certainty of assets to rules around the introduction of new stablecoins to the market.

“By adopting the MiCA report, the European Parliament has paved the way for an innovation-friendly crypto-regulation that can set standards worldwide,” said MEP Stefan Berger after the adoption of the framework by the Economic and Monetary Affairs Committee. “The regulation being created is pioneering in terms of innovation, consumer protection, legal certainty and the establishment of reliable supervisory structures in the field of crypto-assets.”

Uncertainty and panic from the crypto industry leading up to the EU’s vote was hard to miss. Though, in general, new regulation for emerging markets has its usual spread of proponents and opponents, article after article called out a key provision within the bill around banning proof-of-work cryptocurrency mining as a point of concern. Banning this mining method, which would’ve most notably affected proof-of-work-driver Bitcoin, was seen by many in the industry as a potentially self-inflicted fatal wound for Europe’s digital asset market growth.

More specifically, in February, the last-minute added provision to the initial MiCA bill called for a ban on cryptocurrencies that relied on mining practices with a heavy carbon footprint, or “environmentally unsustainable consensus mechanisms,” according to exclusive access to the draft proposal from German publication BTC-ECHO. A de-facto ban on the leading proof-of-work cryptocurrency in Europe, the largest cryptocurrency by market cap, of course sent the crypto community into a frenzy.

Our readers can take a deep breath; after concerted pushback from crypto market leaders, the provision was removed before the vote could take place. However, the language that remains in the approved proposal still signals environmental impact as a priority for the future of EU’s crypto market.

Sections 5a and 5aa of Amendment 1 reiterate the opinions of the committee on the environmental impact of proof-of-work mining. Verbiage within the bill includes…

- “Proof-of-work is today often associated with high energy consumption, a material carbon footprint and significant generation of electronic waste…”

- “Those characteristics might undermine Union and global efforts to achieve climate and sustainability goals…”

- “Unsustainable consensus mechanisms should only be applied on a small scale…”

In Article 2a of the directive, the clearest next step for bringing European crypto, and more specifically proof-of-work mining, into a greener future comes into focus:

“By 1 January 2025, the Commission shall include crypto-asset mining in the economic activities that contribute substantially to climate change mitigation in the EU Sustainable Finance Taxonomy.”

Though the framework is naturally for European markets, the now-quelled concern around Bitcoin’s mining ban placed MiCA firmly in the crypto industry’s global court of public opinion. As Berger put it, “many countries around the world will now take a close look at MiCA.” The bill’s passing started plenty of debates around how to interpret the EU’s focus on cryptomining’s environmental footprint, the future of proof-of-work mining, and strategies for making sure increased profits don’t turn into the only ‘green’ focus for crypto.

How the U.S. Crypto Community is Reacting to MiCA

From the community members MarketScale heard from, who are mostly U.S.-based blockchain and finance professionals, the version of the bill now in EU trilogue for final approval is largely well-received.

“We desperately need clarity on regulation, and this is the first step in helping with that,” said Dr. Leemon Baird, Co-founder and Chief Scientist of Hedera.

“I am in favor of having a foundation of accommodating regulation that is protective of investors while still empowering the industry to thrive. I also think environmental sustainability is incredibly important and there’s certainly a need to balance energy consumption for proof-of-work networks as they continue to scale globally,” said Tim Savage, CPA, Senior Manager for Blockchain and Digital Asset Tax Services at Weaver, a Texas-based assurance, tax and financial advisory firm.

Baird’s Hedera is a renowned decentralized public ledger, with council members like LG, IBM, Google, Deutsche Telekom and Ubisoft. The company’s HBAR, the public network’s cryptocurrency, runs on a proof-of-stake consensus mechanism, the most viable alternative for proof-of-work mining available today. It’s also the consensus mechanism called on by Erik Thedéen, the Swedish vice-chair of the European Securities and Markets Authority, to fill the void of a hypothetical proof-of-work ban.

Even with public embrace of proof-of-stake, Baird was relieved to see no outright ban on Bitcoin’s mining process.

“It is good they didn’t ban anything. I would urge regulators to not just ban things right away. Give us time and let us be able to work through things and give guidance, but don’t just ban everything,” he said. “That said, I think that it is wise for people who have proof-of-work systems to be working on transitioning them to proof-of-stake or some other system that has a smaller energy footprint.”

Savage agreed with Baird, emphasizing the role proof-of-work networks have assumed in getting cryptocurrency’s market penetration to where it’s at today, as well as supporting the growth of other applications, protocols, and networks that rely on a stable blockchain infrastructure.

“Proof-of-work networks and especially Bitcoin are also powerful Layer 1 currency systems. So I’m very glad the last minute legislative addition to limit proof-of-work mining was not passed,” Savage said.

Some see EU regulation as an extension of an already-present shift in crypto’s environmental practices, like Ethereum’s move toward proof-of-stake validation.

“I think it’ll even further push proof-of-work projects such as Bitcoin to become even more efficient than they have already pivoted towards. This in turn will help identify more energy efficient markets and drive innovation for renewables which Bitcoin is already leading the way in,” said Kelly Massad, CEO of Mainstay Digital, a Blockchain and Web3 native company that focuses on demystifying blockchain capabilities for enterprises.

Amar Gautam, Founder & CEO of institutional-grade crypto trading software company HyperLinq, and perhaps the most vocal environmentalist we spoke to, had no qualms being critical of cryptomining’s “lack of willpower” to leave “dirty energy” behind. Though he’s glad there’s no outright ban on proof-of-work mining, he sees the visible hand of government carrying an important role in pushing for change.

“I am on the side of the legislation or regulation where it would enforce mining companies to use 100% renewable energy,” he said.

EU Adds Cryptomining to its List of Long-Term Climate Goal Targets

The EU’s focus on making cryptocurrency operations within its borders a low-impact carbon emitter falls in line with its larger climate goals.

An October report from the European Environment Agency estimated that the EU had met its 20-20-20 goals of reducing greenhouse gas emissions, increasing the share of renewable energy use and improving energy efficiency all by 20%. Now, the EU is aiming for “at least 55% fewer greenhouse gas emissions by 2030” and a net-zero Europe by 2050.

Even then, though, the EU’s largest economy, Germany, failed to meet its climate goals along with six other member states. And while the EU’s goals are ambitious, they’re a political win more than a material one; consulting UN data shows that even if every country met its proposed Paris Climate Agreement goals, the world would still surpass a “catastrophic” 2.7 degrees Celsius of global warming. While climate change action is on the docket for Europe, legislators and business leaders are feeling the heat to do more.

Mounting pressure towards making comprehensive and bold strides against climate destruction are leaking into cryptocurrency regulation, too. MiCA’s final draft language put consensus mechanisms in the crosshairs of the EUs climate goals, saying “the deployment of the proof-of-work method, as it presently stands, is unsustainable and undermines the achievement of the climate objectives under the Paris Agreement.”

