Is Wall Street Overreacting to Netflix Subscriber Losses?

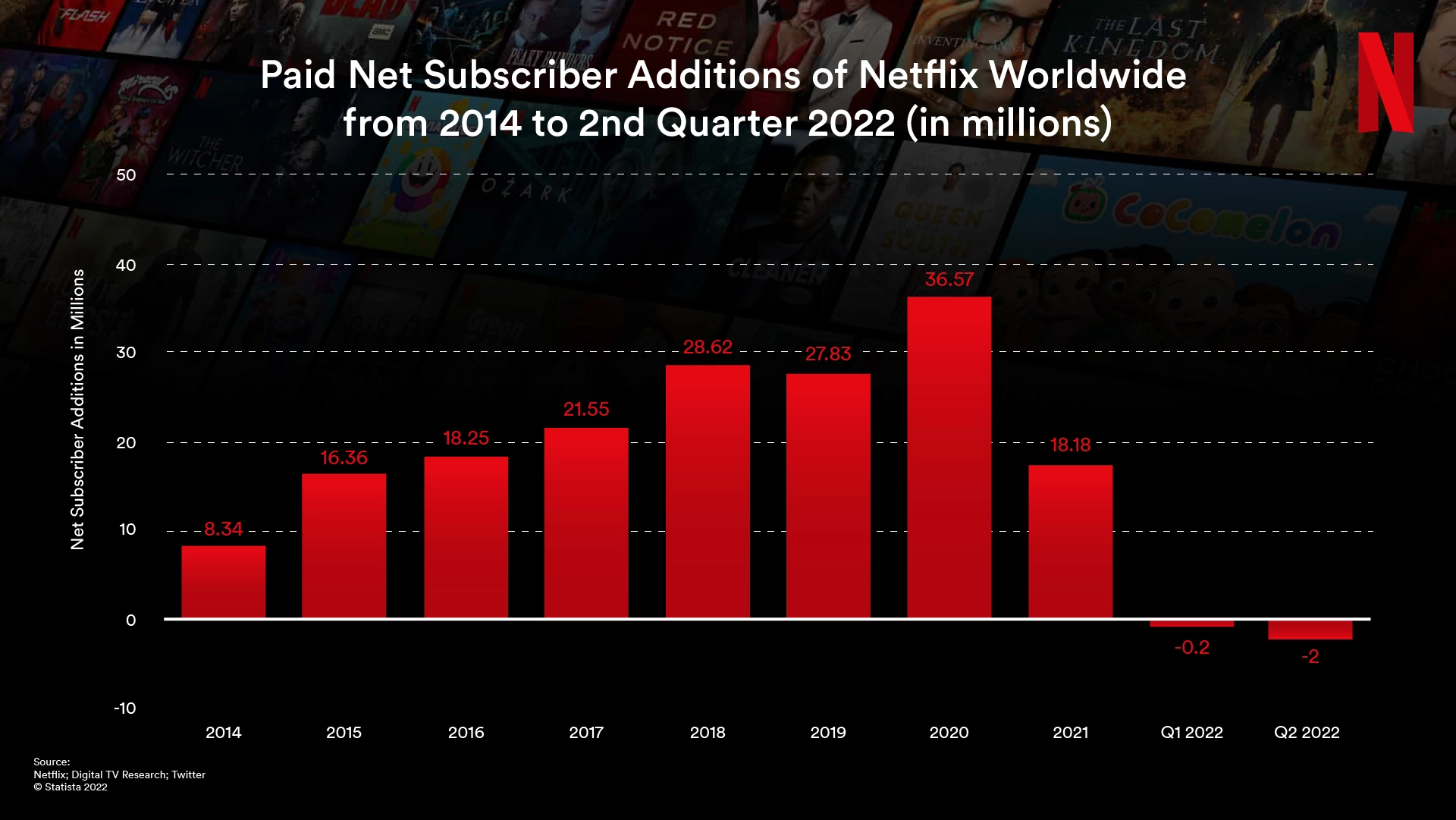

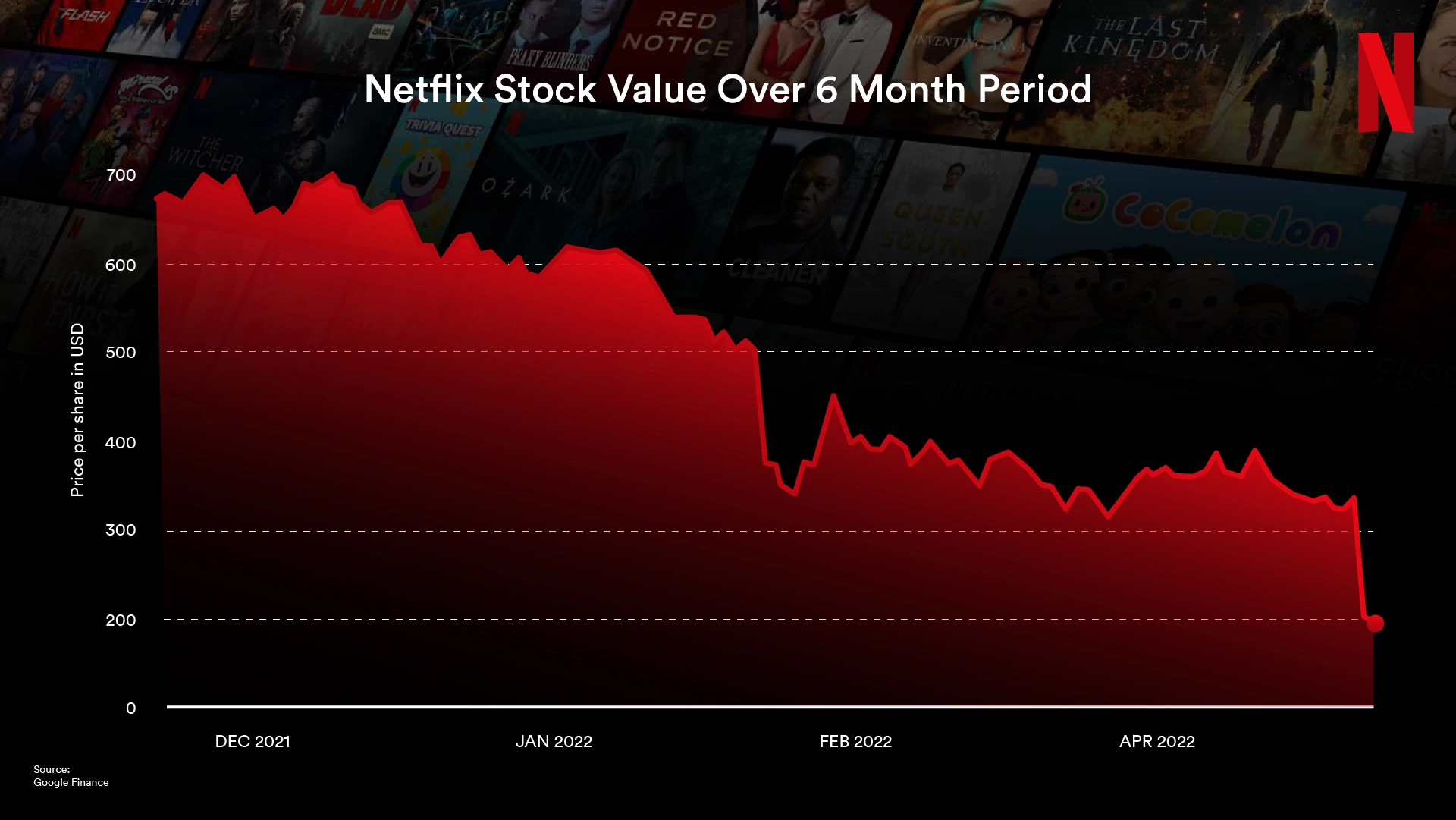

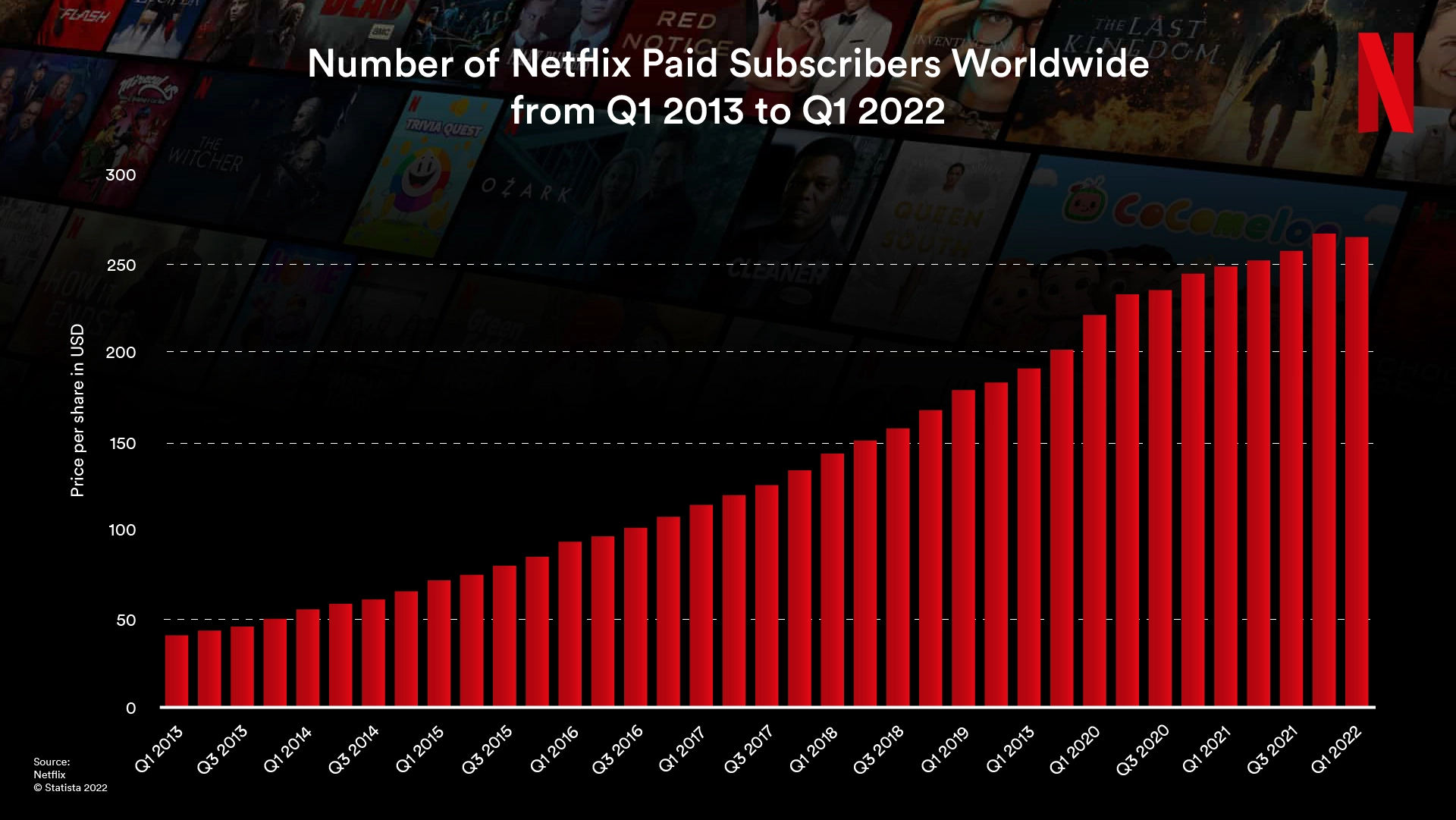

Wall Street did a little cord-cutting of its own this week when it pulled the plug on Netflix’s stock value April 20, sending the company’s share price plummeting from nearly $350 a share the day before to under $220 by market close April 21. As of today, it’s settling in around $210 a share. Netflix’s Q1 2022 report was the catalyst for the pricing uncertainty, where it revealed that for the first time in years, the company had a net loss in subscribers. While the company still leads the streaming subscriber race with 221.6 million paying users globally, it lost 200,000 subscribers in Q1 and announced that it expects to lose two million more in Q2.

