Weaver

In this episode of Weaver: The Alternative Edge, hosts Blayne Lowary and Vardeep Mann delve into the intricacies of Qualified Small Business Stock (QSBS). This conversation provides crucial information for investors and fund managers looking to maximize tax benefits through QSBS. Lowary and Mann bring valuable insights into how QSBS can be a significant advantage…

Latest

Business Services

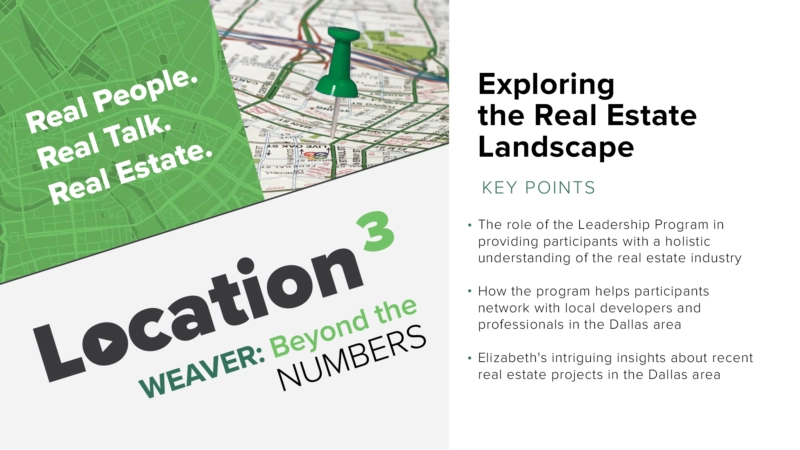

Up Next: Navigating Real Estate Education and Water Management in North Texas

Explore real estate education at TCU and water management in North Texas with podcast guest, James Hill, on this upcoming episode of Weaver: Beyond the Numbers, Location Cubed.

Business Services

Navigating Real Estate Education and Water Management in North Texas

Welcome to another episode of Weaver: Beyond the Numbers, Location Cubed, which examines the complexities of real estate investment and market dynamics with Howard Altshuler and Aaron Grisz. James Hill, the director of the Center for Real Estate at Texas Christian University (TCU), shares his insights on the evolution of TCU’s real estate program, the…

Business Services

Up Next: Understanding Real Estate Valuations

Explore the nuances of real estate valuations and its cadence, challenges and strategies on this upcoming Weaver: Beyond the Numbers, Location Cubed episode with Selina McUmber, the managing director of valuation services at Weaver. Subscribe and listen to future episodes of Weaver: Beyond the Numbers, Location Cubed, on Apple Podcasts or Spotify. ©2024

Business Services

Understanding Real Estate Valuations

In this episode of Weaver: Beyond the Numbers, Location Cubed, Howard Altshuler and Aaron Grisz sit down for a conversation with Selina McUmber, managing director, valuation services. Together, they explore the complexities of real estate valuations, focusing on the importance of cadence and rhythm in the process, particularly regarding fund clients. Whether you’re an industry…

Business Services

Navigating Real Estate Investment

Welcome to another episode of Weaver: Beyond the Numbers, Location Cubed, which examines the complexities of real estate investment and market dynamics. In this episode, Howard Altshuler and Aaron Grisz discuss the challenges and opportunities of today’s real estate landscape with Dan Thomas, founder and president of DT Capital. Key Points: Prioritize lower leverage in…

Business Services

SOC Audits Enhance Momentum’s Security Success

This episode of Weaver: Beyond the Numbers features how Momentum’s strategic approach to SOC audits has driven both security enhancement and business growth. Hosts Lulu Hernandez Walker and Alexis Kennedy welcome Seth Sageser from Momentum. The discussion highlights the evolution of their partnership, focusing on how Momentum expanded its SOC audit practices from two to…

Latest

Latest Community Generated Content - Weaver

Motor Fuels Tax Minute – Episode 47: ExSTARS Requirements

In this week’s episode of Motor Fuels Tax Minute, our hosts dive into some ExSTARS requirements. For information or assistance, contact us. We are here to help. ©2024 Detailed Description of Weaver’s Motor Fuels Tax Minute, Episode 47 00:00:00 Kelly: This is Motor Fuels Tax Minute, where we talk all things motor fuel. In this…

Motor Fuels Tax Minute – Episode 46: Stacking Credits

In this week’s episode of Motor Fuels Tax Minute, our hosts touch on the stacking credits as it relates to the Inflation Reduction Act. For information or assistance, contact us. We are here to help. ©2024 Detailed Description of Weaver’s Motor Fuels Tax Minute, Episode 46 00:00:00 Emilda: Welcome to Weaver’s Motor Fuels Tax…

Motor Fuels Tax Minute – Episode 45: Flash Titles

In this week’s episode of Motor Fuels Tax Minute, our hosts give an overview of flash titles. For information or assistance, contact us. We are here to help. ©2024 Detailed Description of Weaver’s Motor Fuels Tax Minute, Episode 45 00:00:00 Leanne: Welcome to this week’s Motor Fuels Tax Minute, the vlog where we talk all…

Motor Fuels Tax Minute, Episode 43: Biofuel Feedstock

In this week’s episode of Motor Fuels Tax Minute, our hosts discuss non-tax specific permits for biofuel feedstocks. For information or assistance, contact us. We are here to help. ©2024 Detailed Description of Weaver’s Motor Fuels Tax Minute, Episode 43 00:00:00 Emilda: Welcome to Weaver’s Motor Fuels Tax Minute, the vlog where we talk all…