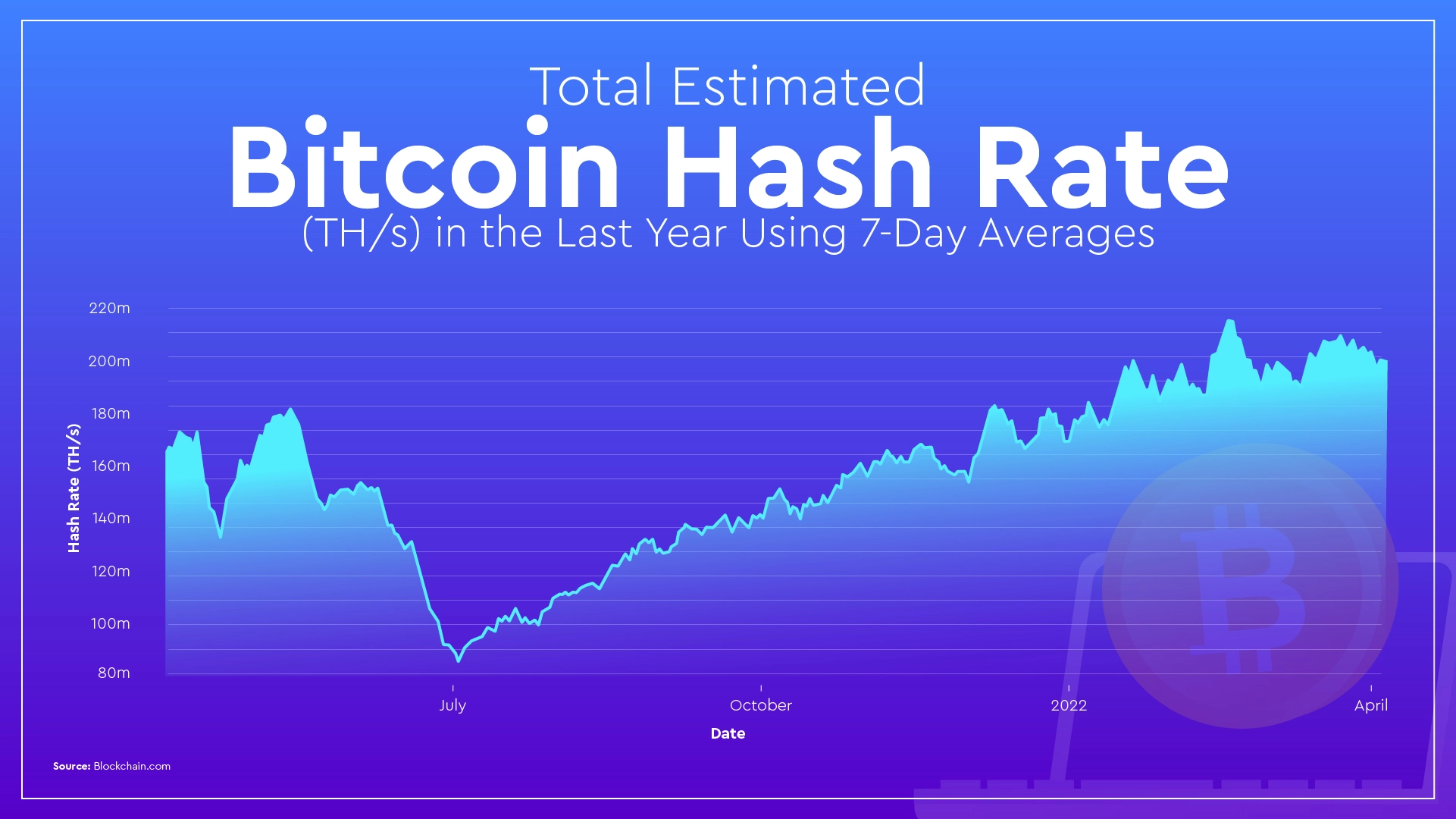

A majority of coins on the market today operate under a proof-of-work mining model, and the leading proof-of-work coins, Bitcoin and Ethereum, have market caps 10 times the size of the top two proof-of-stake coins, respectively. On top of that, the total hash rate for the Bitcoin network has been steadily rising over the last three years; after China’s ban on cryptocurrency mining tanked the estimated number of terashares per second over the summer of 2021, the network has made up its lost share of hashes and then some.