Part of the issue is Netflix’s own failure to properly manage expectations when predicting user retention and growth rates; it’s no wonder Wall Street loses confidence when Netflix promised gains of almost three million subscribers for Q1 2022 in its Q4 2021 report. The Q4 report had tepid optimism for their subscriber growth, admitting that acquisition rates had “not yet re-accelerated to pre-Covid levels” and that its big hits were coming in the back half of the quarter, but still claimed it could reach millions of new subscribers globally. This assessment was clearly off the mark.

“We all knew that during the pandemic, Netflix had a tremendous sort of carry forward of subscriber growth,” said J.D. Connor, associate professor at USC’s Division of Cinema and Media Studies. “It was a burst of subscribers, but we didn’t really know how much of their future growth had been dragged forward by the pandemic as people hunkered down and decided to stream. Was it going to be just a year’s worth of growth or two? And it looks like basically we underestimated how much of that growth had been pulled forward.”

The pandemic also likely inflated the company’s stock value, skyrocketing 86% from the end of 2019 through 2021.

Confidence in Netflix’s growth plan is so shot now that billionaire Bill Ackman, after investing $1.1 billion in Netflix stock in January, had his hedge fund sell off the 3.1 million shares at a $400 million loss. Betting on Netflix stock, even as recently as during the pandemic, used to be more attractive for investors when the company was fresh, defining the market space, supposedly capturing untapped market share, and performing more like an unpredictably surprising tech stock. That honeymoon phase is long over now that Netflix is under the gun as the undisputed market leader.

“Right now, it’s going to perform like a set of more traditional media stocks that are driven by hits, that are driven by long-term audience flows, that are driven by macroeconomic factors like whether inflation moderates to 3% or 4% by the end of the year and things like that,” Connor said.

While this stock crash is, of course, troubling news for investors and shareholders, it’s pretty consistent with Netflix’s fall from grace with Wall Street analysts, a slow decline since an all-time valuation peak of nearly $700 in October and November 2021.

That climb to $700 per share and then a subsequent six month collapse is being blamed on a number of factors, which we’ll get into shortly. But before getting too dismissive about Netflix’s future, this week’s news could also be seen as admission that Netflix stock was over-valued and needed a market correction regardless. Even frequent CNBC contributor and investment advisor Joshua Brown is scratching his head as to why the stock was ever trading as high as $700 in the first place.

The loss is steep, but is it truly representative of Netflix’s strategic capacity in the streaming market?

“My sense is that over the very long-term, and here I mean very long-term like five years, Netflix was on a glide path toward a kind of forward price-earnings ratio that would be consistent with its competitors,” Connor said. “[Wall Street] instituted that full correction right now without a sense of how that ecosystem is going to play out over the next five years and just how steep that glide path should have been.”

Anything but the most bullish of news seems to be unacceptable for Wall Street; the last several Netflix quarterly reports have been met with dissatisfaction and subsequent stock devaluation. Before this week’s report, Netflix saw a similar tumble in January, from $508 a share to under $360 a share. This didn’t come after a high-profile scandal from the company, it came after a Q4 2021 report that said…

- it just barely missed its goal of 8.5 million new subscribers by 300,000 users

- profit was up $65 million year-over-year compared to Q4 2020

- revenue was up by 16%, reaching $7.7 billion

“It’s a total overreaction, because if you look at the Netflix valuation five years ago when it didn’t have 225 million subscribers, and it didn’t have the amount of content and didn’t have even a greater competitive advantage, the earnings multiple or however you want to put a valuation on the stock was much, much higher, and the business hasn’t changed at all. In fact, I think what Netflix has revealed is that they have a lot of monetization opportunities that they’ve just not gone after, because they don’t want to be a cable company,” said Darren Campo, adjunct assistant professor with NYU’s Stern School of Business and a former executive at Time Warner, Discovery & CBS.