Weaver Core Value Awards

How can recognizing core values within a company foster a culture of collaboration and excellence, as exemplified by the achievements of Weaver’s Core Value Award winners? This year’s Weaver Core Value Award winners, Dana Burris, Director of Administration; Christopher Maurer, Manager in Tax Services; Dan Brumwell, Director of Transaction Advisory Services, and Ashley Winkler,…

Weaver: UBIT and Functional Expenses for Nonprofits

For the first episode of Weaver’s “Not-For-Profit” podcast series, the company’s Tax Partner, Kirby Ross, and Assurance Partner, Jackie Gonzalez, discussed unrelated business income tax (UBIT) and functional expenses in the context of nonprofit organizations. Kirby explained that a UBIT is a tax levied on income generated by a nonprofit through activities unrelated to…

Weaver: Learning About Employee Stock Ownership Plans

An employee stock ownership plan is a form of employee benefits that rewards workers by giving them a share in the company in the form of a stock. ESOPs, as they are dubbed, have steadily increased in popularity since their inception in the 1970s. So, what exactly is an ESOP, how do you know if…

Revolutionizing Data Management in Government: Insights and Best Practices

The saturation of data in various areas of life and functionality has led to an interest in exploring different types of data management. Government agencies, along with their goal to be more transparent, have further put a demand on the handling of all of this data. As a result, incorporating newer and improved technology is…

Changes in Sales Tax Law: New Requirements for Businesses

In 2018, a Supreme Court ruling in the case of South Dakota v. Wayfair opened the door for states to implement a sales tax law on remote sellers based on the sales amount even if the seller is not physically present in the state. Many companies with multistate sales are only now learning about their…

Latest Videos - Weaver

Hedge Fund Insights from a 30-year Industry Veteran

This episode of Weaver: Beyond the Numbers, The Alternative Edge, explores the latest trends and strategies in the alternative investments world. In this episode, host Becky Reeder, partner-in-charge, Alternative Investments at Weaver, sits down with David Burch, founder and fund manager of Atlas Fund, Ltd., to discuss Burch’s 30-year journey in the investment industry including…

Motor Fuels Tax Minute – Episode 48: Audit Tips

In this week’s episode of Motor Fuels Tax Minute, our hosts introduce Supervisor and Motor Fuels team member, Bryan Ruwaldt, who offers audit tips. For information or assistance, contact us. We are here to help. ©2024 Detailed Description of Weaver’s Motor Fuels Tax Minute, Episode 48 00:00:00 Kelly: Thank you for joining us on this…

Motor Fuels Tax Minute – Episode 47: ExSTARS Requirements

In this week’s episode of Motor Fuels Tax Minute, our hosts dive into some ExSTARS requirements. For information or assistance, contact us. We are here to help. ©2024 Detailed Description of Weaver’s Motor Fuels Tax Minute, Episode 47 00:00:00 Kelly: This is Motor Fuels Tax Minute, where we talk all things motor fuel. In this…

Motor Fuels Tax Minute – Episode 45: Flash Titles

In this week’s episode of Motor Fuels Tax Minute, our hosts give an overview of flash titles. For information or assistance, contact us. We are here to help. ©2024 Detailed Description of Weaver’s Motor Fuels Tax Minute, Episode 45 00:00:00 Leanne: Welcome to this week’s Motor Fuels Tax Minute, the vlog where we talk all…

Motor Fuels Tax Minute, Episode 44: Heavy Vehicle Use Tax

In this week’s episode of Motor Fuels Tax Minute, our hosts discuss heavy vehicle use tax. For information or assistance, contact us. We are here to help. ©2024 Detailed Description of Weaver’s Motor Fuels Tax Minute, Episode 44 00:00:00 Kelly: Welcome to our Motor Fuels Tax Minute, where we talk all things motor fuel. Emilda…

Motor Fuels Tax Minute, Episode 43: Biofuel Feedstock

In this week’s episode of Motor Fuels Tax Minute, our hosts discuss non-tax specific permits for biofuel feedstocks. For information or assistance, contact us. We are here to help. ©2024 Detailed Description of Weaver’s Motor Fuels Tax Minute, Episode 43 00:00:00 Emilda: Welcome to Weaver’s Motor Fuels Tax Minute, the vlog where we talk all…

Motor Fuels Tax Minute, Episode 42: Net Billed or Gross Gallons

In this week’s episode of Motor Fuels Tax Minute, our hosts go back to the basics with net billed or gross gallons. For information or assistance, contact us. We are here to help. ©2024 Detailed Description of Weaver’s Motor Fuels Tax Minute, Episode 42 00:00:00 Leanne: Welcome to Weaver’s Motor Fuels Tax Minute, the vlog…

Megatrend: Operating Budget Pressures

In this episode of Weaver: Government Impact, host Todd Hoffman, partner-in-charge, Government Consulting Services, offers insights and best practices for approaching operating budget pressures in government. Joined by Brett Nabors, partner, IT Advisory Services, and Morgan Page, partner-in-charge, Digital Transformation and Automation Services, the discussion focuses on navigating financial challenges, optimizing spending and leveraging technology…

Paving the Way for Tomorrow’s Government: An Overview of Six Pillars

In this episode of Weaver: Government Impact, host Todd Hoffman, along with guests Brett Nabors, Weaver partner in IT Advisory Services, and Morgan Page, Weaver partner-in-charge with Digital Transformation and Automation Services, explore key trends impacting government operations. This discussion provides an in-depth look at how governments can effectively respond to modern challenges and opportunities,…