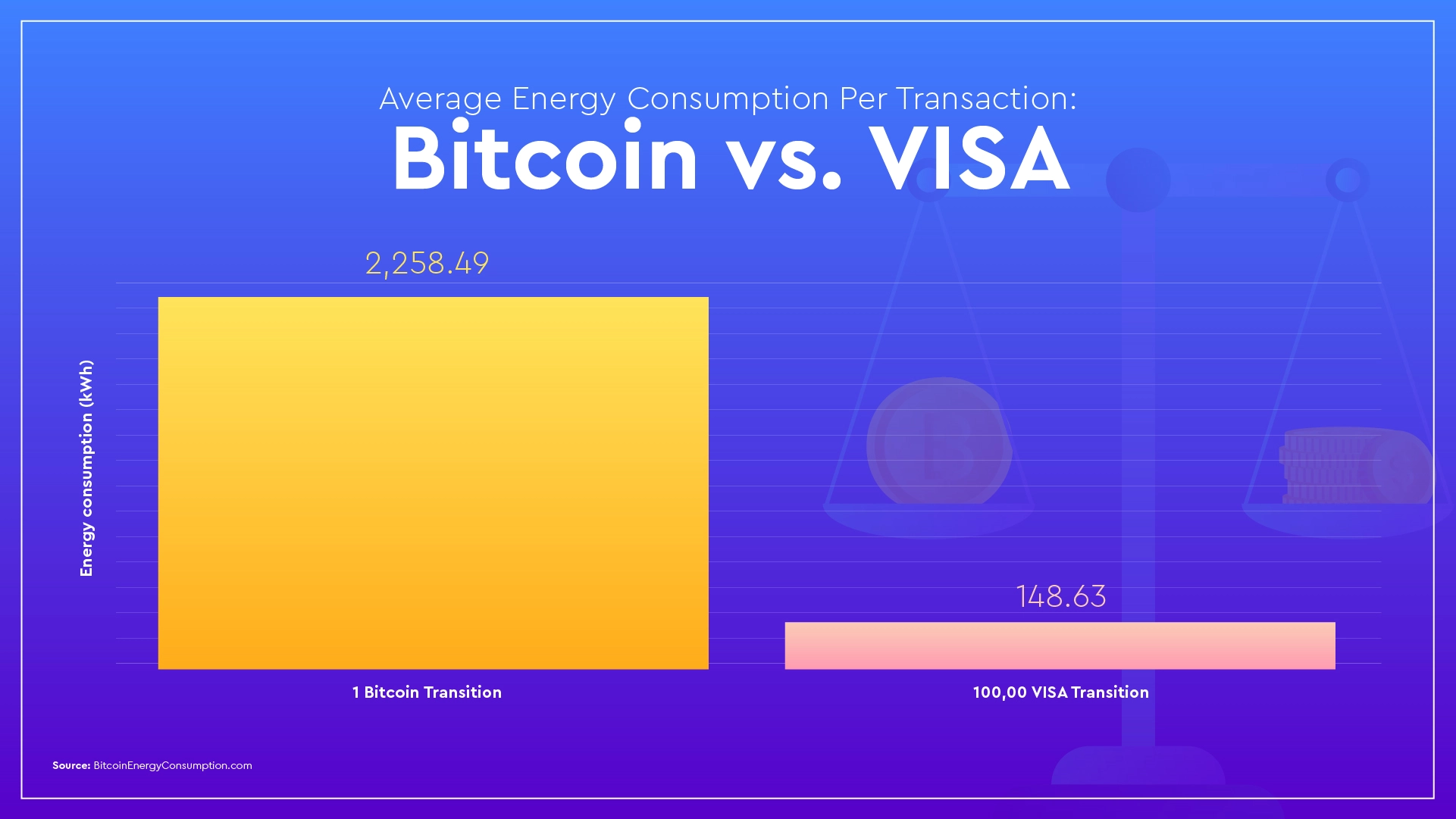

Unfortunately, this rising amount of computing & processing power dedicated to mining also means a considerable amount of electricity burned, as has been noted for years now by cryptocurrency critics and advocates.

“A single cryptocurrency today might use more electricity than all of Ireland. That’s crazy,” said Baird.

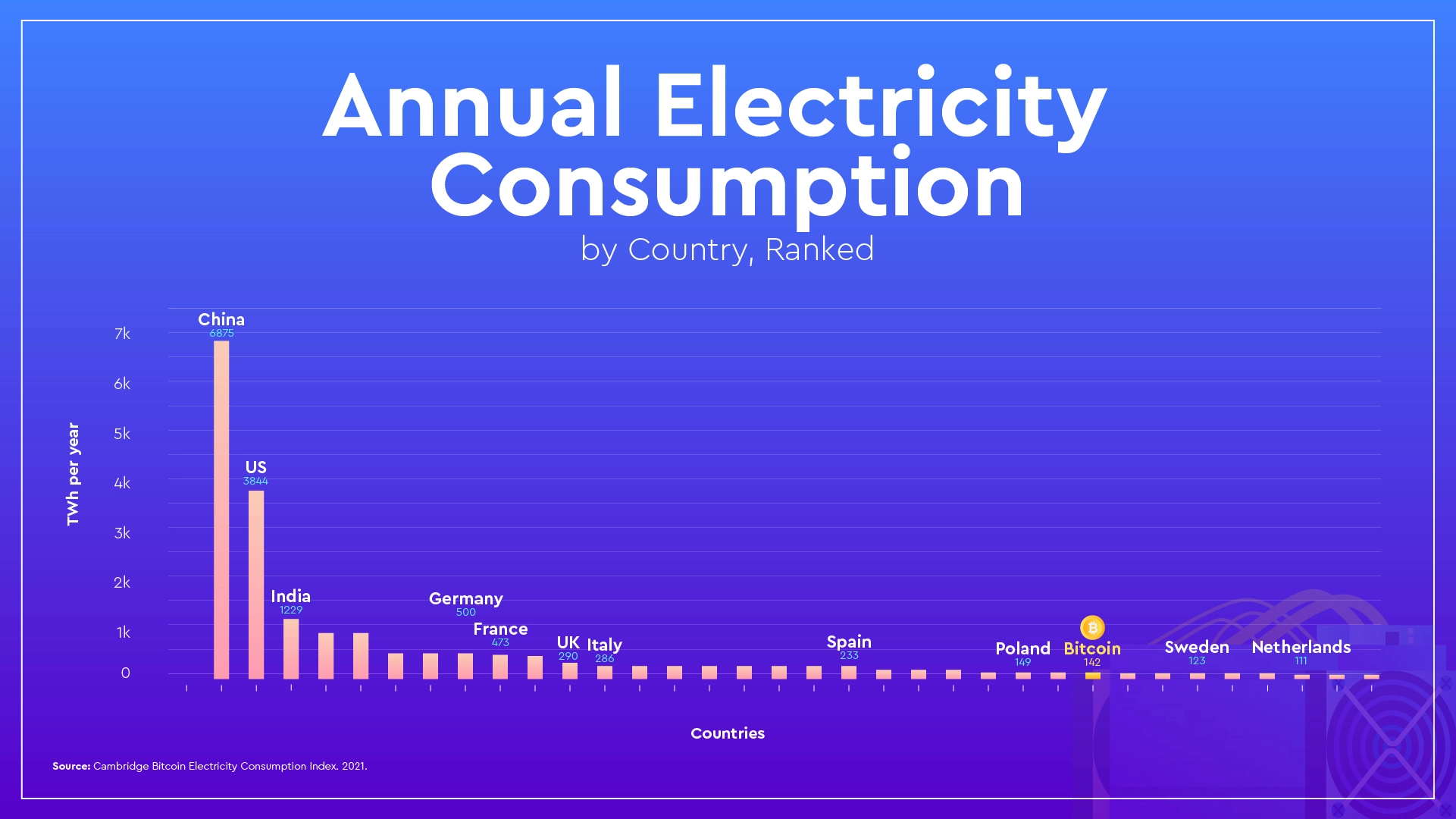

Baird is right, and if anything is underestimating the amount of electricity funneled toward Bitcoin mining. The country comparison is a popular one for measuring the climate impact of cryptocurrency mining; though Ireland was the common comparison in 2018, more current numbers from the Cambridge Bitcoin Electricity Consumption Index place Bitcoin’s terawatt hours per year even higher. It’s now among the top 30 countries in energy consumption, consuming more than Ukraine as well as EU members Sweden and Netherlands.