That Q4 report may have landed below the company’s expectations, but it’s hard to call those numbers the beginning of the end for Netflix. Even looking at the Q1 report, with its subscriber losses and Wells Fargo analysts calling Netflix’s growth narrative “dunzo,” it could be argued the company is still doing quite well. How else would you describe…

- still gaining 8.2 million new subscribers in Q4?

- posting a revenue jump of nearly 10%, up to $7.9 billion, in Q1?

- setting new viewership records with Korean hit show Squid Game? It became the Netflix title with the most hours watched in its first 28 days: 1.65 billion hours.

“That’s the power of that platform globally. So I don’t think that these idiosyncratic sub losses are any indication of any problem with the business,” Campo said.

And even though the company lost 200,000 subscribers in Q1 2022, looking at the raw numbers without context fails to paint the full picture of why those users left and the extraneous ‘self-inflicted wound’ circumstances under which the the hemorrhaging happened.

So if Netflix is still leading the streaming market, performing relatively well in other metrics besides net subscriber gains, and making other business investments into new markets that draw interest from investors, is the stock price panic warranted? Just the critique of Netflix’s lower subscriber numbers reveal it’s not as unique of a challenge as it sounds.

“We’ve definitely seen that once you get to 70, 80 millions of subs, things really tend to slow down. We saw it with HBO…and we’ve seen the same issues with Disney…. They’re hitting the upper limit on the big growth, the low-hanging fruit,” Campo said.

The core factors Netflix blames on the subscriber losses are…

- the Russian military operation in Ukraine

- increased competition from a crowded market

- the persistent challenge of password sharing

Let’s break down the various arguments that both Netflix and Wall Street analysts are giving for the stock crash and loss of subscribers, and get a better sense for the long-term outlook on the various moving pieces at play that are shaping Netflix’s competitive edge.

Russia’s War in Ukraine

After Russia began its ‘special military operation’ in Ukraine, US corporations formed a lockstep response, pulling services, operations and investments out of the Russian economy. This included most of the major streaming platforms, like HBO Max, Disney+, and Netflix.

“The suspension of our service in Russia and winding-down of all Russian paid memberships resulted in a -0.7m impact on paid net adds,” Netflix said in its investor letter.

Leaving the Russian market alone cost Netflix 700,000 subscribers in Q1. However, if Netflix is reporting a net loss of 200,000 subscribers in Q1, even if there were thousands of other subscribers who left for a variety of reasons, the company actually gained a net 500,000 subscribers this quarter.

Without relinquishing the Russian market, an unfortunately self-defeating strategy for a growth narrative dependent on gaining international subscribers quarter-over-quarter, Netflix would have still posted gains and somewhat satisfied investors. This alone should quell some of the concern that Netflix has lost the plot in the long-term.

What’s still uncertain is whether leaving Russia is a permanent move, and whether this is a sign that Netflix has abandoned its internationalist value proposition.

“The Russia situation is obviously entirely out of their control. But if the Russia situation is part of an extended process of de-globalization that actually hits content, because it hasn’t hit content up until now, then it could auger very poorly for them,” Connor said.

“We know Netflix has no position in China and is not going to get one for the foreseeable future, which means that the proposition that they have made over time was, ‘we’ll find the amazing show in Korea, Spain, Argentina, that people around the world want to see and we can do that because we are everywhere around the world’…. If that proposition weakens then they just become somebody who spends a lot of money on content and either has hits or does not have hits.”

Competition in a Crowded Market

In their report, Netflix also highlighted the stiff competition in video-on-demand streaming. While Netflix is no stranger to competition, even in its early DVD-to-streaming transition while it battled Blockbuster, Netflix identifies the entrance of legacy media companies into the market as a growing challenge.

“Over the last three years, as traditional entertainment companies realized streaming is the future, many new streaming services have also launched,” Netflix said. Though they highlight the company’s steady growth in percentage of viewing share among streaming platforms, it was clear that it wanted to “grow that share faster.”

This is likely one of the more existential threats to Netflix’s status as indefinite market leader, as is seen in the constant subscriber growth rates of its competition.

At the end of Q1…

- Disney+ reached nearly 130 million global subscribers, adding 11.7 million users in Q1

- HBO Max & HBO had 76.8 million global subscribers, adding 3 million users in Q1

- Hulu hit 45.3 million US subscribers, adding 2.5 million users in Q1

Perhaps this battle for market share will prove difficult for maintaining endless subscriber growth, a proposition that was always going to have an expiration date. What constitutes the end of an era, though? Is one quarterly loss of subscribers enough to say Netflix’s time has come? Other than YouTube’s online entrance in 2005, Netflix was the first and has remained the leading premium streaming service since 2007. The company’s first subscriber loss in the last 10 years still leaves it with nearly 92 million more subscribers than the next largest platform, Disney+.

Even while reporting quarterly bad news, the company is still loud about its market strength. It’s “the largest subscription streaming service in the world on all key metrics: paid memberships, engagement, revenue and profit,” it confidently explained in its investor letter. Comparing revenue across the major players in the space is difficult as Disney+ and HBO Max’s revenue get presented in the context of their parent companies, Disney and WarnerMedia, but overall, Netflix’s claims are likely accurate. As of April, Netflix can boast over a third of total audience engagement and more than half of total content releases among its market competition, according to Diesel Labs.

The Pain of Password Sharing

I’d bet good money that most of our readers can relate to the peak of modern-day solidarity: sharing your Netflix password with a friend. Unfortunately, Netflix isn’t as big of a fan of the trend; for streaming platforms, password sharing means supporting increased user bandwidth with no compensation, even if they’re still gaining the benefits of brand exposure.

“We estimate that Netflix is being shared with over 100m additional households, including over 30m in the UCAN region,” Netflix said.

Lost revenue isn’t exciting for any company, but the position Netflix is in of making a case to non-subscribers to finally pay for the service isn’t a hopeless one.

“If you have a hundred million people stealing your product, then your product’s probably pretty good,” Campo said.

Is capturing 100 million unsubscribed users worldwide a goal that Netflix can justifiably make with confidence?

“It’s not going to be that 30 million new households subscribers jump in at, in the US, $15.99 a month. It’ll be at the edges. It’ll be a way of bringing in some of that revenue, but certainly not I think a transformative amount,” Connor said.

This is another existential challenge for all streaming platforms which have to ride the line between capturing revenue at the edges of their ecosystem and avoiding price over-correction, which could lead to pricing users out of the service or loss of subscribers in protest.

“It’s a very defensive kind of thing to go public with because it implies that people like your product, but not quite enough to pay for it on their own,” Connor said.

Though Netflix claims this issue hasn’t become a new challenge per se, it’s the compounding effects of a destabilized macro economy that now point the company’s attention toward finally resolving the lost revenue challenge of roping in non-paying users.

How Netflix is Responding to its Stock Crash

Whether Netflix can rebuild trust with Wall Street will take a shift in strategy, which will likely include a change in how they report their growth moving forward considering the stock market’s recent responses to quarterly reports.

“I think this is a good example of why Apple stopped reporting their iPhone handset sales quarterly,” Campo said. “Quarterly numbers are not the business. Netflix has always been bad at predicting quarterly subscribers, but they’ve been very good at predicting annualized subscriber growth.”

Shuffling around KPIs to tell a better growth narrative is one option, but shouldn’t be the company’s main goal if they’re to maintain an innovative approach to Netflix’s competitive edge. As explained in its investor letter, Netflix has big plans for both short-term reactionary solutions and long-term experiential investments. Are these responses going to inspire a new investment outlook for Netflix stock, or could they backfire and dig the company deeper into its Wall Street hole?