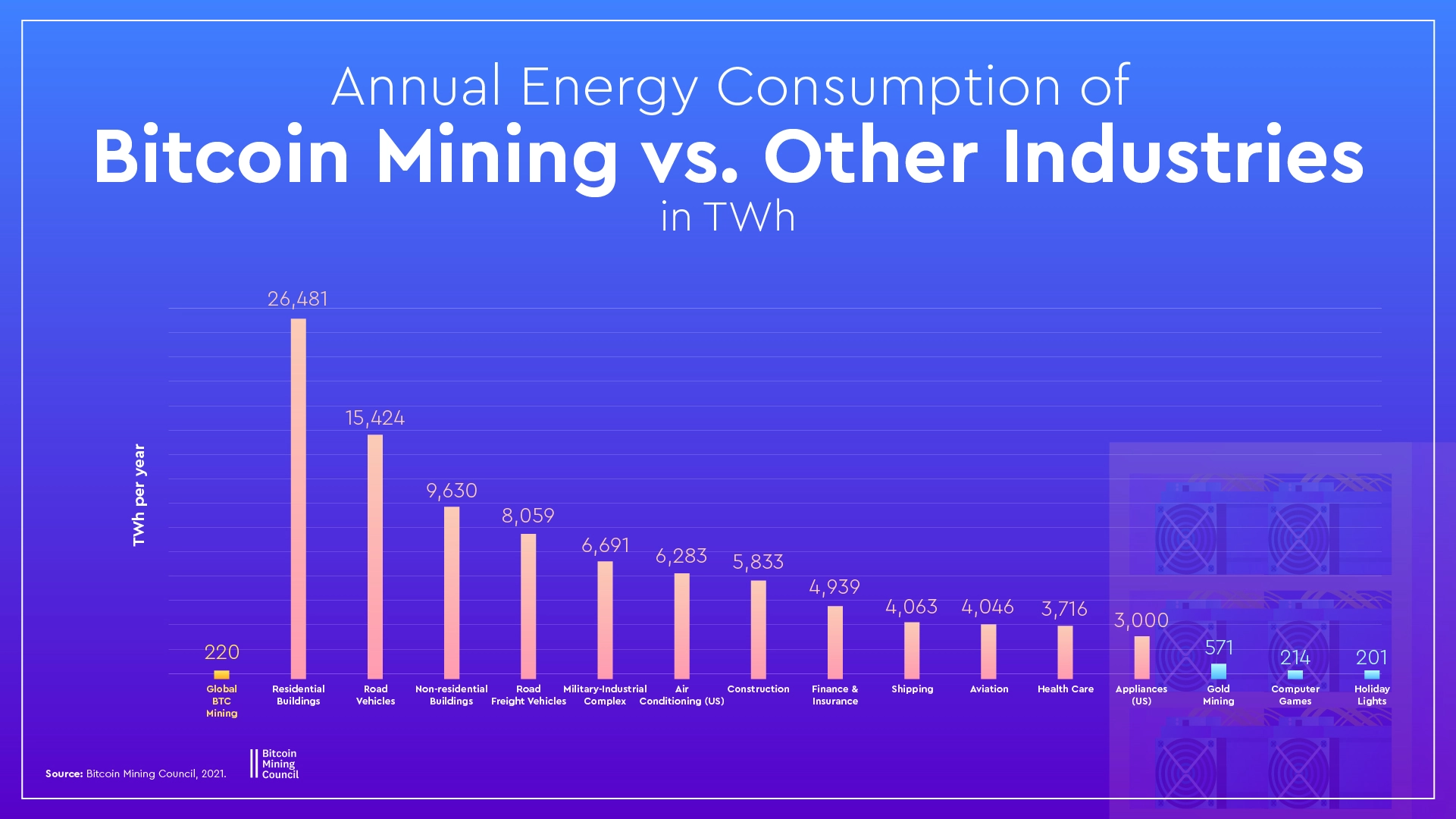

The novelty of crypto’s rise places its energy consumption in the world’s focus, but a little more context helps better understand how this compares to other major industries.

According to the CBECI, two other sectors of rising computational importance, data networks and data centers, both consume more terawatt hours per year of electricity than Bitcoin mining, at 250 and 200 TWh per year respectively. Using the same country comparison, the energy spent to power residential air conditioning globally, for example, would rank third in terawatt hours per year, behind only the US and China.

These industries, of course, aren’t given the same individual scrutiny as Bitcoin’s consensus mechanisms, because they’ve already been normalized as important industries for our daily comfort, productivity and growth. As much as digital asset professionals vouch for the long-term utility of cryptocurrency, is normalizing proof-of-work mining to that degree worth the energy cost?

The debate on whether or not to include a ban on proof-of-work in MiCA did consider this larger dynamic, weighing energy consumption per industry against a global standard rather than isolating energy consumption analysis to the industry itself. That position seems to have won out with MiCA avoiding immediate action on curbing cryptomining’s emissions. Section 5aa of Amendment 1 in the final draft clarifies this stance:

“As other industries (such as the video games and entertainment industry, data centres, certain tools deployed in the financial and banking industry and beyond) also consume energy resources which are not climate friendly, it is an important issue for the Union to tackle in its environmental legislation, as well as in its relationships and agreements with third countries on a global scale. In that context, the Commission should work towards a holistic legislative approach, which is better placed to address such issues in a horizontal manner.”

For cryptocurrency professionals, the debate then becomes not only how to reduce, at-large, the amount of electricity used for cryptomining but also how to make the electricity still consumed have a greener footprint.

As MiCA Critiques Proof-of-Work, How Green is Crypto’s Footprint Already?

A growing share of global energy consumption dedicated to Bitcoin mining alone has professionals weighing the role of renewable energy as a potential solution to crypto’s environmental impact. Weighing the true impact of that share is necessary, though, to understand how much energy to put behind cryptomining environmental regulation like MiCA in a holistic climate change action plan.

“I hope to see miners explore renewable sources as this will give further credence and legitimacy to the industry as a whole,” said Savage. “However, I would say in current form, proof-of-work mining energy consumption is comparatively low to most other industries. As the networks continue to decentralize and add more miners and nodes into the network, consumption rates will obviously increase.”

“I don’t think we should wait for regulation. I think we should self-regulate ourselves and we should bring in practices that help reduce the carbon footprint,” said Gautam.

As an industry built on the notion and vision of breaking with established paradigms, adopting greener practices should align easily with the supposed ethos of cryptocurrency’s disruption. While the EU pushes for greener mining practices with future developments to MiCA, it appears that a portion of the industry is already on Gautam’s wavelength; several reports highlight how and where the crypto industry is adopting renewable energy for mining, a good sign that self-regulation is already on the mind.

“There are estimates that indicate that over 40% to 70% of all Bitcoin mining is already being run on renewable energy,” Massad said.

Those estimates, from late 2019 and mid-2020, come from studies out of CoinShare and the University of Cambridge’s Judge Business School. CoinShare’s numbers are now a bit dated after China ended its global mining dominance, since specifically its Sichuan province and the rest of “relevant remaining China” made up 53% of CoinShare’s 73% estimate of renewables penetration in Bitcoin mining.