The company’s biggest change in tune post-Q1 report is happening around advertising business models. Netflix CEO Reed Hastings has long shut down the idea of Netflix seeking revenue through advertisers, claiming it would cheapen the user experience and complicate the company’s “simpler business model.”

“We want to be the safe respite where you can explore, you can get stimulated, have fun and enjoy – and have none of the controversy around exploiting users with advertising,” Hastings said during Netflix’s 2019 end-of-year earnings call.

When subscriber numbers start to plateau, though, Netflix’s selling point becomes its own obstacle. In his Q1 post-earnings call, Hastings had a different story to tell regarding Netflix and its relationship with ads, going as far as teasing that it was a business model it was “trying to figure out.”

“Those who have followed Netflix know that I’ve been against the complexity of advertising and a big fan of the simplicity of subscription. But as much as I’m a fan of that, I’m a bigger fan of consumer choice. And allowing consumers who like to have a lower price, and are advertising tolerant, get what they want makes a lot of sense.” – Reed Hastings

Creating value for advertisers shouldn’t be too hard for Netflix with its recent major deals with creators like Shonda Rhimes, its millions of paying users and consistent record-breaking hours viewed on the platform. One critical piece of the advertising value puzzle is missing, though. Netflix’s biggest challenge in this space will likely be around how it manages and incentivizes the sharing of its data.

“Netflix though has long treated its data as the kind of thing to be handed out as treats. If you are a good showrunner, you get a little more data. If you are a hardware partner, you get a little more data,” Connor said.

A carrot-dangling strategy for data disclosure won’t be enough for Netflix to build the kind of partnerships it wants in advertising. Advertisers know their own game well: only purchase spots if there are solid metrics to back up the performance of that channel and the potential returns of that audience exposure. While players like NBC, CBS and ABC have the advertising structure of their business model already solidified and can pivot into the streaming market while retaining their tried and true strategies, going in the opposite direction toward an advertising business model without adjusting the value proposition around its data will be a major challenge for Netflix.

“Right now Netflix’s disclosure of data, while certainly much better than it was three years ago, is nothing like the disclosure of data that you would get from a regular over-the-air broadcaster or from a basic cable operator, which means Netflix is going to have to transform the way that it thinks about the proprietary nature of the data it gets about viewers in order to attract enough advertisers to make that go,” Connor said.

Netflix’s other main call-out centers around solving the password sharing problem that they say is costing them 30 million users in the US & Canada alone. In an effort to monetize password sharing and bring in millions of non-paying customers, it rolled out test features in LATAM markets like Chile and Peru: Extra Member and Profile Transfer. Both features result in users paying a new fee to share their log-in information with two users “they don’t live with,” while also enabling the transfer of useful personalization data like “viewing history, My List, and personalized recommendations.” Unfortunately, the strategy for executing on this shift at scale is still unclear.

“The answer they have to give us is how are they going to get people to pay for this? And they obviously don’t have the answer, they would’ve given it to us.” – Prof. Darren Campo

Overall, Netflix is also saying it can maintain its momentum through improving the Netflix experience. This includes new features like a “double thumbs up” for a more accurate content self-rating tool for users, but also investments in new content, both original IP and partnerships with established IP. This has been a market that has proven successful for Netflix, building successful brands like Stranger Things and Bridgerton.

“They’ve proven their willingness to spend money on things that make money for them, and what they need to do is spend money on things that make money for them, not spend money on things that don’t. This is why it remains a hit-driven business in the premium tier, and Netflix may be pivoting more towards that,” Connor said.

Netflix also says it wants to further invest in and build out its capabilities around “creative development, personalization, and language presentation/localization.” Campo is keeping his eye on the more immersive content types Netflix has experimented with in the past as a potential competitive edge.

“They’re trying to merge their experiments with interactive television, not only like they did with Black Mirror and Bandersnatch where you get to choose the story line, but also they’re working on experimenting with building and adding audience, which is almost like a version of fan fiction. So they’re using their technology to enhance the storytelling and I think that’s going to be where the business growth comes from,” he said.