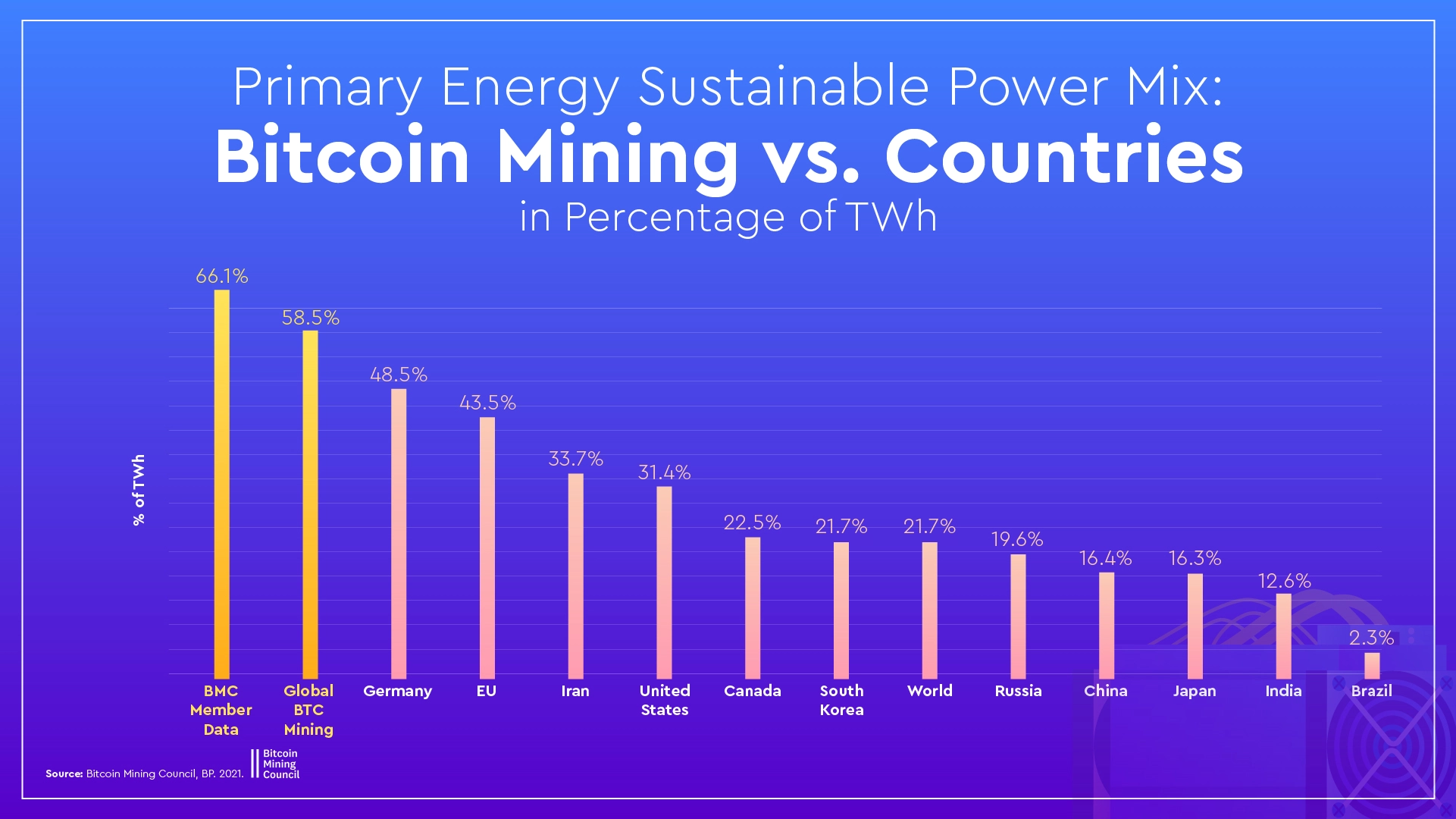

The loss of China’s green weight behind crypto consensus mechanisms, though, shouldn’t be reason for complete pessimism. Although the lost share of mining capacity has been picked up by other countries with a lower share of renewable energy sources, a recent assessment of Bitcoin mining’s reliance on renewables from the Bitcoin Mining Council lands at an estimate squarely within the range determined by the other two popular studies.

Representing 36 mining companies, which make up 46% of the mining network, the BMC has made it a focus to release quarterly reports on global Bitcoin mining data, analyzing specifically the share of energy consumed by Bitcoin, the efficiency of Bitcoin mining, and the amount of renewable energy powering the network. Its Q4 2021 report reveals improvements in every field, across the board.

As it stands, the BMC estimates nearly 59% of the global Bitcoin network is powered by renewable energies, based on its assessment that 66% of its members’ hashes rely on renewable sources. Similar to the Cambridge Centre for Alternative Finance report, BMC’s slide deck draws an even starker comparison between Bitcoin’s energy usage and other major industries. Compared to another critique-worthy and bloated industry, the military industrial complex, Bitcoin’s energy consumption is a drop in the bucket.

When weighing renewable energy for cryptocurrency mining, judging the reduction in carbon footprint is only one decision-making metric. What about comparative costs between energy sources? As Gautam sees it, crypto miners investing in renewables is all about the long game benefits.

“Anything you invest today in renewable energy sources is not going to pay off in the short term. It’s going to pay you off in the long term,” he said.

A 2011 report from Environmental Leader surveyed 400 companies that had adopted renewable energy sources, and around a fifth of respondents said their ROI on said energy was 15 percent or higher. Since this data is over a decade old, it’s hard to say if the trend is materializing the same way, but it can be assumed that the current falling cost of sourcing renewable energy is contributing to higher and higher ROI.

Those falling costs, reflected in studies from the International Renewable Energy Agency, indicate that even in the short term there’s still an incentive to invest in said energy sources. The IEA’s most recent report found renewables were “the cheapest source of power” available in 2020, with 62% of new renewable generation having “lower costs than the cheapest new fossil fuel option.”

Beyond renewable energy adoption, and like the BMC’s report also shows, other improvements to the ecosystem of mining infrastructure are improving Bitcoin mining efficiency and could be judged as another indicator of the industry’s embrace of climate-conscious innovation.

“Companies that are already trying to make proof-of-work more energy efficient include Intel releasing a Gen 2 mining chip that promises to improve upon Gen 1 mining technology,” said Massad.

Weighing every possible option for making consensus mechanisms as green as possible in preparation for the next phase of EU regulation means also looking at ESG strategies, an area where crypto and crypto-adjacent companies can make pledges to self-regulate their climate footprint.

“Forget about bottom line, we don’t even get to bottom line. We just straight up remove 1% of our revenue to extract carbon,” said Gautam. “We are not buying, say for example, the carbon credits. Rather, we invest in technologies that extract carbon and we help those technologies to scale and become cheaper and cheaper as it goes on.”

Gautam’s HyperLinq is a part of the Stripe climate initiative, a group of more than 25,000 businesses across 39 countries aggregating their firms together to support scaling carbon extraction technologies. Regulation can take time to manifest; in the mean time, companies like HyperLinq are turning investments into emergent tech into optimistic wins for their corporate ethos, their industry, and their sales. While its global impact is small, HyperLinq’s strategy can be replicated and scaled by companies with more capital to leverage.

“We are extracting about 22 tons of CO2 per year, which is pretty much like 5 gas cars off the road for a year. And we expect that to go to 100 tons of carbon dioxide per year by end of this year, and we are increasing our contribution to 2% by next year,” said Gautam. “So we want to put this front and center and say we are a company that loves the planet and we want to leave a greener, better, cleaner planet for generations to come, and our customers love this fact.”

Why EU Regulation like MiCA Could Mean More Growth for Cryptocurrencies

Since March 31, the EUs MiCA bill is in the hands of the governing body’s various branches, negotiating final specifics. The most recent update has EU Parliament assigning MiCA’s regulatory authority to the European Securities and Markets Authority, and other reports indicate the EU is considering accelerating the two-year implementation period for MiCA, meaning European digital asset holders, miners and investors will face a new regulatory reality sooner than later.

High-profile changes to cryptomining regulations in the last year have left the global mining community waiting with bated breath for the actual impact of MiCA to come to fruition, hoping to get a better sense of where the industry will find its geographic home and whether Europe will gain or lose steam in that global tug-of-war. In the last 10 months, Bitcoin miners lost…

- the entirety of the Chinese market, which at its peak hosted around 75% of global Bitcoin mining, due to a cost-benefit analysis that ruled cryptomining’s energy usage a burden toward China’s 2060 net-zero goals

- access to the Iranian market (twice) for the span of several months, which came in the face of continued sanctions-induced strain on the country’s power plants

- new market opportunities in Iceland, whose national power company Landsvirkjun is turning away new bitcoin mining contracts amid limited energy supplies

- the small Balkan state of Kosovo, which banned Bitcoin mining and confiscated 429 cryptomining devices as it dealt with extremely high energy import prices and blackouts due to power plant closures

- 106 different mining operations in Kazakhstan, the second-most impactful hub for cryptomining worldwide, which is struggling with electricity shortages and infrastructure failures; the country’s internal financial auditing systems identified illegal activity around said operations and brought down the hammer to correct the market as well as conserve energy consumption

According to the CBECI’s most recent data set, 11.06% of cryptomining operations happen within the EU. However, this number could be somewhat inflated; the CBECI itself indicates that the two countries that contribute the most to this figure, Ireland and Germany, show “little evidence of large mining operations…that would justify these figures,” blaming VPNs and proxy services for the potential inaccuracies. So while there are European players in the global share of mining, the market has yet to become a cornerstone region, and therefore MiCA will have an undeniable role in supporting or hindering the region’s growth.

Outside of mining, Europe is one of the most consequential market for cryptocurrency. Thanks to consistent growth in institutional-sized cryptocurrency transactions worth millions, Central, Northern & Western Europe became the largest cryptocurrency market in the world, representing 25% of transaction volume, according to reporting by Chainalysis. It’s also a market ripe for crypto ETP growth, currently representing 57% of the industry with 73 crypto ETPs and $7 billion in assets.

So with MiCA on the horizon, will Europe attract more climate-conscious miners and further develop a robust digital asset footprint, or will it lead to crypto market instability like in the aforementioned countries?

Savage is of the mind that, if executed with intention and precision, regulation like MiCA can be a market stimulant for digital assets in Europe. Crypto professionals are vocal in calling for more regulation of all kinds, too, from investor protections to increasing the power of regulatory authorities.

“Empirically, most countries who adopt some form of neutral or favorable regulation have seen explosions in new markets, talent and overall opportunities. For this particular regulatory outlook in the EU, since it’s focused on sustainability, I would expect to see miners exploring renewable energy sources,” he said.

This correlation between more regulation and more growth can be seen when looking at other similar financial sectors, such as securities trading. One of the most prominent examples, immediately applicable to the EU, comes from a Chicago Booth School of Business study, analyzing households in the European Economic Area’s willingness to invest in equity markets. Its research found that stricter regulation around securities trading, specifically around harsher penalties for insider trading and increased consumer protections, motivated households to increase their household-equity ownership between 5% and 12%. In this case, regulation built trust.