What Should Be Netflix’s Strategies for Success?

Yes, Netflix’s stock value is low, trading at its lowest since January 2018. With its Q2 2022 subscriber loss projections, valuation will likely stay low for a while unless it has a major narrative comeback. But as explained above, the company is still a market leader and shouldn’t be written off. With its market leader status, it has the unique opportunity to learn from what’s working for the rest of the market, make strategic investments into new content types, and bring those strategies and investments to the largest VoD streaming audience to date. If their bets succeed, the built-in audience reach of quality new features and content on the platform will be hard for even the most innovative of streaming companies to compete with.

Netflix’s most innovative bet moving forward is its gaming division. In November, the company announced a suite of mobile games within its Android and iOS app, like Stranger Things: 1984 and Stranger Things 3: The Game. The goal was to build new ways to engage paying users and keep them on the app for longer. Games are included in the standard Netflix subscription, available in different languages, and playable across various devices and account profiles simultaneously.

Now, as the company readjusts its growth narrative, it’s investing heavily in gaming. Less than a month ago it bought its third video game studio, and has since announced more and more games, including a new Exploding Kittens game (and animated series) and four more games slated for release in May. The market is not known for being ROI-friendly, but Netflix leadership is confident the investments will turn into a new, stable and lucrative profit stream.

“Four or five years ago, they said, ‘our competition is not under other entertainment, our competition is Fortnite. Our competition is all of the video gaming. Our competition is what you do with your time when you’re not at Netflix; what other entertainments?’ So they see their competitive opportunity as all other forms of entertainment,” Campo said.

Netflix can also learn from the growing popularity of free, ad-supported, rolling content-style channel services like Tubi and Pluto TV. Through quality curation, those services have been able to amass significant user bases who seem to be open to consuming content in ways reminiscent of cable television’s glory days. Pluto’s parent company Viacom reported that, since it acquired the streaming platform in 2019, Pluto has grown monthly active users from 12 million to 64.4 million. 10 million of those users were added in Q4 2021 alone, with expectations that by 2024, the platform will boast somewhere between 100-120 million MAU.

“These channels are contributing huge amounts of revenue on very little content spend for other traditional players like Paramount and other owners. And Netflix, in creating itself as a kind of essential streamer, that’s the way they have pitched themselves, needs to figure out where that what we call lean back entertainment is going to fit in that niche,” Connor said.

Netflix should also stay hyper-aware of its competitive content strengths beyond its successful original IP. When it comes to the family entertainment market, Disney+ has become the defacto trendsetter, wielding its entire suite of Disney and Pixar classics along with new Marvel and Star Wars hits. Netflix, though, is still a confident player in the family content space, which will be a key part of their user retention strategy.

“Netflix actually has a really interesting and vital position there with CoComelon and then their really deep bench now of animated work. And children are terrific drivers of sustained low churn subscribers. They’re not terrific drivers of super premium services but they’re terrific drivers of essential services,” Connor said.

Investors like CNBC contributor Josh Brown are looking to a few key areas beyond single-month or single-quarter trends to dictate their Netflix stock portfolio strategies: whether ad-supported models become an additive revenue builder, whether new show line-ups become resounding hits, and whether it can abate more steep subscriber losses.

“I think that the idea that Netflix is going to be the essential streamer is now fragmented. I don’t think that it’s going to hold long-term. The assumption that the US or US & Canada business size was a hundred million or more subscribers which is what that would entail to be essential, seems to be wrong.” – Prof. J.D. Connor

Wall Street’s projections and analysis aren’t the end all be all for Netflix success, though. History has shown Wall Street to consistently misjudge Netflix’s strategies, underestimating the company’s ability to execute on risky strategies. The big Netflix moves that inspired negative reactions from the stock market as bad business decisions, from its transition away from DVD services to streaming, to its original content and IP-purchasing strategy, have proved Wall Street wrong. The streaming market waits with popcorn in hand to see if Netflix proves Wall Street wrong once again.