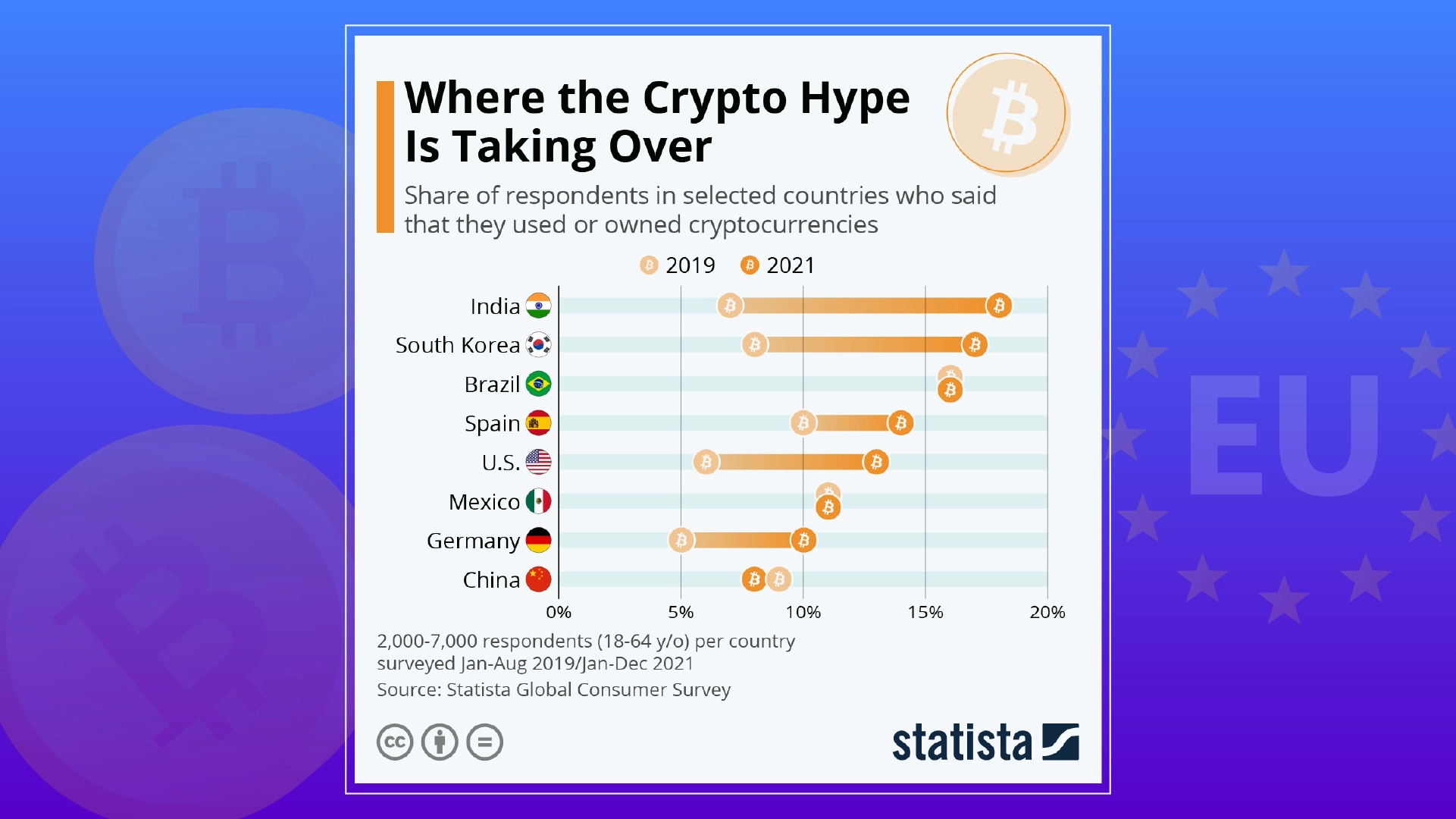

One significant example of regulation’s neutral, or unexpectedly positive, impact on the crypto industry came in India. In early 2021, the country set an 18% goods and services tax on cryptocurrency trading and an income tax on cryptocurrency gains. Capital-rich ventures aren’t known to be the most excited about new federal taxes, so naturally this move drew some heat. This move also came in the face of India’s unequivocal rise in cryptocurrency ownership and usage from 2019 to 2021.

Taxation policy didn’t deter growth in India’s crypto market. In fact, even with a disjointed array of regulations, the country’s cryptocurrency market, or the amount of cryptocurrency received, grew 641% in 2021 according to Chainalysis. Looking at individual companies, India’s largest cryptocurrency exchange platform, WazirX, also grew in the face of a crypto trading tax. From 2020 to 2021, the company posted a 1,735% year-on-year growth in trading volume. All of this was, as CoinDesk reported, “despite lack of clarity on the regulatory front.”

Now, a new 30% tax, as part of a larger Indian Finance Bill, is being critiqued on its own merits as “regressive” and has the Indian crypto community questioning whether this move will continue the industry’s growth. This will be an important regulatory update for legislators to monitor and study; taxation policy should be another metric for the EU to reconsider in its coming legislation.

In the spirit of the Chicago Booth study though, there’s also the secondary argument that increased legislation, taxation or otherwise, generates more trust in a country’s crypto market by validating its existence. As Ashish Singhal, founder and CEO of Indian company CoinSwitch, said on CNBC’s “Street Signs Asia” of India’s most recent proposals, they signal that “the government recognizes this industry” and that crypto-focused legislation would more clearly define “the legality of this ecosystem as well.” The same could be said for the EU’s MiCA bill.

Legislation set by smaller regional governments can also be a real-world use case for the EU to study for inspiration, if its goal is to leverage regulation to grow the market.

“As a great example, Texas is a state where the government is pro-crypto and actually has incentivized miners to relocate to the state and explore sources such as wind and solar, while also trying to make use of petro-based energy sources that would otherwise be harnessed or can’t be harnessed economically,” Savage said.

Currently, the EU’s other cryptocurrency regulations are somewhat distinct compared to other major economies, but generally align with the trend of tacit acceptance but minimal structural integration. Though individual member-states are unable to introduce their own cryptocurrencies, they are widely considered legal across the Union and are recognized as “crypto-assets,” whereas in the US, Canada, China and India, federal bodies have yet to deem cryptocurrencies legal tender and still define cryptocurrencies as a mix of “commodities” and “money services business.”

Uniquely, of course, is how MiCA’s broad impact across 27 countries will set federal regulatory standards across the globe, either to learn from or to avoid.

Proof-of-Stake or Proof-of-Work? The Debate Continues

Crypto professionals aren’t quick to forget that only weeks before MiCA’s final draft was approved, legislators were still debating a complete ban on Bitcoin mining. And as mentioned, European Securities and Markets Authority officials were also making public calls for an end to proof-of-work consensus mechanisms. MiCA’s final phrasing around the environmental impact of cryptomining, even without a clear ban, indicates a lingering apprehension toward proof-of-work operations. With the new 2025 deadline for aligning cryptomining with EU’s Sustainable Finance Taxonomy, the potential of stricter standards could push more blockchains to embrace proof-of-stake.

“Proof-of-stake is not exactly mining since network participants actually just lock their tokens into a smart contract to essentially generate interest on their capital,” Savage said. “Proof-of-work mining involves a competitive validation process that is energy intensive because there are enormous amounts of computing power that is expended to solve cryptographic puzzles.”

The US industry professionals we spoke with seemed to agree on the erroneous analysis that the two consensus mechanisms can be interchanged in a frictionless manner; functionally, they operate very differently and they make competing cases for how the infrastructure of cryptocurrency validation should reflect the ‘ethos’ of cryptocurrencies.

“Proof-of-stake systems in current form are not nearly as decentralized as the Bitcoin network, which is by far the most decentralized currency network. So my opinion is that they’re both useful for different reasons,” Savage said.

Bitcoin’s overwhelming success, even with market volatility, has given proof-of-work mining industry validation. It’s shown itself to be a consensus mechanism effective at maintaining and expanding a decentralized blockchain, creating natural incentives for new miners to join and further secure the network, and providing insulation from bad actors looking to disrupt the mining process. Unfortunately, it’s also an energy hog, as we’ve broken down with the previous Bitcoin examples.

The critique of proof-of-work’s energy consumption is likely to continue in the EU, but it doesn’t necessarily mean proof-of-stake will win out as the resoundingly accepted alternative.

“While proof-of-work is frowned upon as it requires enormous amounts of energy, proof-of-stake could be a risky proposition as networks can easily be bought with large amounts of money, rendering the sovereignty of the token essentially worthless,” said Massad. “The idea is that the proof-of-work identifies and rewards communities based on their participation and value they bring to the protocol, while proof-of-stake simply rewards owners based on the amount that they hold and save regardless of their participation”

Proof-of-stake will need to prove itself to EU legislators, in a cost-benefit analysis, as having its energy-saving positives outweigh the potential centralization concerns and the increasing role of individual actors in validating and maintaining the blockchain. The second-largest proof-of-work coin, Ethereum, has done its own weighing of options and is all in on proof-of-stake, now more than a year into its transition to its Beacon Chain and pioneering a glide path for other major cryptomining operations to transition to proof-of-stake.

“Ethereum is doing this and it’s taking them a very long time, and it’s good that they started a while ago. And I would encourage others to start now too, because it may take awhile. Clearly, this is the path we need to go on,” Baird said.

Ethereum’s most recent update, it’s merging of the Beacon Chain and its mainnet proof-of-work chain on another one of their execution layers, the Kiln testnet, takes it one step closer to upgrading public testnets and realizing the full proof-of-stake transition by its desired date of Q2 2022. When finalized, it will have merged mainnet transaction and mining history with the Beacon Chain, preserving all functionality and adopting a new consensus mechanism with no friction to the blockchain. On top of that, Ethereum’s analysis estimates that the transition to proof-of-stake will decrease the chain’s energy usage by more than 99%.

Considering more than 13% of ethernodes are located in Germany, the second-largest region behind the US for Ethereum proof-of-work systems, its transition to proof-of-stake could be a valuable starting point for the EU to consider adoption and regulation strategies for proof-of-work alternatives as well as set carbon footprint reduction goals.

Hedera’s public ledger, the only ledger running on a proof-of-stake hashgraph consensus mechanism, could be another example for the EU to turn to for regulatory and standard-setting inspiration. Currently, Hedera’s ledger boasts the largest number of total transactions, beating out even Bitcoin and Ethereum.

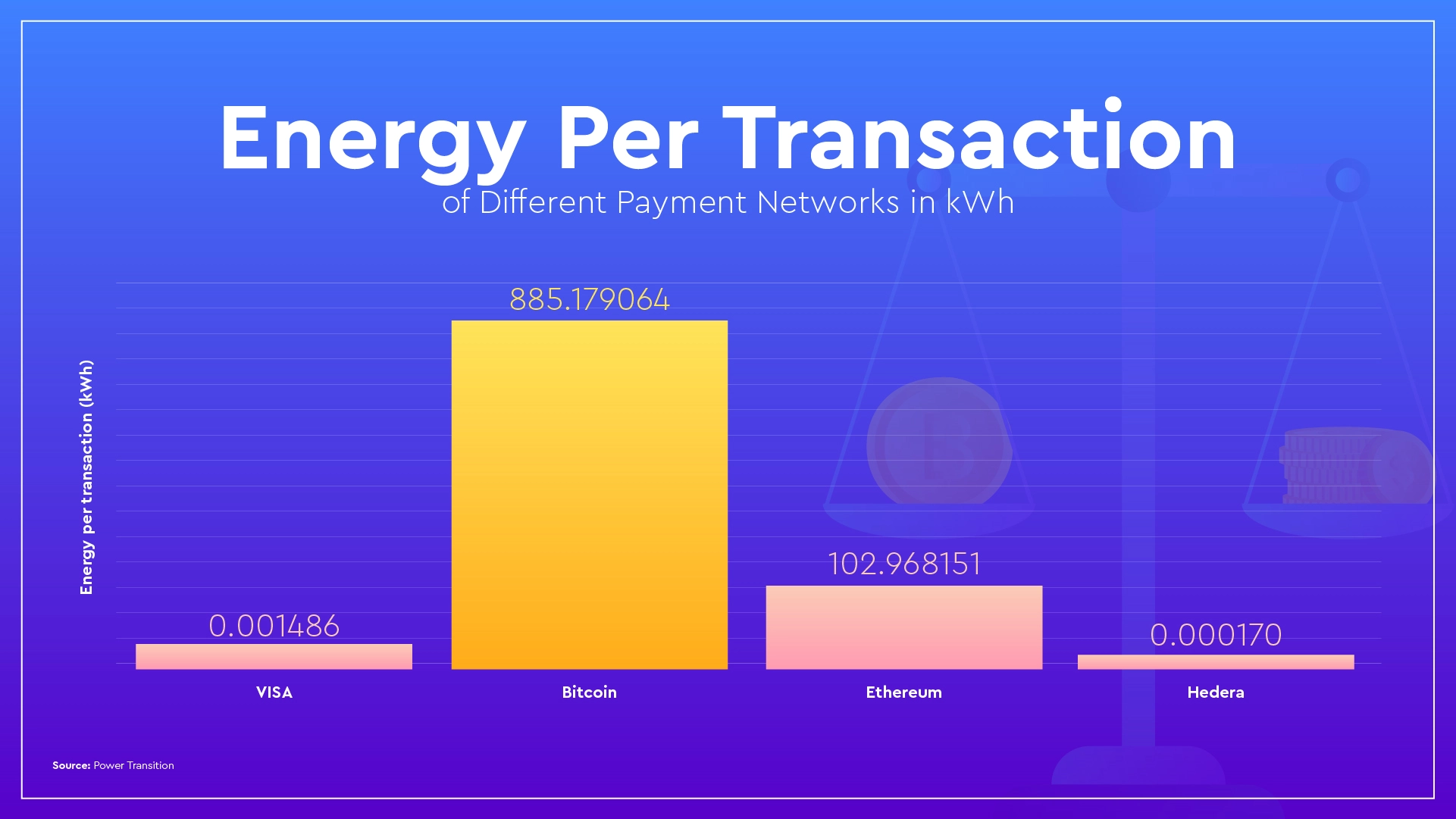

Hedera calls itself a “faster, more secure alternative to blockchain consensus mechanisms.” On these metrics, as well as on energy consumption, independent research backs up those claims. Data compiled by Power Transition found Hedera’s energy per transaction to be substantially lower than Bitcoin’s and Ethereum’s, “600,000 times less energy per transaction than Ethereum and a whopping 5 million times less than Bitcoin.”

Even among its second-generation consensus model peers, Hedera wins out on energy efficiency.

“An independent study by UCL showed that of all the ledgers they were looking at, all the blockchains, we had the lowest energy per transaction by enormous factors. In fact, we were even better than the credit cards. We were 10 times better than credit cards. And the credit cards were far better than all the ledgers,” Baird said.

All of this amounts to what Baird calls a “far better system” in proof-of-stake.

“So the network has to be secured by something that is scarce. You could do it by saying we’ll just burn lots of electricity and that’s the scarce resource that keeps it secure. But then you’re burning lots of electricity for no reason. Or you could say take something like a cryptocurrency and let it be staked and use that as your scarce resource. And then you’re not consuming the scarce resource, you just have it to ensure that the network is secure,” Baird said.

“Rather than destroying something to keep it secure, you just have to hold something to keep it secure.” – Dr. Leemon Baird

Whether proof-of-stake will take hold in the EU, due to increased scrutiny from regulators or use-case validators like Ethereum’s successful transition, is yet to be seen. Until MiCA is finalized in trilogue, we wait to see if any changes will be made to the bill’s language, and EU crypto professionals, especially miners, would be wise to map out some flowcharts for future scenarios. For better or for worse, the EU cryptocurrency market has turned the page on one chapter and is firmly cracking open another.